Availability Of Alternative Remedy Does Not Operate As Absolute Bar To Maintainability Of Writ Petition: SC

The Supreme Court in an appeal filed by the Godrej Sara Lee Limited held that the availability of an alternative remedy does not operate as an absolute bar to the “maintainability” of a writ petition.

The Court considered a matter in which the Punjab and Haryana High Court relegated the assessee to the alternative remedy in a challenge made to the jurisdiction of the revisional authority to reopen the proceedings under Section 34 of the Value Added Tax Act.

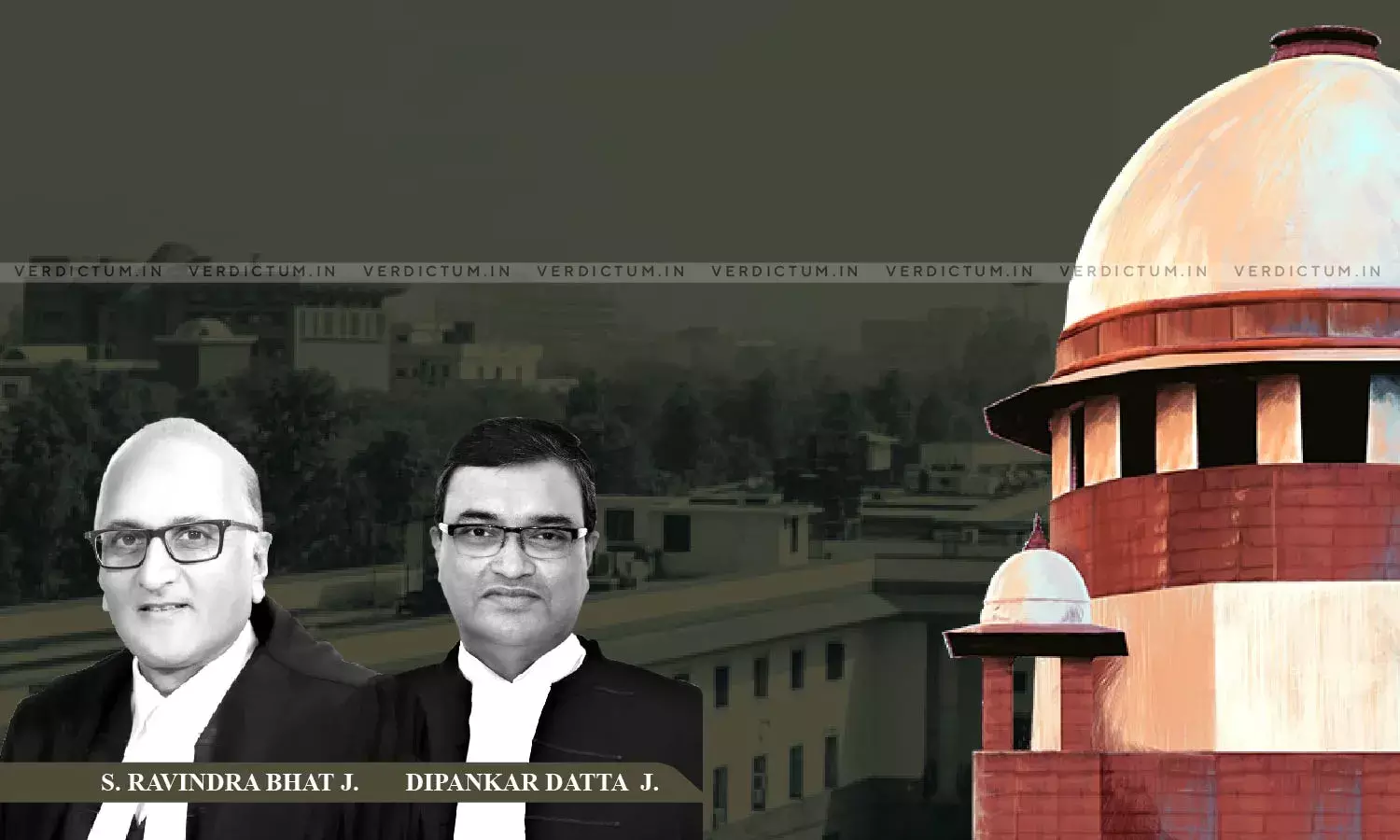

The two-Judge Bench of Justice S. Ravindra Bhat and Justice Dipankar Datta said, “… availability of an alternative remedy does not operate as an absolute bar to the “maintainability” of a writ petition and that the rule, which requires a party to pursue the alternative remedy provided by a statute, is a rule of policy, convenience and discretion rather than a rule of law. Though elementary, it needs to be restated that “entertainability” and “maintainability” of a writ petition are distinct concepts. The fine but real distinction between the two ought not to be lost sight of.”

The Bench noted that the High Courts should normally not entertain a writ petition, where an effective and efficacious alternative remedy is available.

“… it must be remembered that mere availability of an alternative remedy of appeal or revision, which the party invoking the jurisdiction of the high court under Article 226 has not pursued, would not oust the jurisdiction of the high court and render a writ petition “not maintainable”, the Court further noted.

It was also observed by the Court that the mere fact that the petitioner before the High Court has not pursued the alternative remedy available to him, it cannot mechanically be construed as a ground for its dismissal.

Advocate V. Lakshmikumaran appeared for the appellant while Advocate Alok Sangwan appeared for the respondents.

Facts –

The appellant had questioned the jurisdiction of the Deputy Excise and Taxation Commissioner (ST)-cum-Revisional Authority to reopen proceedings, in the exercise of suo motu revisional power conferred by section 34 of the VAT Act. The appellant company was engaged in the business of manufacturing, marketing, and sales of household insecticide products in various forms, viz. mosquito coils, mats, refills, aerosols, baits, and chalks under the popular brand name “Good Knight” and “Hit” and was an ‘assessee’ under the VAT Act.

