Aadhar Card, Indian Passport, And Bank Certificates Sufficient To Prove Residence Of Green Card Holder - Supreme Court

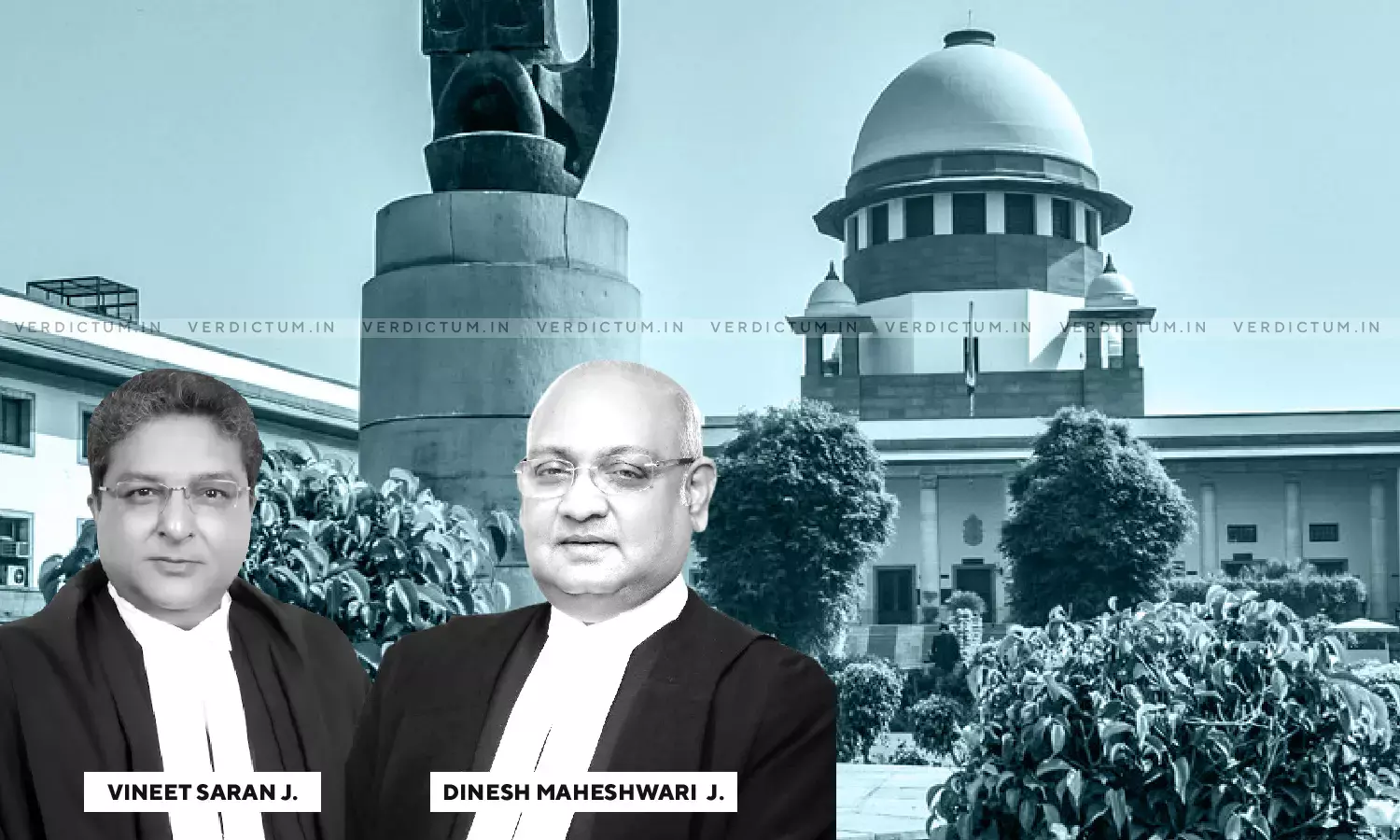

A Supreme Court Bench of Justice Vineet Saran and Justice Dinesh Maheshwari while setting aside an order passed by the Madras High Court of Madras regarding the appointment to the office of founder trustee in a Trust has held that Aadhar Card, Indian Passport, and Bank Certifcates of a green card holder are sufficient to prove his residence.

In this context, the Court held -

"The overwhelming evidence produced by the plaintiff-appellant in the form of Aadhaar Card issued by the Government of India as also his Income Tax assessments in India based on the certification of Chartered Accountant of his fulfilling the requirement of 'resident' in terms of Section 6 of the Income Tax Act, 1961 has been taken to be of little value by the High Court after counting the number of days of the appellant's stay in India and then questioning that the certificates were not showing as to for how many days he was in Madras Presidency."

