Debt Arising Out Of Advance Payment Made To Corporate Debtor For Supply Of Goods Or Services To Be Considered As Operational Debt - SC

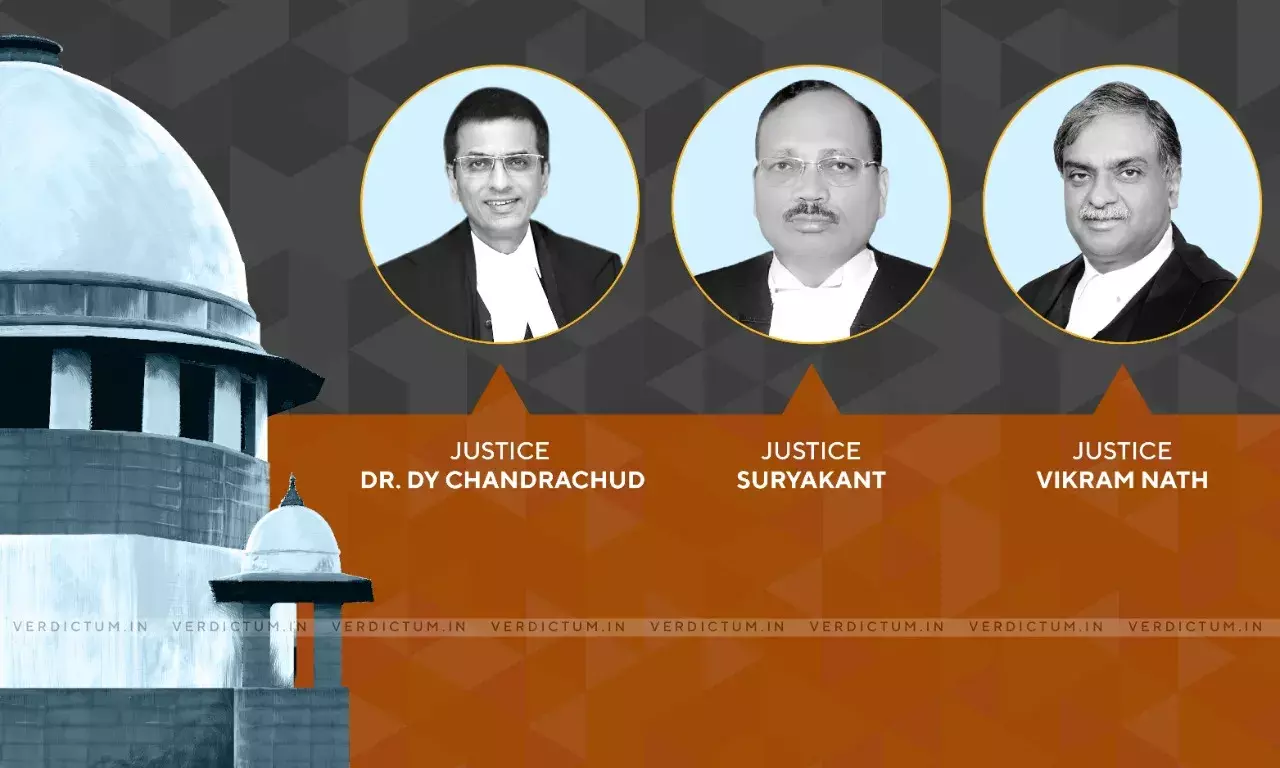

A three-judge bench of the Supreme Court comprising Justice Dr. DY Chandrachud, Justice Surya Kant, and Justice Vikram Nath noted that Section 5(21) of the IBC defines operational debt as a claim in respect of the provision of goods or services. The Court noted that the presence of an invoice is not a sine qua non since a demand notice can also be issued on the basis of other documents which prove the existence of the debt.

