Exemption To Pay Service Tax Cannot Be Claimed By Market Committees Under Rajasthan Agricultural Produce Markets Act - SC

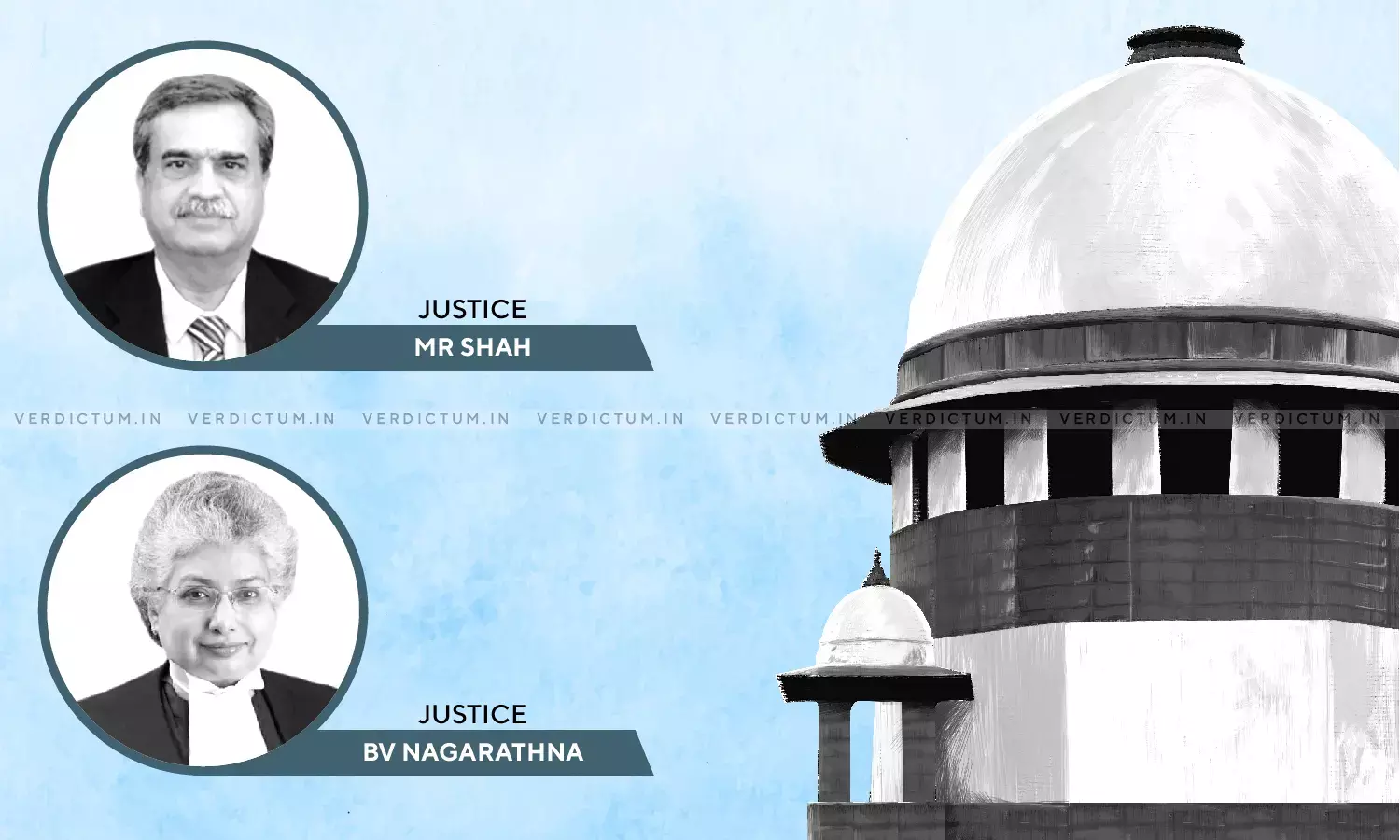

A two-judge bench of the Supreme Court comprising of Justice M.R. Shah and Justice B.V. Nagarathna has held that an exemption to pay service tax could not be claimed by Market Committees under the Rajasthan Agricultural Produce Markets Act, 1961 since it could not be said to be a mandatory statutory obligation of the Market Committees to provide shop/land/platform on rent/lease.

