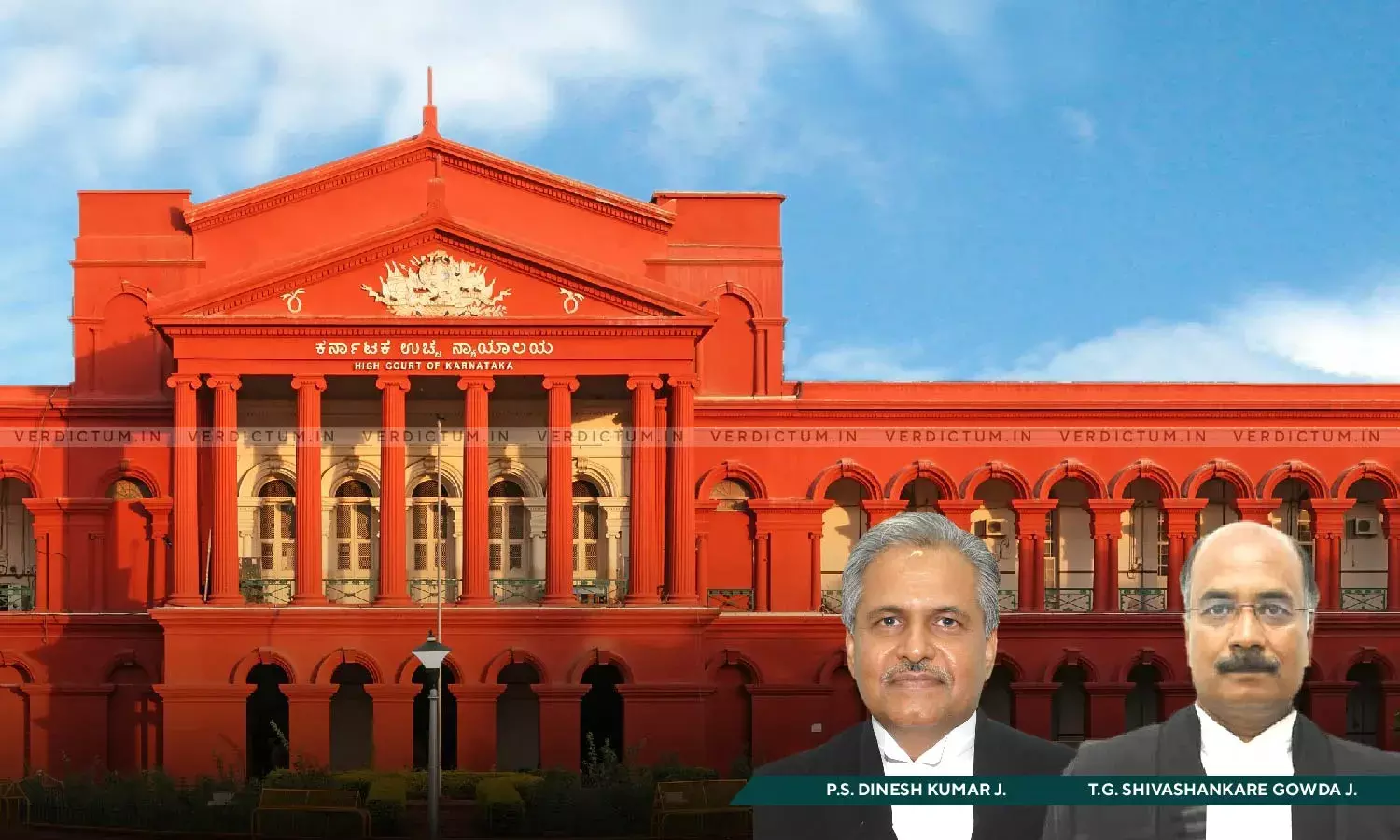

IBM Philippines Not Liable For TDS Under Income Tax Act: Karnataka High Court

The Karnataka High Court held that IBM Philippines is not liable for TDS under Section 195 of the Income Tax Act, 1961.

The Court was dealing with the appeals filed by the Income Tax Department against IBM India Private Limited.

A Division Bench of Justice P.S. Dinesh Kumar and Justice T.G. Shivashankare Gowda observed, “… the payments received by IBM Philippines shall not be liable for TDS under Section 195 of the IT Act. Therefore, assessee cannot be deemed as an 'assessee in default'.”

The appeals filed by the Revenue were against the common order passed by the Income Tax Appellate Tribunal (ITAT).

Advocate K.V. Aravind appeared on behalf of the appellants while Senior Advocate T. Suryanarayana and Advocate Tanmayee Rajkumar appeared for the respondent.

In this case, the assessee company was engaged in the business of information technology services. IBM USA entered into a global arrangement with Procter and Gamble, USA (P&G USA) for rendering payroll-related services to P&G USA. In terms of a companion agreement, IBM India entered into an agreement with P&G India. The services to be rendered by IBM India to P&G India were outsourced to IBM Philippines. In addition, IBM India also outsourced certain human resource services to IBM Philippines for the project.

The IT Department's Assessing Officer in 2012 recorded that IBM India had not deducted tax at source in payments made to IBM Philippines and hence was assesse in default. Both the Assistant Commissioner of Income Tax and Commissioner of Income Tax confirmed it. The company challenged this before the Income Tax Appellate Tribunal (ITAT). The ITAT allowed the company's appeal and held that the payments by IBM India were not chargeable to tax under the India-Philippines Double Tax Avoidance Agreement (DTAA).

The High Court in view of the facts and circumstances of the case asserted, “IBM Philippines is carrying out the work described in the agreement between IBM India and P&G India. Hence, IBM Philippines was not rendering any technical service and therefore, the income in the hands of IBM Philippines is a business income.”

The Court answered the questions of law in favour of the assessee and against the Revenue.

“The ITAT has, in our considered view rightly recorded in para 8.1.3 of its order that as per Article 7(1) of Indian Philippines DTAA, the business profits of an enterprise of a Contracting State shall be taxable only in that State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein. Admittedly, there is no permanent establishment of IBM Philippines in India. As per Article 23 of DTAA, the business profit of IBM Philippines shall be taxable in that State only”, said the Court.

The Court also noted that the transactions between the assessee and IBM Philippines were in the course of its business and the same has not been disputed by the Revenue.

Accordingly, the Court dismissed the appeals.

Cause Title- The Director of Income Tax & Anr. v. IBM India Private Limited

Click here to read/download the Judgment