The Court, while relying upon Pioneer Urban Land and Infrastructure Ltd. v. Union of India, (2019) 8 SCC 416, [that held "[e]xamples given of advance payments being made for turnkey projects and capital goods, where customization and uniqueness of such goods are important by reason of which advance payments are made, are wholly inapposite as examples vis- -vis advance payments made by allottees"] noted that this leaves no doubt that a debt which arises out of advance payment made to a corporate debtor for the supply of goods or services would be considered as an operational debt.

The appeal was filed under Section 62 of the IBC 2016 that arose from a judgment of the NCLAT via which, NCLAT had reversed the decision of NCLT, Chennai.

Mr. M P Parthiban appeared on behalf of the Appellant while Mr. K Parameshwar appeared on behalf of the Respondent.

NCLT had admitted an application filed by the Appellant under Section 9 of the IBC for initiation of CIRP against the Respondent. The NCLT held that Respondent's MoA proved that it took over a proprietary concern and that concern did owe Appellant an outstanding operation debt. NCLT declared a moratorium under Section 14 and appointed an IRP.

NCLAT set aside the decision of NCLT and dismissed the application of Appellant under Section 9. Hence the appeal. The operation of NCLAT was stayed by the Apex Court in an interim order. The questions that Court considered were as follows:

(i) Whether the Appellant is an operational creditor under the IBC even though it was a 'purchaser';

(ii) Whether the Respondent took over the debt from the Proprietary Concern; and

(iii) Whether the application under Section 9 of the IBC is barred by limitation.

The Court noted that an operational debt needs to involve a claim in respect of the provision of goods or services.

The Court made the following crucial observations:

"In accordance with Section 9(1), an operational creditor can file the application under Section 9 after ten days from the date of delivery of the notice under Section 8, if no payment or notice of an existing dispute is received. Section 9(3)(a) requires the application to be accompanied by a copy of the invoice demanding payment or demand notice delivered by the operational creditor to the corporate debtor. This again highlights that it could be either one of the two, i.e., an invoice or a demand notice."

The Court noted that operational creditors and those whose debt arises from operational transactions i.e. transactions that are undertaken in relation to the operation of an enterprise.

The Court noted that "Another point of difference between financial and operational creditors would be in the nature of their role in the Committee of Creditors21, because it is assumed the operational creditors will be unwilling to take the risk of restructuring their debts in order to make the corporate debtor a going concern. Thus, their debt is not seen as a long-term investment in the going concern status of the corporate debtor, which would incentivize them to restructure it, but merely as a one-off transaction with the corporate debtor for certain goods or services."

The Court then relied upon a series of judicial precedents inter alia including Swiss Ribbons (P) Ltd. v. Union of India, (2019) 4 SCC 17 and Pioneer Urban Land and Infrastructure Ltd. v. Union of India, (2019) 8 SCC 416.

The Court noted that the Court had on earlier occasions highlighted its concern that operational creditors may initiate insolvency proceedings against corporate debtors for miniscule amounts of debt which in turn could jeopardize the financial health of the corporate debtor.

On the MoA, Court made the following observations:

"Consequently, the MOA of the respondent still stands and the presumption will continue to be in favor of the appellant. Thus, it can be concluded that the respondent took over the Proprietary Concern and was liable to re-pay the debt to the appellant. Hence, the application under Section 9 of the IBC was maintainable."

On the question of limitation, the Court noted that Section 9 application will not be barred by limitation.

The Court answered the aforementioned three questions as follows:

"(i) The appellant is an operational creditor under the IBC, since an 'operational debt' will include a debt arising from a contract in relation to the supply of goods or services from the corporate debtor;

(ii) The respondent will be considered to have taken over the Proprietary Concern in accordance with its MOA; and

(iii) The application under Section 9 of the IBC is not barred by limitation."

The Court allowed the appeal and set aside the impugned judgment of NCLAT. The Court noted that since CIRP in respect of respondent was ongoing, no further directions would be required.

Click here to read/download the Judgment