Supreme Court Upholds Constitutional Validity of Foreign Contribution (Regulation) Amendment Act 2020

The Supreme Court on Friday has upheld the constitutional validity of the Foreign Contribution (Regulation) Amendment Act 2020 which regulates the acceptance and use of foreign contributions by certain individual associations or companies.

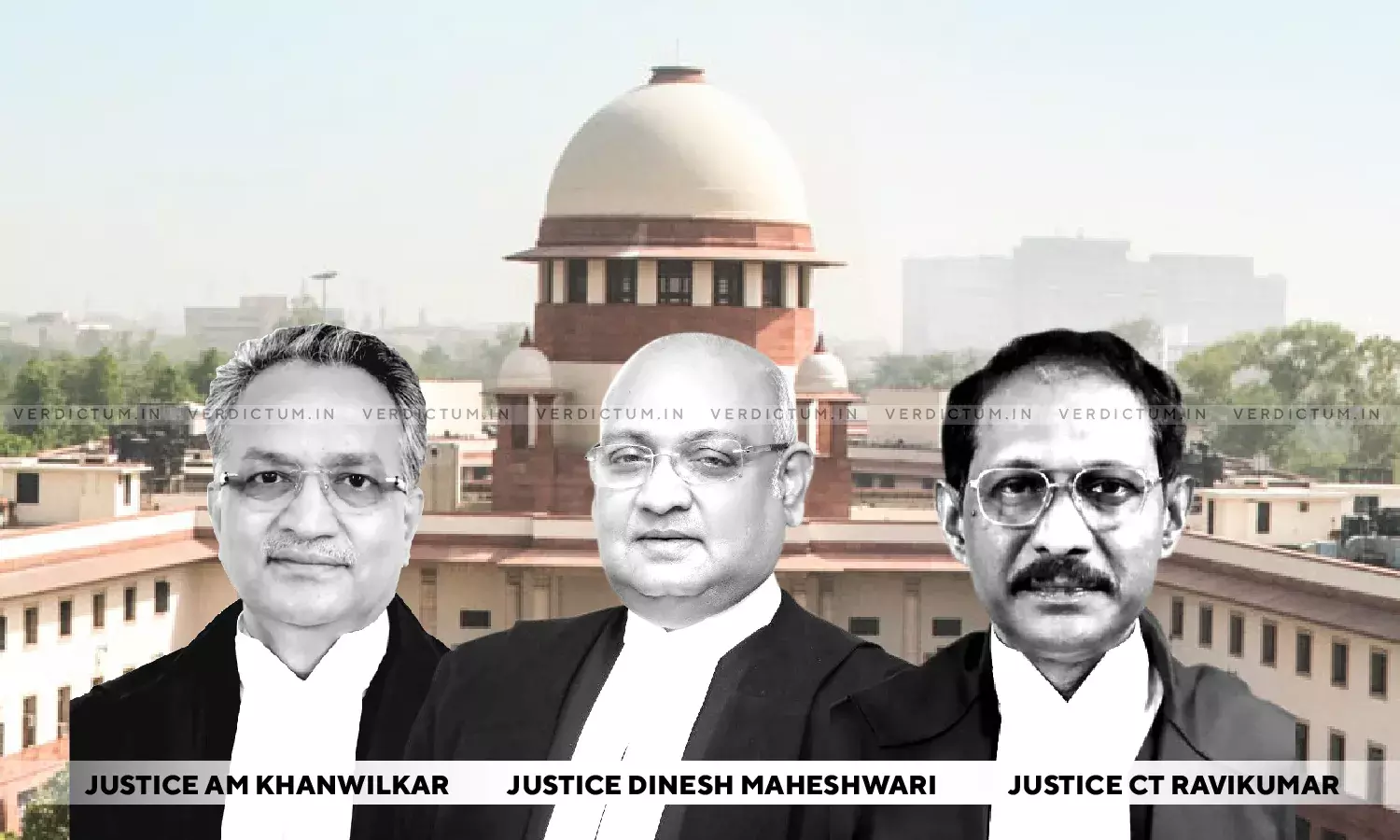

A three-judge Bench of Justice AM Khanwilkar, Justice Dinesh Maheshwari, and Justice CT Ravikumar while pronouncing its verdict observed -

"To sum up, we declare that the amended provisions vide the 2020 Act, namely, Sections 7, 12(1A), 12A and 17 of the 2010 Act are intra vires the Constitution and the Principal Act, for the reasons noted hitherto."

Senior Advocate Mr. Gopal Sankaranarayanan along with Counsel Mr. Gautam Jha appeared for the Petitioners while Solicitor General Mr. Tushar Mehta and ASG Mr. Sanjay Jain appeared for the Respondents before the Apex Court.

The challenge of the Petitioners was for the following amendments –

Section 7 states the prohibition to transfer foreign contributions to another person

Section 12 (1A) states that the very person who makes an application under sub-section (1) shall be required to open an FCRA account in the manner specified under Section 17 and mention details of such account in his application.

Section 17 provides that every person granted a certificate or prior permission under Section 12 shall receive foreign contributions only in an account designated as an FCRA Account to be opened in any of the branches of the State Bank of India in New Delhi.

Section 12(A) empowers the Central Government to require Aadhar number etc., as an identification document.

The Petitioners had alleged that the above-mentioned sections are manifestly arbitrary, unreasonable, and impinge upon the fundamental rights guaranteed to the Petitioners under Articles 14, 19, and 21.

Whereas the Respondent – Union of India contended that these amendments are intended to ensure effective regulatory measures regarding inflow and utilization of foreign funds and they are uniformly applicable and do not discriminate against any NGO receiving contribution from foreign donors and its utilization.

