Onus Of Showing Person Was In Possession Of Unpublished Price Sensitive Information Is On Person Alleging It – Supreme Court

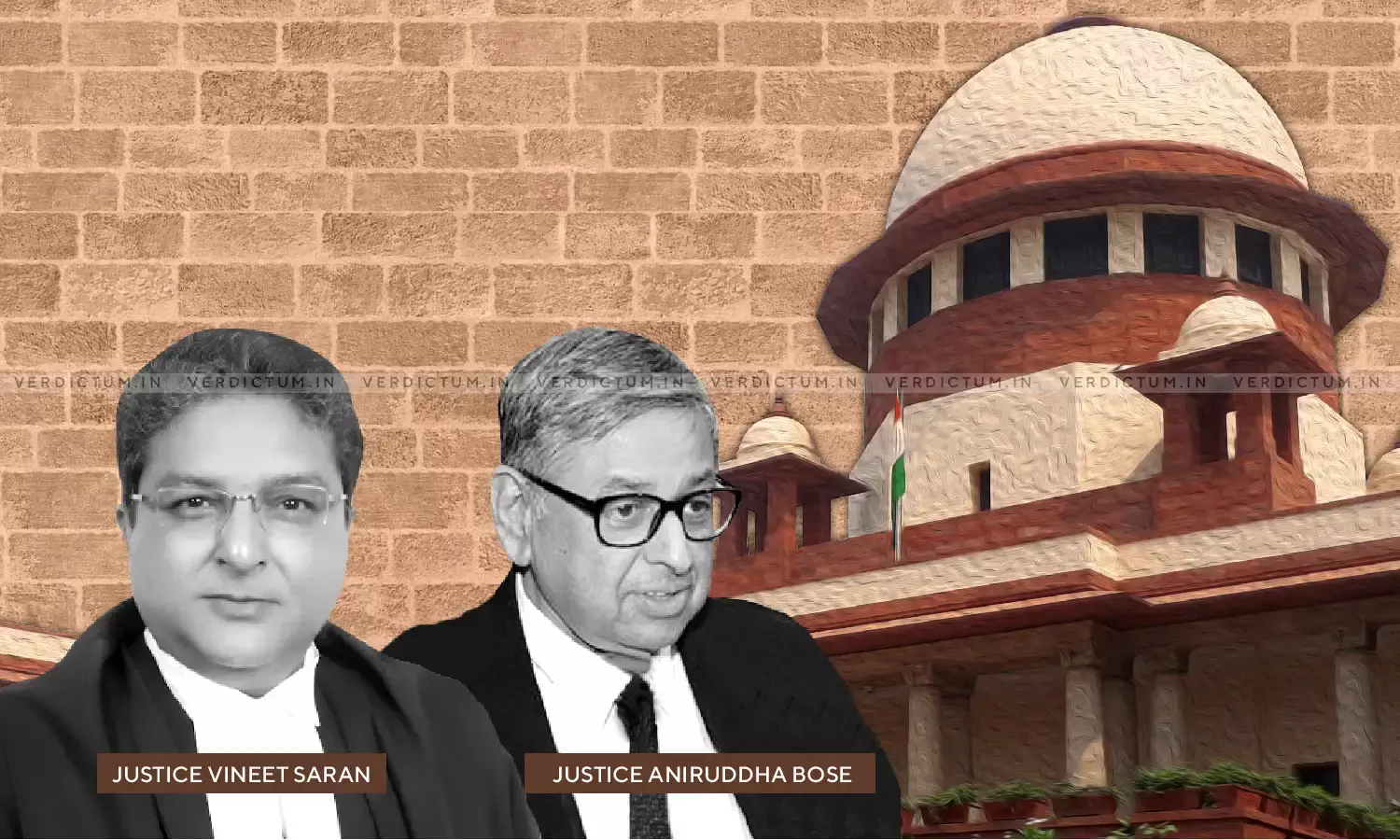

A two-judge Bench of Justice Vineet Saran and Justice Aniruddha Bose has in a case against PC Jewellers held that the onus of showing that a certain person was in possession of unpublished price sensitive information (UPSI) at the time of trading in on the person alleging it under Regulation 2(1)(g) of SEBI (Prevention of Insider Trading Regulations), 2015 (PIT Regulations).

The Court also noted that in the absence of any material on record it could not be said that the Appellants were "insiders" in terms of Regulation 2(1)(g)(ii) of the PIT Regulations only and entirely on the basis of circumstantial evidence.

