Proceedings Cannot Continue Under SARFAESI Act Once CIRP Is Initiated and Moratorium Ordered - Supreme Court

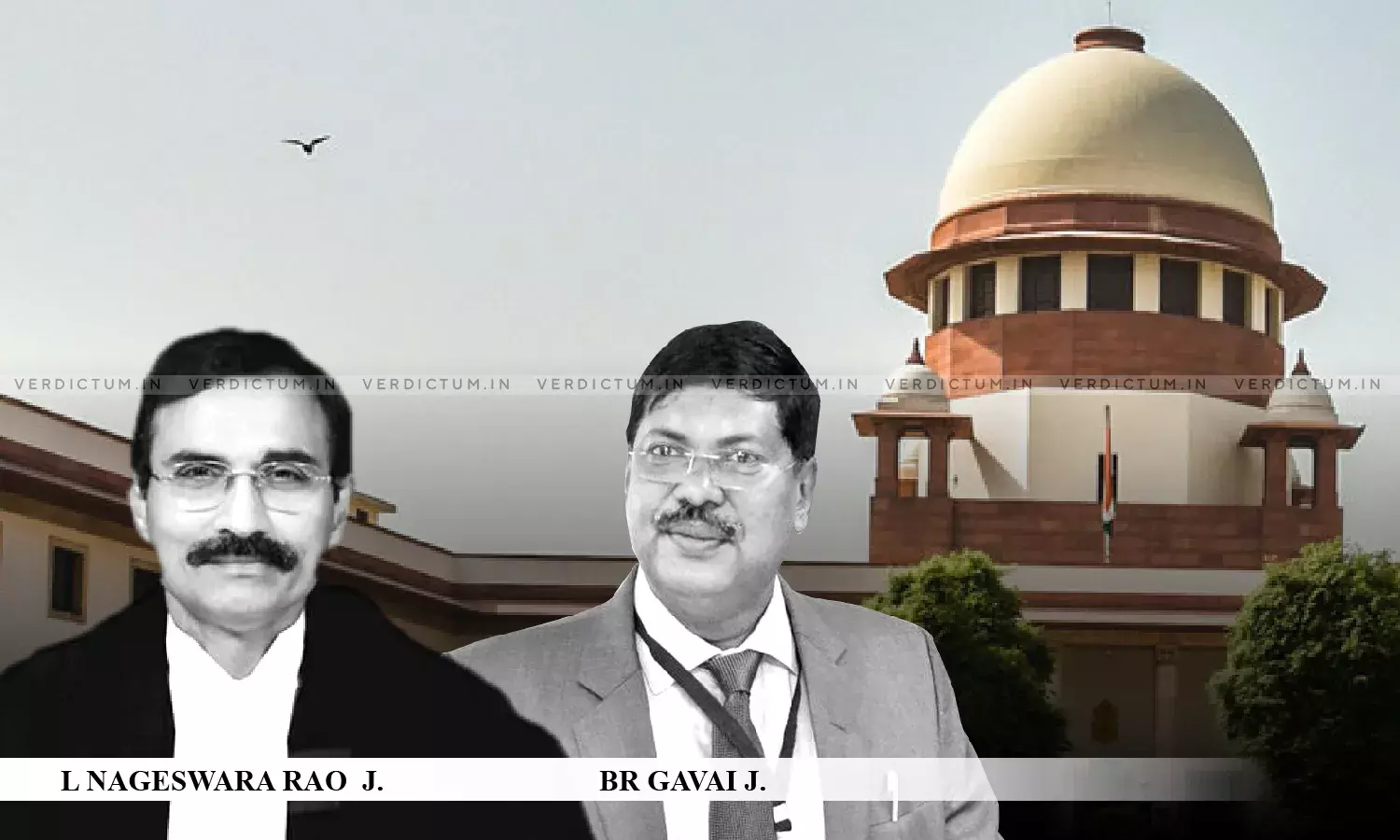

A Supreme Court Bench of Justice L Nageswara Rao and Justice BR Gavai upheld a judgment passed by the National Company Law Appellate Tribunal, which dismissed the appeal filed by the Appellant Bank against an order which set aside the sale of the assets of the Corporate Debtor.

