Borrower Has Waived Reply U/s. 13(3A) Of SARFAESI Act: Supreme Court Upholds Sale Of Mortgaged Asset

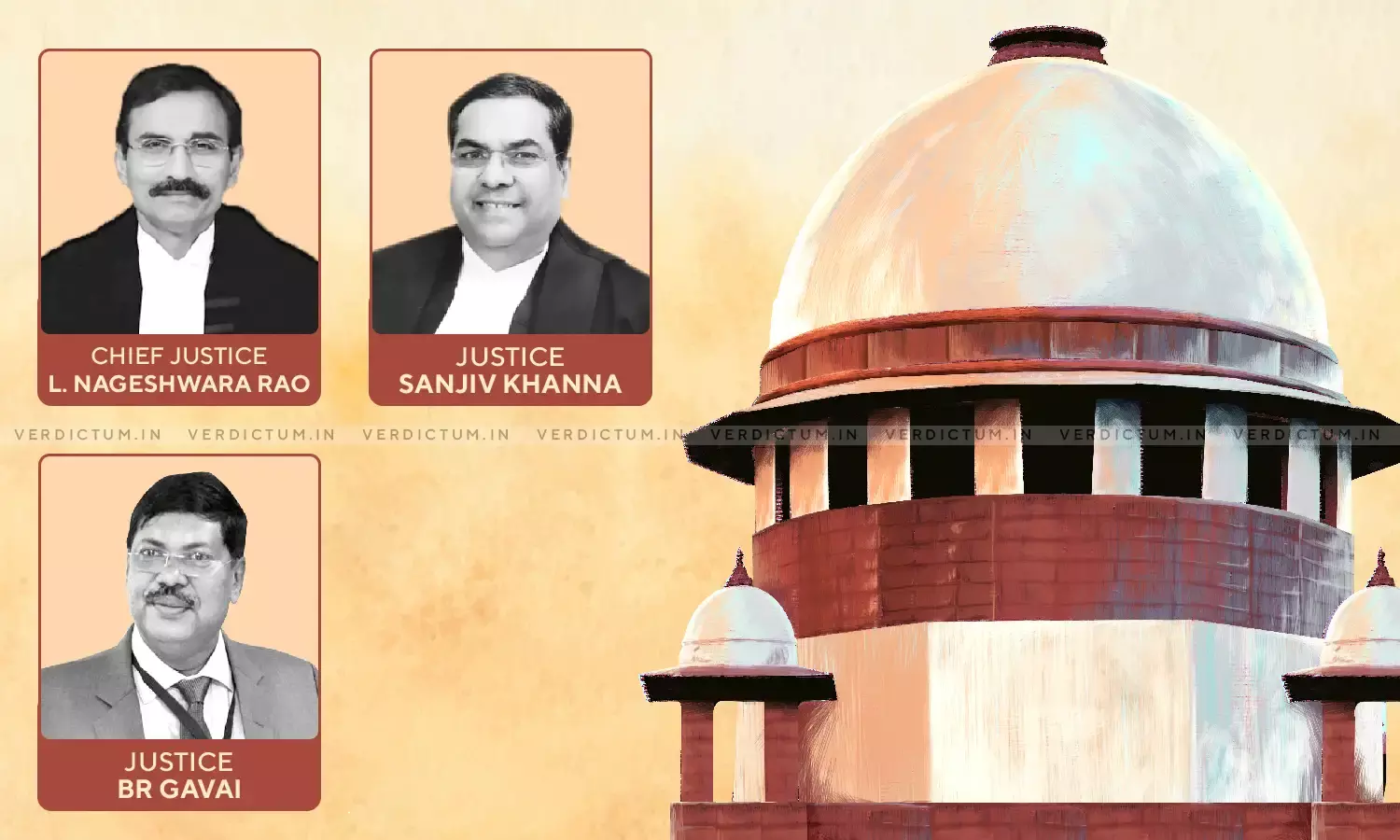

A Bench of the Supreme Court consisting of Justice L Nageshwarao, Justice Sanjiv Khanna and Justice BR Gavai has ruled that the action taken by the creditor to auction the property of the borrower could not be nullified on the ground of failure to submit its reply mandatory under Section 13(3A) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SERFAESI Act), on the facts of the case, while upholding the sale of the mortgaged property.

