Dissenting Debenture Holders Have Right To Stand Outside Proposed Resolution Plan – SC Holds In Exercise Of Article 142

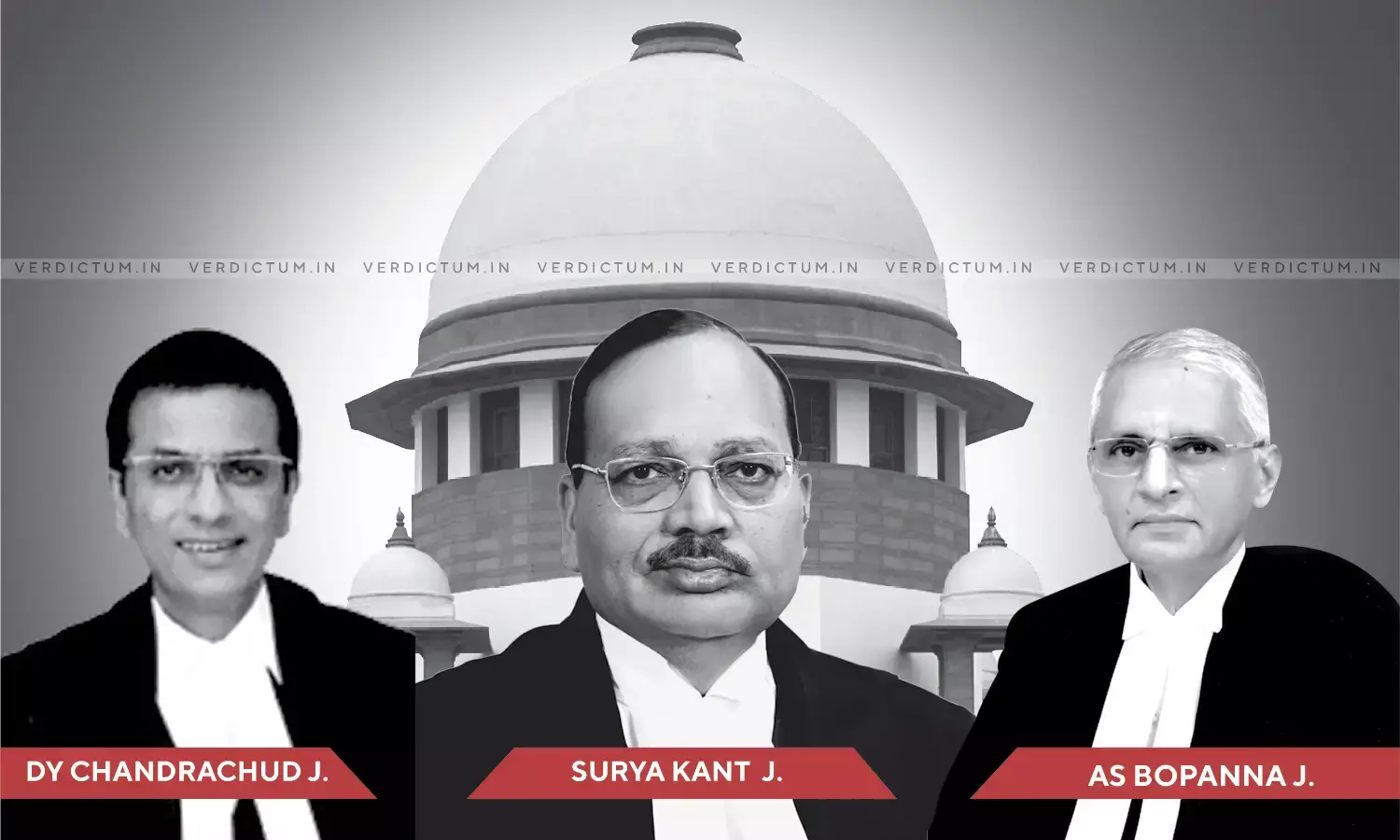

A Supreme Court Bench of Justice Dr. DY Chandrachud, Justice Surya Kant, and Justice AS Bopanna exercised powers under Article 142 of the Indian Constitution to mitigate a potential denial of rights and held that "dissenting debenture holders should be provided an option to accept the terms of the Resolution Plan. Alternatively, the dissenting debenture holders have a right to stand outside the proposed Resolution Plan framed under the lender's ICA and pursue other legal means to recover their entitled dues."