Further, the Bench also held, "The appellant's ownership and possession of property in India, including residential property; having bank accounts in India; being assessed as resident for the purpose of Income Tax Act, 1961 have all been brushed aside by the High Court by mere count of number of days of stay in India. With respect, we are unable to endorse this approach."

The Respondent-Trust was initially administered as per the trust deed, that had been executed by 4 people. They followed a comprehensive Scheme of Administration provided by the Principal Subordinate Judge. The Scheme provided that there shall be a Board of Trustees of 9 members out of which, the 4 people were recognized as "Founder Trustees" while the rest were referred to as "Elected Trustees". It was also provided that one of the founder trustees shall be the "Managing Trustee". It was further provided that a founder trustee shall be entitled to hold office for life.

One of the founder trustees died, leaving behind two sons. After his demise, his son held the position of the founder trustee, until his demise. Then his brother became the founder trustee and held the position until he submitted his resignation and nominated his son, Shri Naren Rajan, to be appointed as founder trustee. This act triggered the dispute and it was alleged that as a consequence of their resignation, he had lost his right to nominate or vote in the selection process of the hereditary trustee of the branch represented by him. The Appellant was his nephew.

The Trial Court held that all rights to vote had been lost after the resignation and the remaining founder trustees should make the selection. The founder trustees unanimously chose the Appellant. However, on appeal, the High Court issued a mandatory injunction to appoint Shri Naren Rajan as one of the founder trustees. The High Court injuncted the Trust from appointing the Appellant as a founder trustee, and Shri Naren Rajan was appointed. However, he met his untimely death due to an accident.

After his death, the Appellant filed a suit for recognizing him as a founder trustee. However, the suit failed and Shri Naren Rajan's father was appointed against the vacancy, and he continued to serve until his death.

The Appellant then intimated the Board of his willingness to hold office as founder trustee. The Appellant was called upon by the Board to furnish proof of his permanent residence in India because the Board was of the view that SOA mandated that for a person to be qualified for the post of founder trustee, he must be "permanently" residing in Madras. When all correspondences failed, the Appellant filed a suit. The Trial Court accepted the Appellant's right to be recognised as the founder trustee and granted injunction restraining the defendants from interfering with the right of the Appellant as a founder trustee.

The Respondents approached the High Court, where the High Court observed that the Appellant was a permanent resident of the U.S.A., as reflected from his Green Card. He was holding Aadhaar Card to raise the presumption of his residence at the address mentioned therein and he was an income tax assessee in India as well as in the U.S.A. Further, it held that as per the spirit of the SOA, the Appellant had failed to prove his animus to reside in Madras Presidency and could not be termed as a resident. To that end, the High Court opined that the Appellant was not eligible for the office of the founder trustee. The Appellant then approached the Supreme Court.

The Apex Court noted that the High Court had approached the case from an altogether wrong angle and proceeded on irrelevant considerations while ignoring the relevant facts and material considerations.

Further, the Bench also held that the High Court seemed to have picked up the residential requirement in the qualification of trusteeship in the Scheme of Administration as being of strict physical presence, dehors the context, and dehors the purpose.

"With respect, it appears that the High Court in the first place seems to have missed out the fundamentals on the spirit of formation of trust and its Scheme of Administration," the Court added.

Additionally, the Court held, "When looking at the spirit of the Scheme of Administration of Trust, in our view, it would be a travesty of the Scheme itself if in the presence of the appellant, the representation of this branch of the founder trustee is annulled or the position is shifted to someone else. Of course, this could happen if it is established beyond doubt that the appellant has incurred one or more of the disqualifications. In this suit, no other disqualification has been alleged by the respondents against the appellant except his want of residence in Madras Presidency."

The Supreme Court upheld the findings of the Trial Court, and to that end opined that "The requirements of physical residence, with the rapid advancement of the means of communication and transport cannot be ignored particularly when the purpose of the term 'residence' in document in question is to ensure participation in the affairs of the trust effectively, as and when required. The intent of the Trial Court in its observations had been only this much that in view of the present-day advancement, literal meaning of residence, by requiring actual physical presence every day and every moment is not correct."

Further, the Supreme Court also opined that the Respondents were unjustified in questioning the eligibility of the Appellant to hold the office of founder trustee with reference to his Green Card and want of permanent residence in the area in question.

Accordingly, the Supreme Court set aside the order of the High Court and upheld the decree of the Trial Court. It ordered that the Appellant shall be entitled to hold the office of founder trustee.

Click here to read/download the Judgment