Supreme Court Upholds Manner Of Implementation Of One Rank One Pension (OROP) Scheme By Government

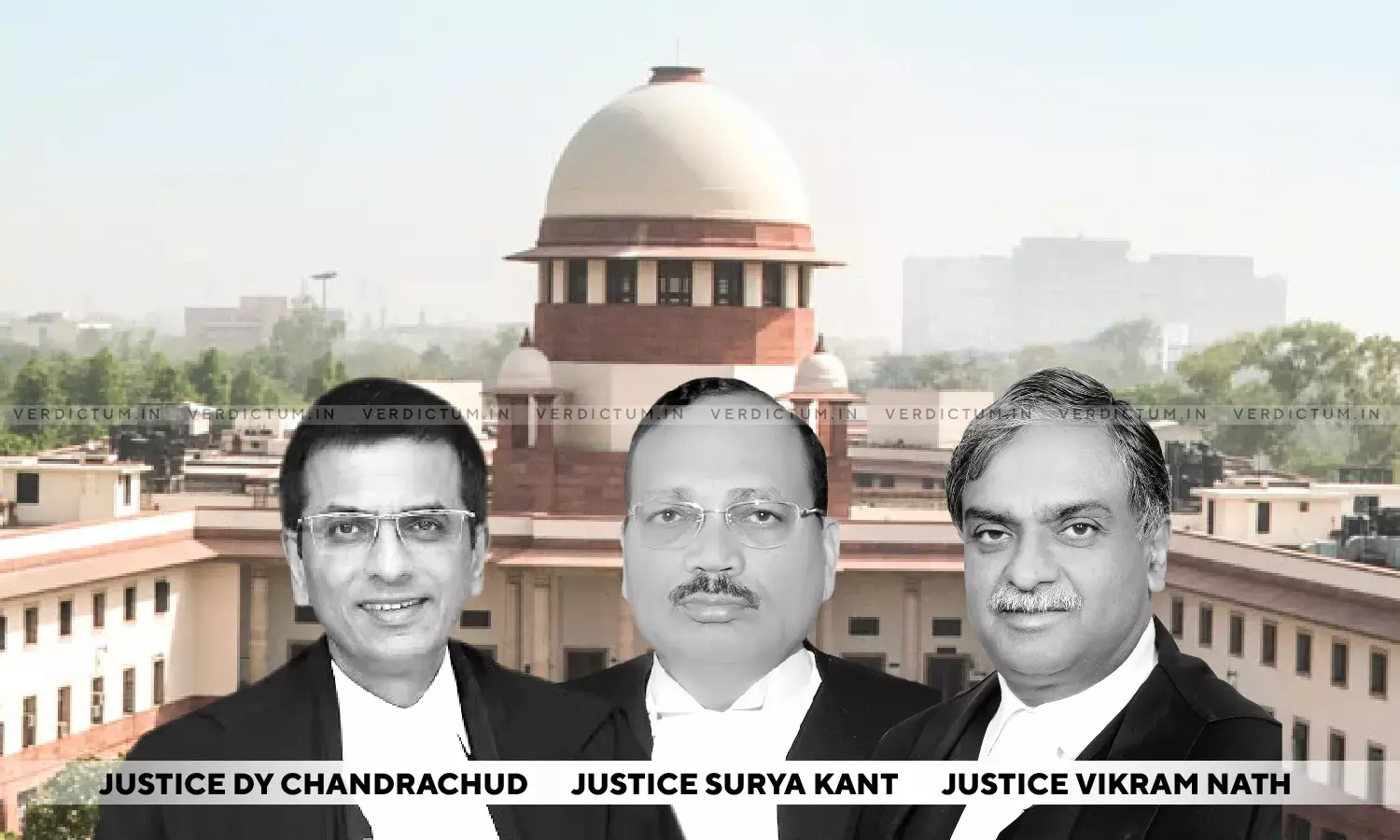

The Supreme Court bench comprising of Justice D. Y. Chandrachud, Justice Surya Kant and Justice Vikram Nath recently heard and passed a judgment on the matter regarding the One Rank One Pension Scheme of the Government of India which aimed at bridging the gap between the rate of pension of current and past pensioners at periodic intervals among the personnel of the armed services.

The Bench while holding that they did not find any constitutional infirmity upheld the One Rank One Pension Scheme of the Government while noting that "the benefit of OROP was to be effected from 1 July 2014. Para 3 (v) of the communication states that "in future, the pension would be re-fixed every five years". Such an exercise has remained to be carried out after the expiry of five years possibly because of the pendency of the present proceedings." The Court directed that "a re-fixation exercise shall be carried out from 1 July 2019, upon the expiry of five years. Arrears payable to all eligible pensioners of the armed forces shall be computed and paid over accordingly within a period of three months."

Factual Matrix

The petition filed before the Apex Court challenged the manner in which the One Rank One Pension Scheme for ex-servicemen of defence forces was implemented by the Government of India. The petitioners before the court had contended that the initial definition of OROP was altered by the first respondent and, instead of an automatic revision of the rates of pension, the revision now would take place at periodic intervals. The petitioners argued that the deviation from the principle of automatic revision of rates of pension, where any future enhancement to the rates of pension are automatically passed on to the past pensioners, was arbitrary and unconstitutional under Articles 14 and 21 of the Constitution.

The Parliament first examined the demand for One Rank One Pension in 2010-11. In December 2011 the Koshiyari Committee presented a report on the petition praying for grant of OROP to Armed Forces Personnel in which it was recommended by the Committee that the OROP Scheme should be implemented. The Committee defined OROP as a uniform pension to be paid to armed forces personnel retiring in the same rank with the same length of service, irrespective of their date of retirement, where any future enhancements in the rates of pension were to be automatically passed on to the past pensioners. This was revoked by the third central pay commission in 1973.