Senior Counsel Mr. Dhruv Mehta appeared for the Appellant Balram Gupta, Senior Counsel Mr. V. Giri appeared for Appellants Mrs. Shivani Gupta, Sachin Gupta, Amit Garg, and Quick Developers Pvt. Ltd and Senior Counsel Mr. Arvind Datar appeared for SEBI – Respondent before the Apex Court.

In this case, the Appellants who were the family members of the PC Gupta (Chairman of PC Jewellers) were accused of trading on the basis of UPSI received by them on account of their alleged proximity to PC Gupta and Balram Gupta (Brother of PC Gupta).

The WTM of SEBI had passed the final order and imposed a penalty of 20 lakhs on the Appellants. They were also restrained from accessing the securities market and buying, selling, or dealing in securities for 1 year and also restrained the Appellants from dealing in shares of PCJ for 2 years.

The above order was upheld by SAT. Aggrieved by the order of SAT the Appellants approached the Supreme Court.

It was contended by Senior Counsel Mr. Mehta before the Apex Court that Mrs. Shivani Gupta, Sachin Gupta, and Amit Garg were not "connected persons" or "immediate relatives" qua the Appellant Balram Garg and that this finding of the WTM has become final. Further, it was argued that to prove the violation of Regulation 3 of PIT Regulations, the burden of proof was on SEBI to establish any communication of UPSI by placing on record cogent evidence, which it has failed to place any such evidence on record.

It was argued by Mr. V. Giri that the entire case of insider trading is set up against these Appellants only on the basis of the close relationship between the parties, however, sufficient material was placed on record to show that there was a complete breakdown of ties between the parties, both at a personal and professional level and it was much prior to the UPSI having coming into existence.

The Apex Court noted that the contention of the Respondent that the Appellant Balram Garg violated Regulation 3(1) of the PIT Regulations and Section 12A(c) of SEBI Act by communicating UPSI to the other Appellants being an 'insider' and 'connected person' is not worthy of acceptance.

Further, the Bench held that the SAT has erred in upholding the order of the WTM of SEBI as it has to failed to independently assess the evidence and material on record while exercising its jurisdiction as the First Appellate Court.

The Court also held that SAT again fell into error when in spite of observing that there is no direct evidence that suggests who had disseminated the insider information to the Appellants. It concluded on mere 'preponderance of probability' that it was late PC Gupta as well as Balram Garg who disseminated both UPSI to the Appellants.

The two major issues which were dealt with by the Bench were –

i) Whether the WTM and SAT rightly rejected the claim of estrangement of the appellants in C.A. No.7590 of 2021, namely, Mrs. Shivani Gupta, Sachin Gupta, and Amit Garg.

ii) Secondly, could the aforementioned appellants be rightly held to be "insiders" in terms of Regulation 2(1)(g)(ii) of the PIT Regulations, only and entirely on the basis of circumstantial evidence?

First Issue

Regarding the first issue, the Court noted that the WTM and SAT wrongly rejected the claim of the Appellants that they were estranged from the family and did not have the required connection with the Appellant Balram Garg. The Bench in this context held that both WTM and SAT ought to have appreciated the relevant facts for ascertaining the true relationship between the parties.

The Bench additionally held, "given the fact that the entire case against the appellants for the offence of insider trading was based on the nature of close relationship between the parties, once it has been rightly held by the WTM that the appellants are neither "connected persons" within the meaning of Regulation 2(1)(d) nor "immediate relatives" within the meaning of Regulation 2(1)(f) of PIT Regulation, the question of ipso facto relying on the nature of relationship between the parties to come to the conclusion that they were "in possession of or having access to UPSI" while trading with the shares of the company is legally unsustainable."

The Court found merit in the contention of the Appellants that even assuming that the said family arrangements did not result in complete estrangement of social relations between the parties, the SAT could not, by virtue of this very fact, discharge SEBI of the onus of proof placed on them to prove that the Appellants were in possession of UPSI.

Second Issue

In this context, the Bench noted that SAT erred in holding the Appellants to be 'insiders' under Regulation 2(1)(g)(ii) of the PIT Regulations on the basis of their trading pattern and their timing of trade (circumstantial evidence).

Further, the Court held, "In such view of the matter, we are of the opinion that there is no correlation between the UPSI and the sale of shares undertaken by the appellants in C.A. No.7590 of 2021. The said decisions of selling the shares and the timings thereof were purely a personal and commercial decision undertaken by them and nothing more can be read into those decisions."

The Court also held that merely because a person was related to the connected person cannot by itself be a foundational fact to draw an inference.

In the light of these observations, the Court allowed the appeals and set aside the impugned order of SAT.

Click here to read/download the Judgment