In this case, the Krishi Upaj Mandi Samiti (Agricultural Produce Market Committees) were located in different parts of the State of Rajasthan. The respective Appellants were established under the provisions of the Rajasthan Agricultural Produce Markets Act, 1961. The State Government constituted various Market Committees (including the Appellants herein) in the notified market areas to carry out the functions as envisaged in the Act, 1961 and the Rules made thereunder. The respective Appellants regulated the sale of agricultural produce in the notified markets. They charged a "market fee" for issuing licenses to traders, agents, factory /storage, company, or other buyers of other agricultural produce. The Appellants also rented out the land and shops to traders and collect the allotment fee/lease amount for such land/shop.

The Revenue was of the view that the Appellants were liable to pay the service tax on the services rendered by them by renting/leasing the lands/shops. However, the Appellants were held liable for service tax under the category of "renting of immovable property" in respect of renting of land(s)/shop(s) for consideration.

Accordingly, the Service Tax demands were confirmed. Penalties under Sections 76, 77, and 78 of the Finance Act, 1994 were also imposed on them. The Appellants preferred appeals before the CESTAT which held that the Appellants – Market Committees were not liable to service tax. The CESTAT also set aside the penalties imposed on the Appellants. The respective Market Committees located in the State of Rajasthan had preferred the present appeals before the Apex Court.

Counsel, Shri Prakul Khurana, and Counsel, Ms. Divyasha Mathur, appeared on behalf of the respective Appellants while Counsel, Ms. Nisha Bagchi represented the Respondent before the Supreme Court

The primary issue in this case was –

(i) Whether an exemption to pay service tax can be claimed?

It was contended by the Appellants that under Section 9(2)(xvii) of the Act, 1961, it was the duty cast upon the respective Market Committees for allotment/disposal of land or any movable or immovable property for the purpose of effectively carrying out its duties. It was submitted that as per Section 9(2)(xiii), the Market Committees were authorized to levy, recover, and receive rates, charges, fees, and other sums of money to which the Market Committee was entitled. Therefore, it was the case on behalf of the respective Market Committees that the activities of the said Market Committees of allotment/leasing/renting the shop/land/platform was in the nature of a statutory activity and therefore as per Circular No.89/7/2006, the respective Market Committees were exempted from payment of service tax on such activities, which were in the nature of the statutory activity.

On the other hand, the Respondent argued that all the authorities below had rightly held that the activities of allotment/renting/leasing of the shop/shed/platform/land could not be said to be a mandatory statutory activity, and therefore, the Market Committees were not exempted from service tax as per 2006 circular as claimed by the respective Market Committees.

The Court observed that it was settled law that the notification had to be read as a whole. If any of the conditions laid down in the notification was not fulfilled, the party was not entitled to the benefit of that notification.

According to the Court, an exception and/or an exempting provision in a taxing statute should be construed strictly and it was not open to the court to ignore the conditions prescribed in the relevant policy and the exemption notifications issued in that regard.

The Court asserted that – "As per the law laid down by this Court in a catena of decisions, in a taxing statute, it is the plain language of the provision that has to be preferred, where language is plain and is capable of determining a defined meaning. Strict interpretation of the provision is to be accorded to each case on hand. Purposive interpretation can be given only when there is an ambiguity in the statutory provision or it results in absurdity, which is so not found in the present case."

In this case, the Court observed that under the Act, 1961, it could not be said to be a mandatory statutory obligation of the Market Committees to provide shop/land/platform on rent/lease. According to the Court, if the statute mandated that the Market Committees had to provide the land/shop/platform/space on rent/lease then and then only it could be said to be a mandatory statutory obligation otherwise it was only a discretionary function under the statute. If it was a discretionary function, then, it could not be said to be a mandatory statutory obligation/statutory activity. Hence, no exemption to pay service tax could be claimed.

Thus, the Supreme Court held that the appeals had failed and the same were accordingly dismissed.

Click here to read/download the Judgment