Co-Ordinate Bench Cannot Comment Upon Discretion Exercised Or Judgment Rendered By Another Bench Of Same Strength- Apex Court

The Supreme Court has held that any passing reference of the impugned judgment made by the Bench of the equal strength could not be a ground for review. The judgment sought to be reviewed was adversely commented upon in a subsequent judgment delivered by a bench of the same bench strength. This was cited by the review petitioners as a ground to seek review of the judgment.

The Court held this in a batch of review petitions seeking to review the common judgment and order passed by the Apex Court in the appeals preferred by the State Tax Officer.

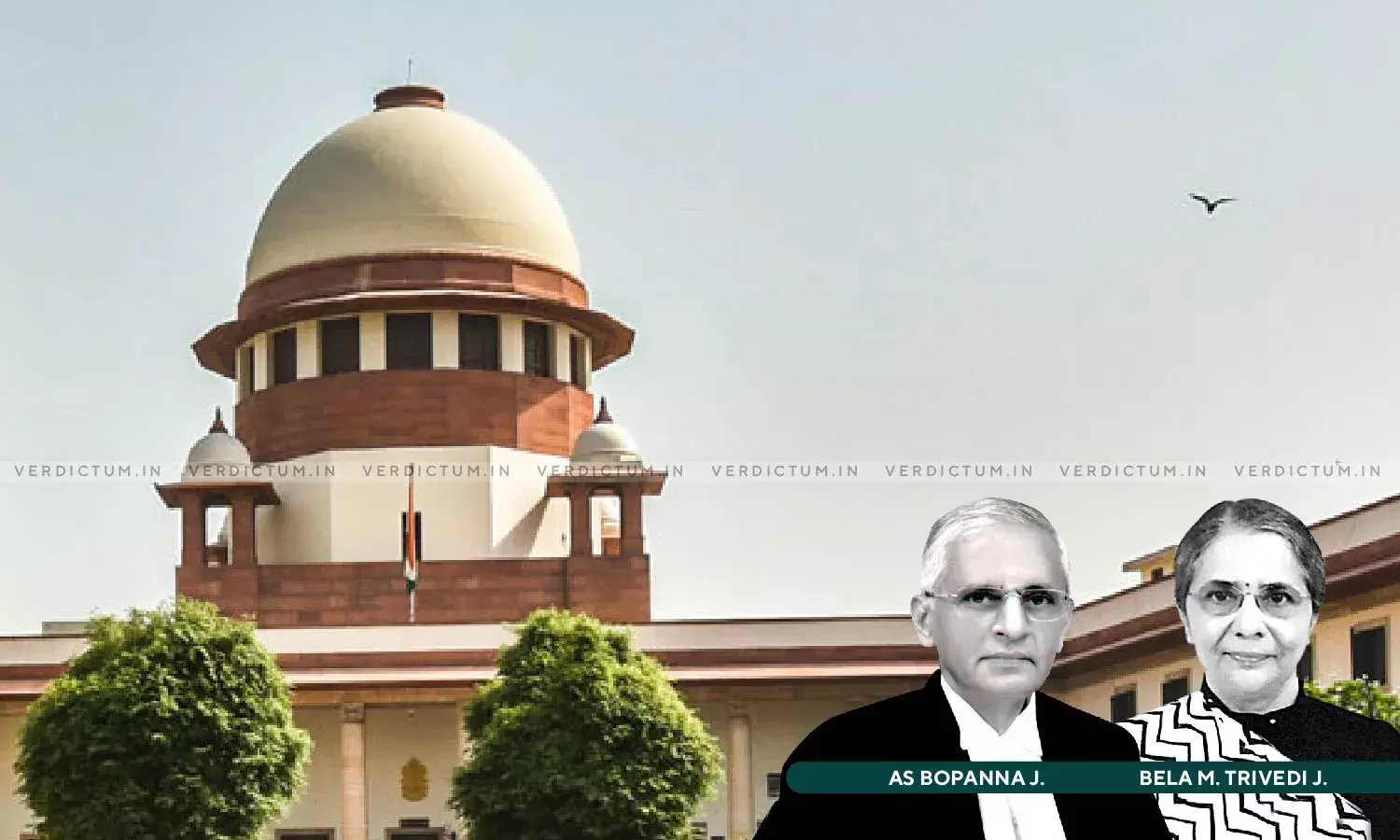

The two-Judge Bench of Justice A.S. Bopanna and Justice Bela M. Trivedi observed, “Taking recourse to the said observations made by the co-ordinate bench, the learned Counsels for the Review Petitioners have urged to review the impugned judgment. The said submission of the learned Counsels for the review petitioners deserves to be outrightly rejected for the simple reason that any passing reference of the impugned judgment made by the Bench of the equal strength could not be a ground for review. It is well settled proposition of law that a co-ordinate Bench cannot comment upon the discretion exercised or judgment rendered by another co-ordinate Bench of the same strength.”

The Court added that if a Bench does not accept as correct the decision on a question of law of another Bench of equal strength, the only proper course to adopt would be to refer the matter to the larger Bench, for authoritative decision, otherwise the law would be thrown into the state of uncertainty by reason of conflicting decisions.

Senior Advocates Harish N. Salve, Naveen Pahwa, Dhruv Mehta, Ramji Srinivasan, Siddharth Bhatnagar, and Sumesh Dhawan appeared for the review petitioners while Senior Advocate Maninder Singh with Advocate Aastha Mehta appeared for the respondents.

In this case, a civil appeal was preferred by the appellant-State Tax Officer against the respondent-Rainbow Papers Limited (Corporate Debtor), being aggrieved by the judgment and order passed by the National Company Law Appellate Tribunal (NCLAT), dismissing the company appeal filed by the appellant. The said company appeal was filed against the order passed by the Adjudicating Authority, rejecting the application filed by the appellants, in which it was held that the appellant cannot claim first charge over the property of the Corporate Debtor, as Section 48 of the Gujarat Value Added Tax 2003 (GVAT Act) cannot prevail over Section 53 of the Insolvency and Bankruptcy Code, 2016 (IBC).