On 17th February 2014 the then Finance Minister Arun Jaitley announced in its budget that the Union Government had in principle accepted the OROP Scheme, it was to be applied prospectively and had announced Rs. 500 crores to be transferred to Defence Pension Account to meet the budgetary expenses but it was not applied then. On 10th July 2014 the Finance Minister reaffirmed the Union Government's commitment to implement OROP and a further sum of Rs 1000 crores was set apart to meet the requirement. This was emphasized by the petitioners to show that OROP always entailed an automatic revision of the rates. On 7th November 2015, the Joint Secretary of the Central Government to the Chiefs of three defence forces introduced a revised definition of OROP, where the revision between the past and current rates of pension was to take place at periodic intervals. This was implemented while implementing OROP in 2015 with rates of pension to be revised after every five years.

The petitioner by a letter to the Defence Secretary on 25th January 2016 objected to the revision of the definition of OROP highlighting that the deviation from the automatic revision of rates of pension to a revision at periodic intervals changed the accepted meaning of OROP. It was contended that the revised definition would deprive the past pensioners of equal monetary benefits, which militated against the principle of OROP. In the meantime, the Government issued a letter to the Chiefs of the three defence forces on 3 February 2016 regarding the implementation of OROP. On 29 October 2016, the Government issued a letter to the Chiefs of the three defence forces revising the pension of pre-2016 defence forces' pensioners and family pensioners.

Submissions of the Counsels

Senior Advocate Huzefa Ahmadi appearing for the petitioners had argued that the implementation of the scheme with the new definition would lead to a situation where the pension drawn by an ex-serviceman who retired on an earlier date would be less than the pension drawn by an ex-serviceman who retired in 2014, until such time that a 'periodic' review is conducted to correct the anomaly. The new definition creates a class within a class where ex-servicemen who retired with the same rank and same length of service would receive different pensions. He further added that MACP Scheme should be given to all past retirees to comply with the judgment of this Court in SPS Vains. While the Union Government argued that the benefit of OROP is to be given to 'past retirees', it has created confusion by stating that the scheme must be given prospective effect.

The Additional Solicitor General Mr. Venkataramanan appearing on behalf of the respondents submitted that OROP seeks to bridge the gap by taking the maximum and minimum pension within the rank of pensioners holding the same rank and same length of service to determine the average. Those who are below the average pension are brought to the average and those who are drawing a higher pension are protected. He also argued that an executive decision of the Union Government on the OROP can only be challenged on legal principles. However, the petitioners were seeking the most beneficial interpretation of OROP to be implemented. It cannot be contended that the most beneficial interpretation of OROP is the only 'true' interpretation and that it must be implemented as a right.

Observation and Decision

Quoting American Legal Philosopher Lon L. Fuller the Apex Court in its judgment stated that "Lon Fuller described public policy issues that come up in adjudication as "polycentric problems", that is, they raise questions that have a "multiplicity of variable and interlocking factors, decisions on each one of which presupposes a decision on all others". Such matters, according to Fuller, are more suitably addressed by elected representatives since they involve negotiations, trade-offs and a consensus-driven decision-making process. Fuller argues that adjudication is more appropriate for questions that result in "either-or" answers. Most questions of policy involve complex considerations of not only technical and economic factors but also require balancing competing interests for which democratic reconciliation rather than adjudication is the best remedy. Further, an increased reliance on judges to solve matters of pure policy diminishes the role of other political organs in resolving contested issues of social and political policy, which require a democratic dialogue. This is not to say that this Court will shy away from setting aside policies that impinge on constitutional rights"

The Supreme Court while upholding the OROP Scheme of the Government summarised the principles governing the pensions and cut off dates as follows:

"(i) All pensioners who hold the same rank may not for all purposes form a homogenous class. For example, amongst Sepoys differences do exist in view of the MACP and ACP schemes.

(ii) The benefit of a new element in a pensionary scheme can be prospectively applied. However, the scheme cannot bifurcate a homogenous group based on a cut-off date.

(iii) The judgment of the Constitution Bench in Nakara (supra) cannot be interpreted to read the one rank one pension rule into it. It was only held that the same principle of computation of pensions must be applied uniformly to a homogenous class.

(iv) It is not a legal mandate that pensioners who held the same rank must be given the same amount of pension. The varying benefits that may be applicable to certain personnel which would also impact the pension payable need not be equalised with the rest of the personnel."

Placing reliance on the above principle the court found no constitutional infirmity in the OROP principle for the following reasons:

"(i) The definition of OROP is uniformly applicable to all the pensioners irrespective of the date of retirement. It is not the case of the petitioners that the pension is reviewed 'automatically' to a class of the pensioners and 'periodically' to another class of the pensioners.

(ii) Since the uniform application of the last drawn salary for the purpose of calculating pension would put the prior retirees at a disadvantage, the Union Government has taken a policy decision to enhance the base salary for the calculation of pension. Undoubtedly, the Union Government had a range of policy choices including taking the minimum, the maximum or the mean or average. The Union government decided to adopt the average. Persons below the average were brought up to the average mark while those drawing above the average were protected. Such a decision lies within the ambit of policy choices.

(iii) While no legal or constitutional mandate of OROP can be read into the decisions in Nakara and SPS Vains, varying pension payable to officers of the same rank retiring before and after 1 July 2014 either due to MACP or the different base salary used for the calculation of pension cannot be held arbitrary.

(iv) Since the OROP definition is not arbitrary, it is not necessary for us to undertake the exercise of determining if the financial implications of the scheme is negligible or enormous."

Click Here to read/download the Judgment