Entire Life of NBFC From Womb To Tomb Is Regulated By RBI – SC Upholds Applicability of RBI Act On NBFCs

The Supreme Court on Tuesday upheld the applicability of the Reserve Bank of India Act, 1934 over Non-Banking Financial Companies, holding that the State Enactments such as the Kerala Money Lenders Act, 1958 and Gujarat Money Lenders, 2011 in the case cannot override the provisions of the RBI Act in relation to NBFCs.

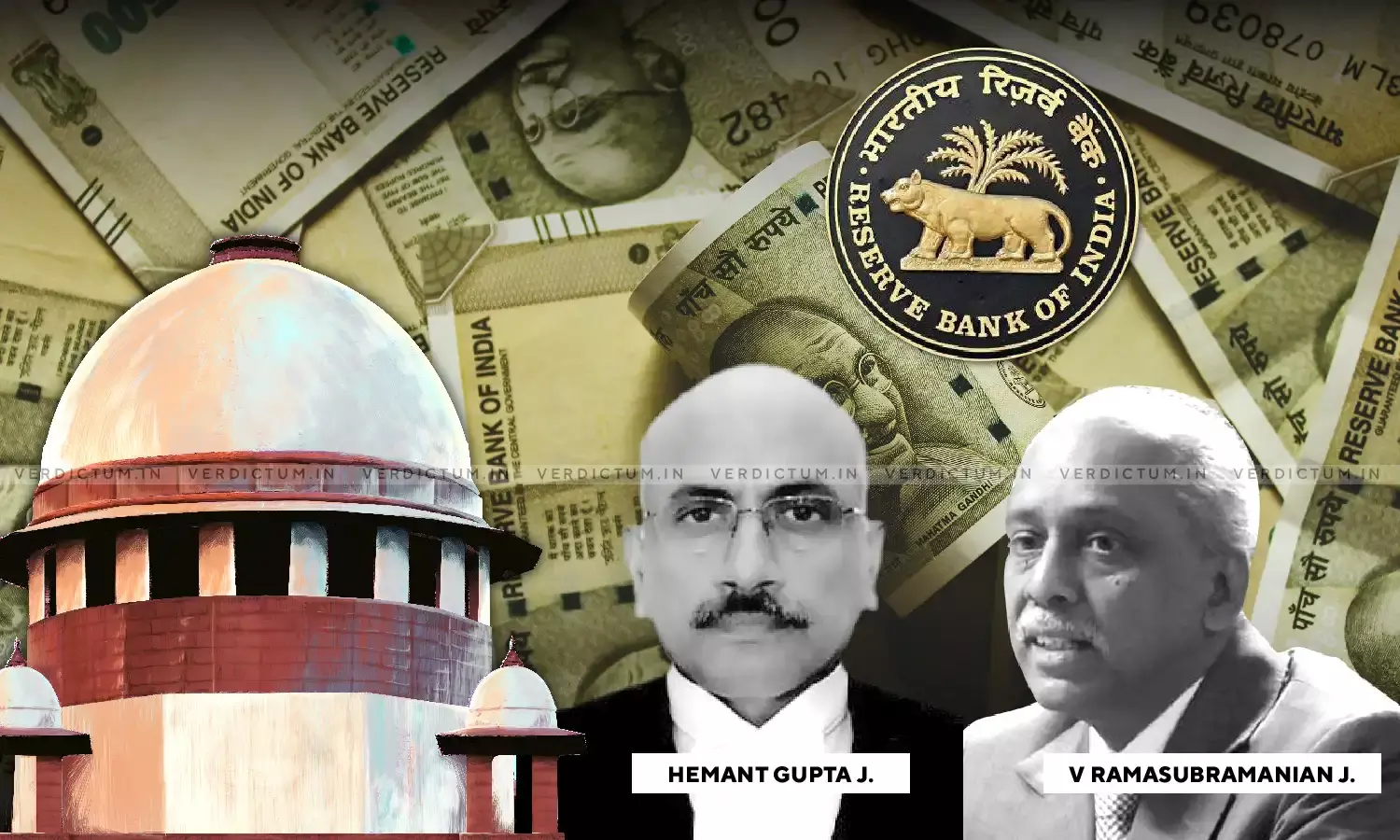

The Bench comprising of Justice Hemant Gupta and Justice V Ramasubramanian held that no NBFC can carry on its business without being registered under the RBI Act, and thus observed –

"The above scheme of Chapter IIIB of the RBI Act shows that the power of intervention available for the RBI over NBFCs, is from the cradle to the grave. In other words, no NBFC can carry on business without being registered under the Act and a NBFC which takes birth with the registration under the Act is liable to be wound up at the instance of the RBI. The entire life of a NBFC from the womb to the tomb is also regulated and monitored by RBI."