It was found from Schedule C of the said Act that pesticides, weedicides, and insecticides were included in Entry 1 and taxable @ 4%. The Returns were filed by the appellant for the Assessment Years 2003-04 and 2004-05 and such returns were duly accepted. However, in view of an amendment in Entry 67 of Schedule C notices were issued by the Assessing Authority as to why tax liability @ 10% instead of 4% should not be imposed.

The Supreme Court after hearing the contentions of both counsel asserted, “Once the issue stands finally concluded, the decision binds the State, a fortiori, the Revisional Authority. The decision of the Tribunal may not be acceptable to the Revisional Authority, but that cannot furnish any ground to such authority to perceive that it is either not bound by the same or that it need not be followed. The first proviso, in such a case, gets activated and would operate as a bar to the exercise of powers by the Revisional Authority.”

The Court further said that unless the discipline of adhering to decisions made by the higher authorities is maintained, there would be utter chaos in the administration of tax laws apart from undue harassment to assesses.

“A decision may be questioned as suffering from an illegality if its maker fails to understand the law that regulates his decision making power correctly or if he fails to give effect to any law that holds the field and binds the parties”, the Court noted.

It was also noted by the Court that there was nothing on record to justify either illegality or (procedural/moral) impropriety in the proceedings before the Assessing Authority or the orders passed by him, as such, and that the Assessing Authority was bound by the order of the Tribunal and elected to follow it having no other option.

“… to brand the orders of the Assessing Authority as suffering from illegality and impropriety appears to us to be not only unjustified but also demonstrates thorough lack of understanding of the principle regulating exercise of suo motu revisional power by a quasi-judicial authority apart from being in breach of the principle of judicial discipline, while confronted with orders passed by a superior Tribunal/Court”, the Court said.

The Court, therefore, invalidated the impugned final revisional orders and made the interim order absolute.

Accordingly, the Apex Court allowed the appeal.

Cause Title- M/S Godrej Sara Lee Ltd. v. The Excise And Taxation Officer-Cum-Assessing Authority & Ors.

Click here to read/download the Judgment