Additional Solicitor General N Venkatraman appeared for the Appellant. Senior Counsel Darius Khambata appeared for Reliance Commercial Finance Limited (RCFL). Senior Counsel KV Viswanathan appeared for the Bank of Baroda. Senior Counsel Dhruv Mehta appeared for Authum Investment and Infrastructure Limited.

In this case, RCFL had issued Non-Convertible Debentures to various people. Vistra ITCL (India) Limited was the Debenture Trustee under three Debenture Trust Deeds. RCFL committed its first default under the Debenture Trust Deeds in March 2019.

Thereafter, the RBI issued the Reserve Bank of India (Prudential Framework for the Resolution of Stressed Assets) Directions 2019. Clause 4 of the RBI circular provided a framework for early recognition, reporting and time bound resolution of stressed assets. The RBI circular also provided that certain lenders may opt for a resolution strategy available to them under the existing legal framework, including entering into a resolution plan or initiating legal proceedings for recovery or insolvency. If the lenders chose to implement a Resolution Plan, they were required to enter into an intercreditor agreement (ICA). Bank of Baroda and other lenders of RCFL entered into an ICA pursuant to the RBI Circular. Bank of Baroda was later appointed as the lead bank under the ICA.

The RBI Circular applied to banks and specified categories of lenders. Other investors were outside its purview. SEBI issued a circular whose subject was the "Standardisation of procedure to be followed by Debenture Trustee(s) in case of 'default' by issuers of listed debt securities".

RCFL and Vistra amended the Debenture Trust Deeds by executing a Supplementary Debenture Trust Deed which took note of the SEBI circular. The Resolution Plan submitted by Authum was approved by RCFL's lenders.

Seventeen debenture holders instituted a suit on the Original Side of the Bombay High Court.. The debenture holders instituted the suit for the protection of their interests with respect to the amounts due to them by RCFL. RCFL was impleaded as the first defendant to the suit. The debenture holders urged that Vistra - who was impleaded as the third defendant - should have taken necessary steps to protect their interests. The debenture holders also alleged that certain funds available with the Bank of Baroda (second defendant), were distributed amongst creditors without regard to their status as "secured" or "unsecured" creditors. They also alleged that this was done without their consent and that they had a first charge on the receivables of RCFL. The debenture holders alleged that the RBI Circular permitted this "illegal" distribution of funds.

They also stated that RCFL, Bank of Baroda, and Vistra could not seek ex post facto consent from the debenture holders for either the ICA or the Resolution Plan. They urged that it was mandatory for Vistra to sign the ICA on behalf of the debenture holders before considering the Resolution Plan. The plaintiffs in the suit before the High Court sought the setting aside of the RBI Circular as illegal and ultra vires. They also sought an injunction restraining RCFL, Bank of Baroda, and RBI from implementing the RBI Circular.

The Single Judge of the High Court suggested that all the concerned parties enter into a negotiated settlement.

All individuals/ HUFs holding debentures of a value less than Rs. 10 Lakhs were to get 100% of their principal sum due, while individuals and HUFs holding debentures in excess of Rs. 10 lakhs were to receive 24.96% of the principal.

The Single Judge recorded that RCFL and the resolution applicant had agreed to pay the debenture holders an additional sum of 5% of the total principal sum outstanding as an additional settlement. Therefore, the debenture holders were to receive an aggregate sum of Rs. 91,00,000/- representing 29.96% of the total principal outstanding.

The Court directed that in return, debenture holder parties to the suit would have to accept the terms of the negotiated settlement in full and final satisfaction of all their claims against the parties and agreed to transfer their debentures in favour of the resolution applicant. In the same order, the Court held that the SEBI Circular could not be permitted to operate retrospectively and did not govern the Debenture Trust Deeds.