A civil appeal was preferred by the appellant-State Tax Officer against the respondents, being aggrieved by the order of the NCLAT. The NCLAT by the said judgment and order had dismissed the appeal of the appellant based on the judgment and order passed in company appeal. The Apex Court allowed the appeals vide the impugned order. Five review petitions were filed by the review petitioners being aggrieved by the common judgment and order and the Court vide an order, had allowed the applications seeking permission to file review petitions and also allowed the applications seeking Intervention/Impleadment.

The Supreme Court after hearing the contentions of the counsel noted, “Apart from the well-settled legal position that a co-ordinate Bench cannot comment upon the judgment rendered by another co-ordinate Bench of equal strength and that subsequent decision or a judgment of a co-ordinate Bench or larger Bench by itself cannot be regarded as a ground for review, the submissions made by the learned Counsels for the Review Petitioners that the court in the impugned decision had failed to consider the waterfall mechanism as contained in Section 53 and failed to consider other provisions of IBC, are factually incorrect.”

The question that arose before the Court was whether the Review Petitioners were able to make out any case within the ambit of Order XLVII of Supreme Court Rules, read with Order XLVII of CPC, for reviewing the impugned judgment.

“As evident from the bare reading of the impugned judgment, the Court had considered not only the Waterfall mechanism under Section 53 of IBC but also the other provisions of the IBC for deciding the priority for the purpose of distributing the proceeds from the sale as liquidation assets. … In view of the above stated position, we are of the opinion that the well-considered judgment sought to be reviewed does not fall within the scope and ambit of Review”, said the Court.

The Court concluded that the counsels for the review petitioners failed to make out any mistake or error and have failed to bring the case within the parameters laid down by the Court in various decisions for reviewing the impugned judgment.

Accordingly, the Apex Court dismissed the review petitions.

Cause Title- Sanjay Kumar Agarwal v. State Tax Officer & Anr. (Neutral Citation: 2023 INSC 963)