Merely Because Tenant Is Obliged To Pay Half Of Property Tax & Surcharge, It Cannot Become Part Of Rent Amount: SC

The Supreme Court has recently observed that "Merely because the obligation to pay half of the property tax and surcharge would be upon the tenant as per section 230 of the Act 1980 (Kolkata Municipal Corporation Act, 1980) and the tenant is obliged to pay his share of municipal tax as an occupier of the premises under Section 5(8) of the Act 1997 (West Bengal Premises Tenancy Act, 1997) and merely because for the purpose of recovery of the tax due from the tenant, such tax apportioned can be recovered as rent, such tax apportioned (half of the amount of the property tax and surcharge) cannot become part of the rent of the premises which is tenanted."

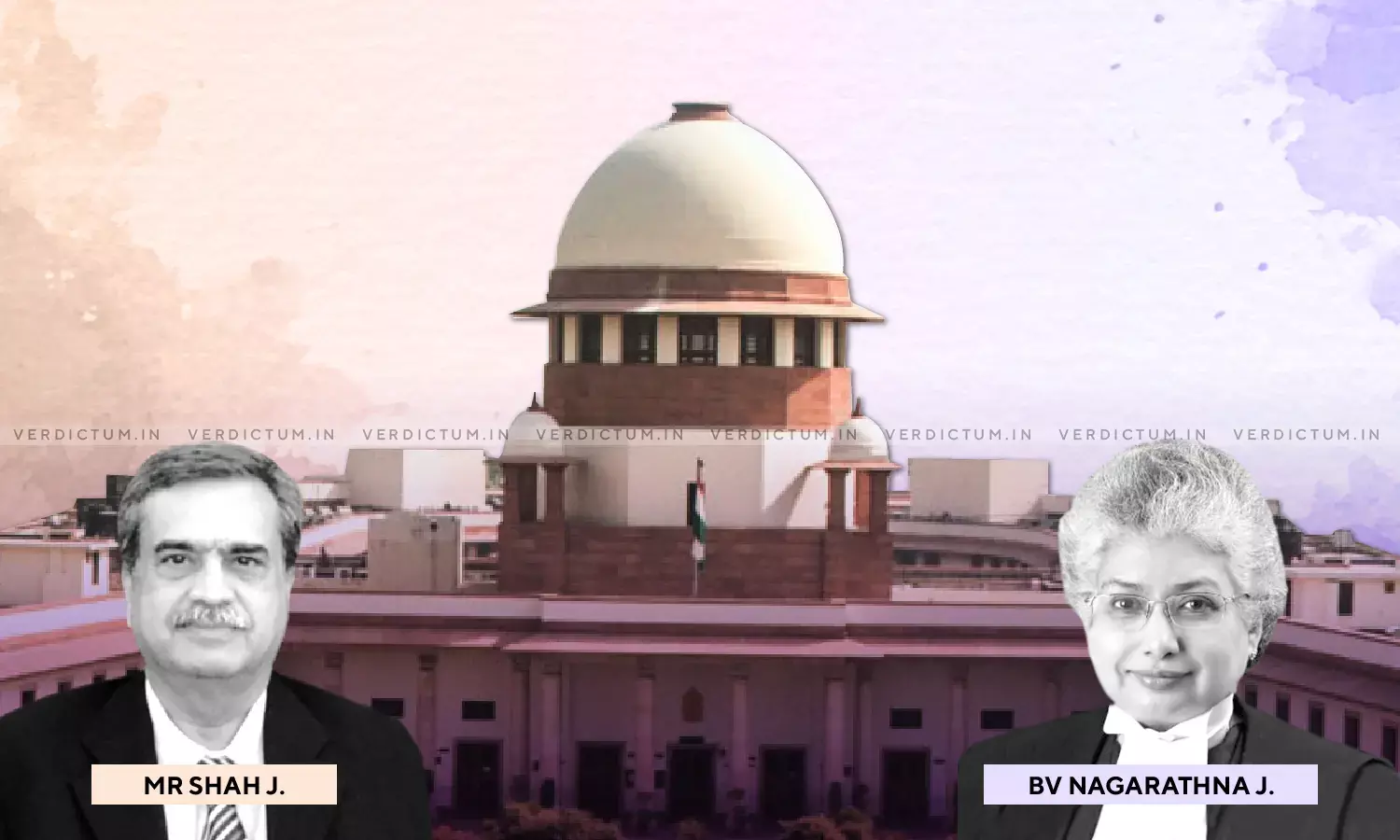

The Bench of Justice MR Shah and Justice BV Nagarathna made this observation while deciding the issue- whether, share of municipal tax due and payable by the tenant under Section 230 of the Act 1980 and Section 5(8) of the Act 1997 shall be included within the expression 'rent'.