Senior Counsel Mr. Jaideep Gupta appeared for the State of Kerala before the Supreme Court.

The Bench was adjudicating upon the issue as to whether NBFCs regulated by RBI under Chapter III-B of the RBI Act could also be regulated by State enactments such as the Kerala Money Lenders Act and Gujarat Money Lenders Act with the Kerala and Gujarat High Courts taking opposite views.

With respect to the State of Kerala, after the rapid growth of NBFCs, the Government of Kerala had started to insist NBFCs take a license under the Kerala Act, failing which penal consequences were threatened. This led to the filing of Writ Petitions before the Kerala High Court wherein the Judge of the High Court had dismissed the batch of Writ Petitions which was confirmed by the Division Bench of the High Court. Aggrieved, NBFCs approached the Supreme Court.

The batch of appeals was filed before the Apex Court seeking a declaration that NBFCs registered under the RBI Act will not come under the purview of the Kerala Act.

With respect to the State of Gujarat, batch of Special Civil applications was filed seeking a declaration that the provisions of the Gujarat Act are not applicable to NBFCs registered under the RBI Act. The Division Bench of the Gujarat High Court had allowed the applications holding that the Gujarat Act, 2011 is ultra vires the Constitution for legislative incompetence as it seeks to have control over NBFCs registered under the RBI Act.

The Gujarat High Court had also issued a consequential direction restraining the State Government from applying the provisions of the Gujarat Act against NBFCs registered under the RBI Act. Aggrieved, the State of Gujarat approached the Supreme Court.

- Chapter III-B of the RBI Act

The Apex Court noted that in contrast to the State enactments regulating the business of money lending, whose one-eyed focus is only on the protection of the borrowers, the RBI takes a holistic approach to the business of banking, money lending, and operation of the currency and credit system of the country.

The Bench further also observed that the scheme of Chapter III-B of the RBI Act shows that the power of intervention available for the RBI over NBFCs is from the cradle to the grave and thus observed –

"In other words, no NBFC can carry on business without being registered under the Act and a NBFC which takes birth with the registration under the Act is liable to be wound up at the instance of the RBI."

The Court also held that the directions issued by RBI are statutory in character and binding on all NBFCs.

The Bench further added –

"Once it is found that Chapter IIIB of the RBI Act provides a supervisory role for the RBI to oversee the functioning of NBFCs, from the time of their birth (by way of registration) till the time of their commercial death (by way of winding up), all activities of NBFCs automatically come under the scanner of RBI. As a consequence, the single aspect of taking care of the interest of the borrowers which is sought to be achieved by the State enactments gets subsumed in the provisions of Chapter IIIB."

- Regulations/Master Circulars/Directions issued by RBI at regular intervals

The Court held that apart from the provisions of Chapter III-B, the regulations, master circulars and directions issued by RBI at regular intervals also bind the NBFCs, the Bench in this context further held –

"There is a long list of Regulations/directions or Master Circulars issued by RBI from 1977 onwards, which shows that even before the 1997 Amendment to the RBI Act, some kind of control was exercised by RBI over NBFCs. After the 1997 amendment, every aspect of the business of NBFCs, including loans, is covered by Master Circulars/ Directions issued by RBI. In other words, the only field occupied by the State enactments stand appropriated by the Master Circulars/Directions."

Thus, the Court held that since the regulations, master circulars and directions issued by RBI are binding on NBFCs, it is clear that all aspects of NBFCs are regulated by the RBI and nothing is left untouched.

- Is Chapter III-B a complete code?

The Bench placed reliance on Integrated Finance Company Limited vs. Reserve Bank of India and Others, in which the Apex Court had held that Chapter III-B of the RBI Act is a complete code in itself.

The Court further held, "…no NBFC can commence or carry on business without obtaining the certificate of registration under the Act. We have also seen that their continuation in business would depend upon compliance with certain prescriptions found in the RBI Act as well as the circulars/directions issued by RBI. The RBI has the power to supersede the Board of Directors of a NBFC and has power even to wind up a NBFC. Thus the supervision and regulation of NBFCs, by the RBI, is from the time of birth till the time of death. If a statutory enactment which provides for such a type of control and supervision is not a complete code in itself, we do not know what else could be a complete code."

- Overriding Effect

The Bench held that as per Section 45-Q of the RBI Act, it confers overriding effect upon Chapter III-B over all other laws. Thus, the States of Kerala and Gujarat cannot contend that the laws made by them are in addition to the provisions of Chapter III-B.

Thus, the Court held that the Kerala Act and Gujarat Act will have no application over NBFCs registered under the RBI Act and are regulated by RBI.

In the light of these observations, the Court allowed the appeals filed by NBFCs against the judgment of the Kerala High Court and dismissed the appeals filed by the State of Gujarat against the judgment of the Gujarat High Court.

Click here to read/download the Judgment