To that end, the Bench opined that "In view of the provisions of Section 14(1)(c) of the IBC, which have overriding effect over any other law, any action to foreclose, recover or enforce any security interest created by the Corporate Debtor in respect of its property including any action under the SARFAESI Act is prohibited. We are of the view that the appellant Bank could not have continued the proceedings under the SARFAESI Act once the CIRP was initiated and the moratorium was ordered."

Solicitor General Tushar Mehta appeared on behalf of the Appellant Bank. Senior Counsel CS Vidyanathan appeared on behalf of the impleading applicants. Senior Counsel KV Viswanathan appeared on behalf of Respondent No. 1 and Mr. Aditya Verma appeared on behalf of Respondent No. 2.

The Appellant Bank had extended certain credit facilities to the Corporate Debtor, but the Corporate Debtor failed to repay the dues and the loan account of the Corporate Debtor became irregular and eventually a Non-Performing Asset.

The Appellant Bank issued a Demand Notice under Section 13(2) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, calling upon the Corporate Debtor and its guarantors to repay the outstanding amount due to the Appellant Bank.

The Corporate Debtor failed to comply with the Demand Notice, and therefore, the Appellant Bank took symbolic possession of two secured assets mortgaged exclusively with it, in the exercise of powers conferred on it under Section 13(4) of the SARFAESI Act read with Rule 8 of the Security Interest (Enforcement) Rules, 2002. One of the properties stood in the name of the Corporate Debtor and the other in the name of the Corporate Guarantor. An Eauction notice was issued by the Appellant Bank to recover the public money availed by the Corporate Debtor.

In the meantime, the Corporate Debtor filed a petition under Section 10 of the Insolvency and Bankruptcy Code, 2016 before the NCLT.

Eventually, through E-auction, three people became successful bidders by jointly offering a price for both the secured assets, and subsequently, the sale was confirmed in their favour. The successful bidders deposited 25% of the bid amount including the Earnest Money Deposit of the said amount and the Appellant Bank issued a sale certificate to them. They were required to pay the balance of 75% within 15 days.

On the 15th day, the auction purchasers addressed a letter to the Appellant Bank, seeking handing over of peaceful and vacant possession of the secured assets, and also prayed for an extension of another 12 days to pay the balance of 75% of the bid amount. This request was accepted by the Appellant Bank, and in the exercise of its powers under Rule 9(4)(a) of the Rules, it extended the period.

The NCLT admitted the petition filed by the ex-promoter of the Corporate Debtor. As a result of the order passed under Section 10 of the IBC, the Corporate Insolvency Resolution Process of the Corporate Debtor commenced and a moratorium as provided under Section 14 of the IBC was notified and an Interim Resolution Professional was also appointed.

The Appellant Bank filed its claim in Claim Form-C with the IRP, upon it coming to know about the admission of the insolvency petition filed by the Corporate Debtor. The Appellant Bank claimed that since the balance 75% of the bid amount was not yet received, it was not excluded from the claim filed before the IRP. During the pendency of the CIRP, the Appellant Bank accepted the balance of the bid amount and submitted its revised claim in Claim Form-C to the IRP. The Appellant Bank also intimated the IRP about the successful sale of the secured assets.

The promoter of the Corporate Debtor then filed an application in the pending company petition, praying that the NCLT sets aside the security realization during the CIRP period carried out by the Appellant Bank, or cancel the impugned transaction. The NCLT passed an order allowed the application and setting aside the sale of the property owned by the Corporate Debtor. Aggrieved, the Appellant Bank filed an appeal before the NCLAT and the same was rejected.

The Appellant Bank then approached the Supreme Court.

On referring to Section 14(1)(c) of the IBC, the Supreme Court opined that once the CIRP is initiated all actions including any action under the SARFAESI Act to foreclose, recover or enforce any security interest are prohibited.

Referring to Section 238 of the IBC and a catena of judgments including Innoventive Industries Limited v. ICICI Bank and Another, the Court opined that the IBC is a complete Code in itself and in view of the provisions of Section 238 of the IBC, the provisions of the IBC would prevail notwithstanding anything inconsistent therewith contained in any other law for the time being in force.

On perusal of the facts of the case, the Court found inconsistencies and opined that the sale was not complete upon receipt of the part payment.

Further, the Court opined that the Appellant Bank could not have continued the proceedings under the SARFAESI Act once the CIRP was initiated and the moratorium was ordered.

To that end, the Court found that no case was made out for interfering with the concurrent orders passed by the NCLT, and therefore dismissed the Appeal.

Click here to read/download the Judgment