Section 13(3A) of the Act deals with the response by the Bank, if on receipt of the notice under sub‑section (2), the borrower makes any representation or raises any objection and if the Bank comes to the conclusion that such representation or objection is not acceptable or tenable, within fifteen days.

Advocate Raavi Yogesh Venkata appeared for Petitioner while Advocate Somanatha Padhan and Advocate Bejjenki Bhaskara Chary appeared for the Respondents.

In this case, the borrower took a loan from the Creditor (Andhra Bank) and when it failed to repay the debt as per the moratorium, the account was declared NPA. The Bank then issued notice to the borrower under Section 13(2) of the SARFAESI Act calling upon to discharge its liability within sixty days failing which the Bank would be entitled to exercise all or any of its rights under sub-section (4) to Section 13 of the SARFAESI Act. The borrowers didn't respond to the notice within 60 days.

Later, the borrowers started making communications with the Creditor explaining reasons for defaults and requesting restructuring of the debt. The Creditor deferred the procedure under the Act and granted time. However, borrowers did not adhere to the promise and hence the Creditor took symbolic possession of the property invoking Section 13(4) of the Act and later the physical possession. The Creditor started the procedure for auction of the property.

In meantime, the borrowers wrote letters to the Creditor, but it was not accepted on the ground of non-compliance as the documents and proposal as sought by it were not provided. Later, the property was auctioned and the sale certificate issued. The property was resold to the Respondent by the original purchaser.

In October 2018, the borrower filed a petition before the Debts Recovery Tribunal (DRT) challenging the enforcement proceedings in respect of the subject property, including all steps taken right from issue of notice under Section 13(2) of the SARFAESI Act. The DRT issued an order in favor of the Bank. The order was assailed before the High Court instead of approaching the statutory appellate forum. The High Court upheld the challenge and the proceedings by the Creditor were set aside. Therefore, the purchaser of the property appealed before the Supreme Court.

After hearing the parties, the Bench observed that the borrower was conscious about its right but choose to abandon the statutory claim.

"Not only did the Borrower not question or object to the action of the Bank, but it by express and deliberate conduct had asked the Bank to compromise its position and alter the contractual terms. The Borrower wrote repeated request letters for restructuring of loans, which prayers were considered by the Bank by giving indulgence, time and opportunities. The Borrower, aware and conscious of its rights, chose to abandon the statutory claim and took its chance and even procured favourable decisions," the Bench stated.

The Bench further stated that the Bank gave sufficient time to the borrower and legal remedy was invoked only after third party right was created. Therefore the principle of equitable estoppels and a rule of evidence don't support the borrower.

"Even if we are to assume that the Borrower did not waive the remedy, its conduct had put the Bank in a position where they have lost time, and suffered on account of delay and laches, which aspects are material. Action on the Subject Property was delayed by more than a year as at the behest of the Borrower, the Bank gave them a long rope to regularise the account. To ignore the conduct of the Borrower would not be reasonable to the Bank once third party rights have been created. In this background, the principle of equitable estoppel as a rule of evidence bars the Borrower from complaining of violation," the Bench stated.

Referring to earlier judgments, the Bench stated that, "If a party gives up the advantage that could be taken of a particular position in law, it cannot later be permitted to change and turn around so as to avail of that advantage."

The Bench concluded thus, "Taking into consideration the entire facts of the case, which perspicuously reflect disingenuous conduct on part of the Borrower to gain indulgence, unfulfilled assurances and promises, their unwillingness to pay, and in light of the law laid down by this Court, we are of the view that the Borrower has waived and is stopped from challenging violation of Section 13(3A) of the SARFAESI Act."

The Bench set aside the Judgment of the High Court while confirming the order of the DRT.

Click Here to Read/Download the Judgment