The Apex Court noted that when the FCRA (Amendment) Bill, 2020 to the challenged provisions was being considered, the members expressed their concern about the volume of inflow of foreign contributions. It was noted that NGOs have been formed, which in turn receive foreign contributions and spend the funds as per their own desire and the same is being misused, threatening the security apparatus and sovereignty of the country.

Rights guaranteed under Part III of the Constitution not absolute rights

The Bench observed that the rights guaranteed under Part III of the Constitution and Article 19, in particular, are not absolute rights. The same are subject to reasonable restrictions as predicated in clauses (2) and (6) of Article 19.

The Court also held that it is for the State to make a law and impose reasonable restrictions on the exercise of such right (Article 19 (1)(a)).

"Further, there is no fundamental right vested in anyone to receive foreign contribution (donation) or foreign exchange; and that the purport of the Principal Act and the impugned amendments are only to provide a regulatory framework and not one of complete prohibition," the Bench held.

Need for the FCRA (Amendment) Act 2020

The Court noted that serious concerns about the impact of widespread inflow of foreign contributions on the values of a sovereign democratic republic were repeatedly expressed at different levels including the Parliament.

The Bench also held that in the due course of time it was realized that the 2010 Act was not yielding the desired results that impelled the Parliament to amend the 2010 Act via the 2020 Act to make it more stringent and effective for the receipt of foreign contributions.

"To eradicate misuse and abuse of foreign contribution in the past, despite the firm regime in place in terms of the 2010 Act, the Parliament in its wisdom has now (vide Amendment Act of 2020) adopted the path of moderation by making it mandatory for all to accept foreign contribution only through one channel and to utilise the same "itself" for the purposes for which permission has been accorded. Undeniably, the sovereignty and integrity of India ought to prevail and the rights enshrined in Part III of the Constitution must give way to the interests of general public much less public order and the sovereignty and integrity of the nation. It must be borne in mind that the legislation under consideration must be understood in the context of the underlying intent of insulating the democratic polity from the adverse influence of foreign contribution remitted by foreign sources," the Bench held.

Validity of Section 7

The Court held that if the foreign contribution is utilized for definite purposes, including administrative expenses permissible under Section 8, even though it may theoretically entail in the transfer of foreign contribution, it would not be a case attracting the rigors of Section 7.

The Bench in this context observed –

"In other words, Section 7 may be attracted if the utilisation is not for the definite or permitted purposes for which the certificate of registration or permission under the Act has been granted by the competent authority. Indeed, if the recipient of foreign contribution engages services of some third party or outsources its certain activities to third person, whilst undertaking definite activities itself and had to pay therefor, it would be a case of utilisation. The transfer within the meaning of Section 7, therefore, would be a case of per se (simplicitor) transfer by the recipient of foreign contribution to third party without requiring to engage in the definite activities of cultural, economic, educational or social programme of the recipient of foreign contribution, for which the recipient had obtained a certificate of registration from the Central Government. On this interpretation, it must follow that the argument regarding amended Section 7, being ultra vires, must fail."

The Court also held due to the absence of such stringent provisions, some of the recipient organizations were reportedly indulging in the successive chain of transfers to other organizations, thereby creating a layered trail of money and also utilization of funds towards administrative costs of successive transfers up to fifty percent leaving very little funds for spending on the purposes for which it was permitted.

In this regard, the Bench noted -

"Hence, providing complete restriction on transfer simplicitor, was the just option to fix accountability of the recipient organisation and maximise utilisation for the permitted purposes. Such being the avowed objective and purpose of the amendment, the challenge to the amended Section 7 must fail."

Restriction or Complete Prohibition On Transfer To Third Parties

The Bench held that restriction or the complete prohibition on transfer to third parties, by no standards deprives acceptance of foreign contribution and utilization thereof.

The Court held –

"The restriction or complete prohibition on transfer to third party, by no standards deprive acceptance of foreign contribution and utilisation thereof in the manner permitted for definite purposes, such as cultural, economic, educational or social programme. Such a provision must be understood as being procedure established by law in the interests of the general public and in the interests of sovereignty and integrity of the country, including public order. Resultantly, there is no infraction even of Article 19(1)(c) or 19(1)(g) of the Constitution as urged by the writ petitioners before us, including Articles 14 and 21 of the Constitution. Consistent with this view, we must reject the challenge to the amended Section 7 on all counts."

Validity of Section 12(1A) and Section 17(1)

The Court in this context held that merely because the framework of acceptance of foreign contribution had been changed cannot be the basis to question the validity of the amended provisions.

The Court also opined that opening of FCRA account in the designated bank as per the law made by the Parliament cannot be brushed aside on the specious argument of some inconvenience being caused to registered associations.

Validity of Section 12A

The Bench in this context opined that in the years 2010 and 2019 the inflow of foreign contributions had almost doubled and many of the registered associations had failed to comply with basic statutory formalities necessitating the cancellation of certificates of registration of more than 19,000 registered organizations.

'…this amendment had been necessitated to safeguard the sovereignty and integrity of the country, and public order, including in the interests of the security of the State and of the general public,' the Court held.

The Court also noted, "As regards Section 12A, we have read down the said provision and construed it as permitting the key functionaries/office bearers of the applicant (associations/NGOs) who are Indian nationals, to produce Indian Passport for the purpose of their identification. That shall be regarded as substantial compliance of the mandate in Section 12A concerning identification."

The Court finally declared that the amended provisions vide the 2020 Act, namely, Sections 7, 12(1A), 12A, and 17 of the 2010 Act are intra vires the Constitution and the Principal Act.

Click here to read/download the Judgment