The Court also directed Vistra to conduct a meeting of all debenture holders in terms of the Debenture Trust Deed(s). The Judge clarified that the meeting should not deviate from the terms of the Debenture Trust Deed(s) and that the Supplementary Trust Deeds would have to be read with the Debenture Trust Deed(s) in a consistent manner. The Court also held that a mere reference to the SEBI Circular would not override the express terms of any of the Debenture Trust Deeds.

SEBI challenged the Single Judge's orders before Division Bench. SEBI submitted in its appeal, that the SEBI Circular is applicable and the consent of the debenture holders at the International Securities Identification Number (ISIN) level is necessary before a Resolution Plan could be implemented.

The Division Bench dismissed the appeal. SEBI then approached the Supreme Court.

RCFL had argued before the Supreme Court that the SEBI Circular was only applicable if the debenture holders choose to enter into an ICA under the RBI Circular, and consequently, the debenture holders could opt out of an ICA and instead approve or reject the restructuring of debt at the stage of implementation of a Resolution Plan.

The Supreme Court observed the RCFL's arguments could not be accepted. To that end, it held that "The purpose of the SEBI Circular is multi-fold – not only does it protect the interests of debenture holders at large (Clause 7), but it also protects the interests of any dissenting debenture holders (Clause 6.6). If RCFL's argument was to be accepted, both these protections would fail. In the absence of Clause 7, debenture trustees would likely be unable to exit the ICA or the Resolution Plan even if they were not "in the interest of investors" or if the Resolution Plan was not finalized within 180 days from the end of the review period."

The Court also observed that the dissenting ISIN level debenture holders would be bound by the ICA / Resolution plan. In that context, it held that "Dissenting creditors do not have the option of "exiting" the compromise or arrangement arrived at in terms of Section 230 Companies Act. Similarly, dissenting lenders do not have the option of "exiting" the ICA / Resolution Plan under the RBI Circular. The respective majorities provided for in each of these laws bind dissenting creditors. It is along these lines that the SEBI Circular binds dissenting debenture holders. Indeed, the SEBI Circular could bind dissenting debenture holders even in the absence of similar provisions in other laws."

SEBI had argued before the Supreme Court that the SEBI Circular is retroactive in nature as it does not take away or impair any vested rights and that it operates in the future, based on events that arose prior to its issuance. RCFL argued that the effect of applying the SEBI Circular to the present case will render it retrospective and not retroactive.

The Supreme Court held that the SEBI Circular has retroactive application and relied on the judgment in the cases of Vineeta Sharma vs Rakesh Sharma and State Bank's Staff Union (Madras Circle) v. Union of India. In that context, the Court observed that "RCFL issued the debentures and defaulted on the payments to the debenture holders prior to the issuance of the SEBI Circular. However, as of 13 October 2020 (the date on which the SEBI Circular came into force), a compromise or agreement on the restructuring of the debt owed by RCFL did not exist. The debenture holders were not vested with any rights with respect to the resolution of RCFL's debt. The existence of the debt and the subsequent default by RCFL was the status of events, which existed prior to 13 October 2020. Once it came into force, the SEBI Circular applied to the manner of resolution of debt, as specified therein."

The Supreme Court used its powers under Article 142 of the Constitution to stipulate suitable directions to mitigate the potential denial of rights. In that context it said that "the application of the SEBI Circular will lead to a scenario where a Resolution Plan validly agreed upon by the ICA lenders under the RBI Framework will have to be unscrambled. For this reason, we consider it necessary to extend the benefit under Article 142 to the retail debenture holders by allowing the Resolution Plan to pass muster."

The Supreme Court allowed the appeal preferred by SEBI in part, subject to the directions it issued under Article 142 of the Constitution.

Cause Title - Securities and Exchange Board Of India v. Rajkumar Nagpal & Ors.

Click here to read/download the Judgment