In the present case a landlord-appellant had inducted the respondent as tenant by virtue of a tenancy agreement. Under the Tenancy Agreement, the rent was fixed at Rs. 10,000/- per month and the liability to pay the taxes including surcharge and water tax/fees was upon the respondent – tenant.

The appellant-landlord terminated the tenancy by issuing notice under Section 106 of the Transfer of Property Act, 1882. Upon expiry of the notice period, the appellant-landlord filed a suit before the Single Judge of the Calcutta High Court, seeking eviction of the respondent – tenant from the tenanted premises.

According to the appellant, as the liability to pay the tax payable to the Calcutta Municipal Corporation was upon the respondent – tenant and in view of Section 5(8) of the Act 1997 r/w Section 3(f), the total rent payable by the tenant inclusive of monthly rent and taxes would exceed the ceiling limit of Rs.10,000/- per month specified in Section 3(f)(i) of the Act 1997 for commercial premises, hence the Act 1997 was not applicable and therefore the landlord terminated the tenancy by issuing notice under Section 106 of the TP Act.

The original defendant – tenant after appearing in the suit filed an application before the Single Judge under Order 7 Rule 11 Code of Civil Procedure for rejection of the plaint, inter alia, on the ground that the suit was barred by reasons of the provisions of the Act 1997 being applicable because the rent of the said premises was Rs. 10,000/- per month and the tenancy being for commercial purpose is not exempted under Section 3(f)(i) of the Act 1997.

The Single Judge allowed the said application and rejected the plaint by holding that the rent payable by the tenant was Rs. 10,000/- per month which is below the ceiling limit mentioned in Section 3(f)(i) of the Act 1997 and therefore the Act 1997 is applicable and therefore the suit under Section 106 of the TP Act is impliedly barred by the provisions of the Act 1997.

An appeal against this decision of the Single Judge was challenged before the Division Bench but the Division Bench of the High Court dismissed the appeal and confirmed the order passed by the Single Judge.

Feeling aggrieved the appellant-landlord approached Supreme Court.

Senior Advocate Rana Mukherjee, appeared on behalf of the landlord and Senior Advocate Siddharth Dave, appeared on behalf of the tenant.

The Court noted that the tenancy agreement did not provide that the parties agreed that the rent would be inclusive of municipal taxes payable and that as and when such taxes are enhanced, rent would be proportionately raised. The Court held that under the tenancy agreement, the rent payable would be Rs. 10,000/- per month and the liability to pay municipal taxes was separate and distinct on the tenant.

The Court observed that as per Section 230 of the Act 1980, a person primarily liable to pay the property tax (lessor) in respect of any land or building may recover half of the amount of the property tax from the occupier (lessee/tenant) of the property.

"Section 231 of the Act 1980 provides that the person primarily liable to pay any property tax is entitled to recover the consolidated rate including surcharge from the occupier of the property and for that purpose the person primarily liable shall have the same rights and remedies as if such sum were 'rent' payable to him by the person from whom he is entitled to recover such sum. Section 5(8) of the Act 1997 casts an obligation on the tenant to pay his share of municipal tax as an occupier of the premises in accordance with the provisions of the Act 1980.", the Court observed.

The Court opined that merely because the obligation to pay half of the property tax and surcharge would be upon the tenant as per section 230 of the Act 1980 and the tenant is obliged to pay his share of municipal tax as an occupier of the premises under Section 5(8) of the Act 1997, such tax apportioned (half of the amount of the property tax and surcharge) cannot become part of the rent of the premises which is tenanted.

"For example, if in the tenancy agreement if it is provided that the tenant shall pay 'X' amount which shall include the taxes, the tax component can be said to be 'part of the rent'. However, if under the agreement and/or even under Section 230 of the Act 1980 r/w Section 5(8) of the Act 1997, the tenant is liable to pay tax separately or half of the amount of tax now statutorily liable to be paid, the same can be recovered as arrears of rent because such 'tax' is to be treated as 'rent' for the purpose of recovery. However, the same cannot be said to be 'part of the rent'.", the Court stated.

Therefore the Court upheld the order of the High Court holding that the Act 1997 shall be applicable and that therefore the civil suit filed by invoking Section 106 of the Transfer of Property Act is impliedly barred.

Cause Title- EIH Limited v. Nadia A Virji

Click here to read/download the Judgment