Section 192 of IT Act - Immunity Under IDS Would Only Be Granted To Declarant And Not To Other Assessee - SC

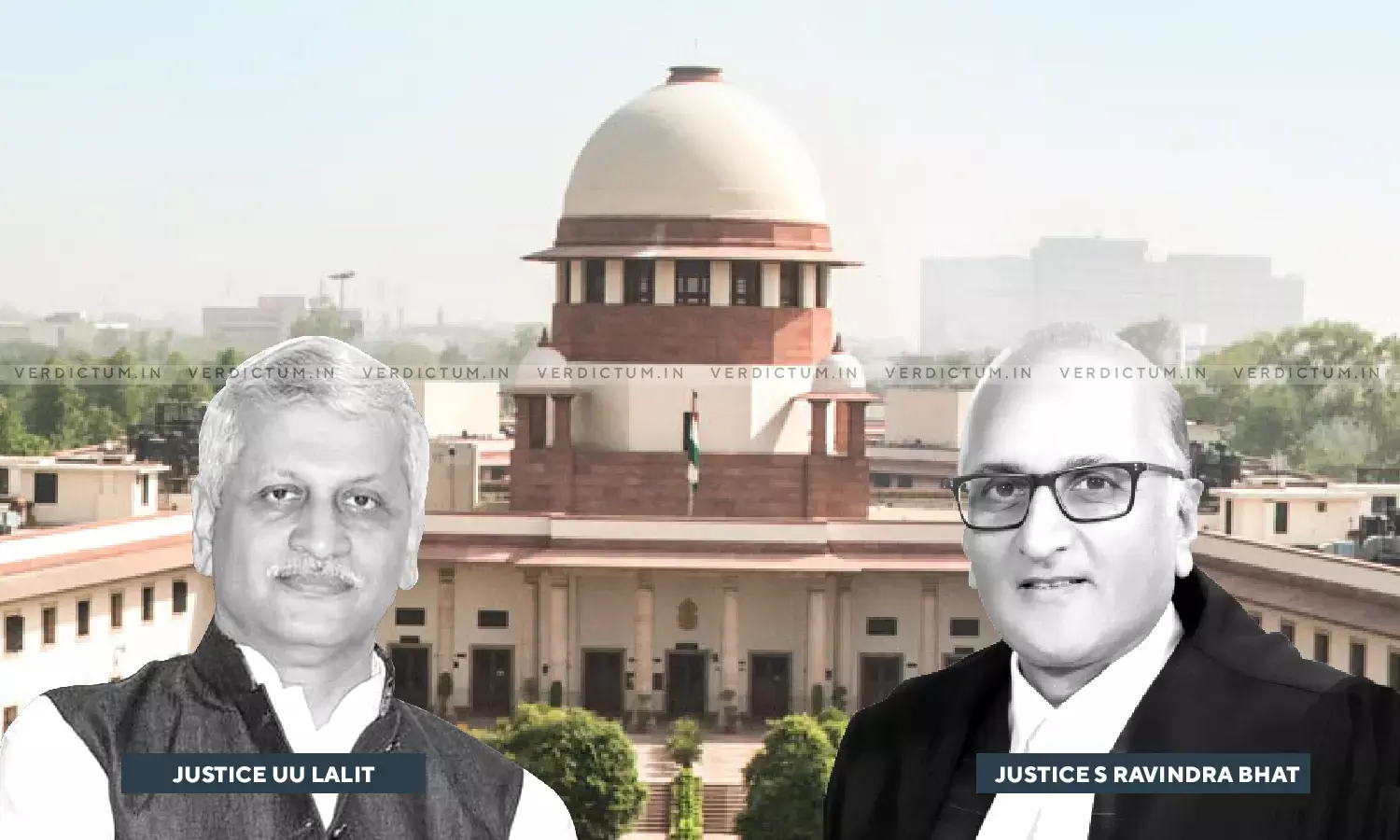

A two-judge Bench of Justice U.U. Lalit and Justice S. Ravindra Bhat while setting aside a judgment of the Gujarat High Court has held that immunity under IDS Scheme cannot be extended to the assessee but only to the declarant.

The Gujarat High Court had quashed a notice under section 148 on the grounds that there was no tangible material to re-open the assessment. The High Court noted IDS immunity was given in respect of amounts declared and brought to tax in terms of such a scheme and the declaration could not be relied upon.

ASG Mr. N. Venkataraman appeared for Revenue, while, Senior Counsel Mr. Guru Krishnakumar appeared for the Assessee before the Apex Court.

The Apex Court placed reliance on various precedents to consider what could be the valid grounds for re-opening the assessment under Section 147 of the Income Tax Act and held that a valid re-opening is one, preceded by specific, reliable, and relevant information and that the sufficiency of such reasons is not subject to judicial review- the only caveat being that the court can examine the record if such material existed, it was held that the facts disclosed in the return, if found later to be unfounded or false, can always be the basis of a re-opening of assessment.

The Court further noted that the assessee's contention that reopening was done based on the disclosure made by Garg Logistics was not correct.

Further, the Bench also noted that the original assessment was not completed after scrutiny, but was under Section 143 (1) of the Act. The Court held that the status of such an assessment is essentially weak.

"The "reasons to believe" forming part of the Section 147- in this case, clearly point to the fact that the reopening of assessment was based on information accessible by the AO that a substantial amount of unaccounted income of promoters/directors was introduced in the closely held companies of the assessee group," the Court observed.

The Bench further opined, "Another aspect which should not be lost sight of is that the information or "tangible material" which the assessing officer comes by enabling re-opening of an assessment, means that the entire assessment (for the concerned year) is at large; the revenue would then get to examine the returns for the previous year, on a clean slate – as it were. Therefore, to hold- as the High Court did, in this case, that since the assessee may have a reasonable explanation, is not a ground for quashing a notice under Section 147."

"...the scope and effect of the Income Declaration Scheme (IDS), introduced by Chapter IX of the Finance Act, 2016. The objective of its provisions was to enable an assessee to declare her (or his) suppressed undisclosed income or properties acquired through such income. It is based on voluntary disclosure of untaxed income and the assessee's acknowledging income tax liability. This disclosure is through a declaration (Section 183) to the Principal Commissioner of Income Tax within a time period, and deposit the prescribed amount towards income tax and other stipulated amounts, including penalty," the Court held.

The Court held that it was Garg Logistics Pvt. Ltd which was the declarant and not the assessee and the immunity under Section 192 is essentially granted to the declarant only.

The Bench additionally held that the opinion that the High Court fell into error, in holding that the sequitur to a declaration under the IDS can lead to immunity (from taxation) in the hands of a non-declarant.

In the light of these observations, the Court allowed the Revenue's appeal and set aside the impugned order of the High Court, and directed the AO to complete the re-assessment.