Karnataka HC Exempts Tax On Voluntary Donation For Educational Purposes As Exemption Certificate Was In Force

The Karnataka High Court has held that for voluntary donation or corpus funds for educational purposes, the assessee would be entitled to exemption, if the exemption of certificate is in force. The bench noted that the department had issued the exemption certificate, however the Assessing Officer (AO) on an incorrect assumption had treated the money collected by the assessee as a capitation fee under the KEI (Prohibition of Capitation Fee) Act.

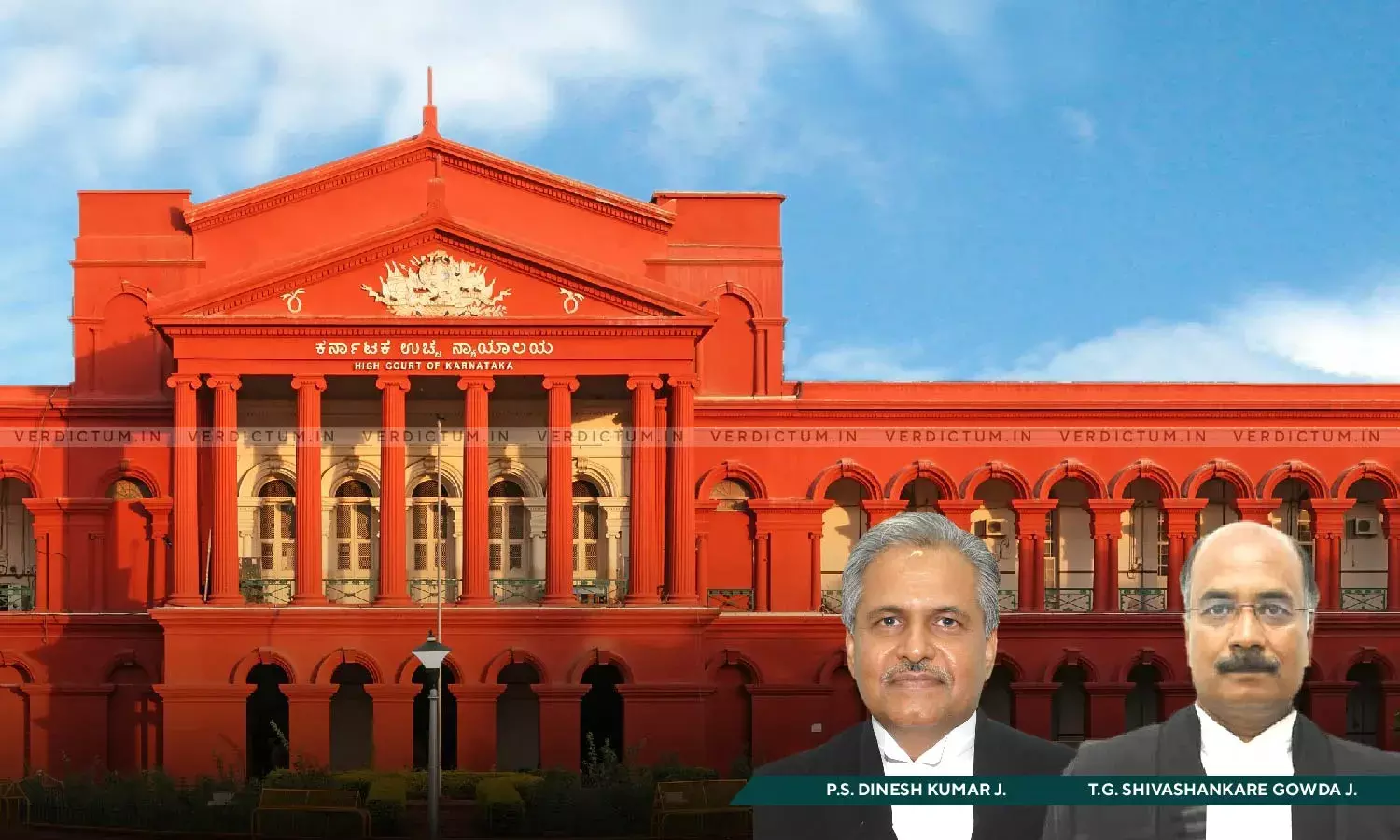

While holding that the AO’s decision was based on surmise and assumption and the ITAT has rightly reversed the incorrect assumption and referring to New Noble Educational Society Vs. Chief Commissioner of Income-Tax, a bench of Justice P.S.Dinesh Kumar and Justice T.G. Shivashankare Gowda thus observed, “In the case on hand, we are not dealing with a situation where the IT Department was considering any application for granting the exemption. On the other hand, the department had issued the exemption certificate and the AO on an incorrect assumption has treated the money collected by the assessee as capitation fee under the KEI (Prohibition of Capitation Fee) Act. Therefore, the said authority does not lend any support to the Revenue. This court has already taken a view in Kammavari Sangham and the same is applicable to the facts of this case”.

Standing Counsel E.I. Sanmathi appeared for the appellants and Senior Advocate Vikram Huilgo appeared for the respondent .

In the instant case, the assessee is a charitable trust registered under Section 12A of the Income Tax Act, 1961.

As per the averments made, it had obtained approval under Sections 11 and 12 of the Act. For A.Y.2012-13, assessee filed returns of income declaring income as nil. The case was selected for scrutiny and notices under Sections 142(1) and 143(2) were issued. Assessee filed revised returns. The difference between two returns was claimed as corpus donations and according to the assessee, the Trust was exempted in original returns and had disclosed the income under the head ‘other income’ in revised returns. Therefore, it was alleged that the exemption certificate was in force as on the date of issuance of notice.

However, the AO denied the benefit of exemption by holding that the assessee had received a sum of Rs.27,23,55,000/- as capitation fee in the guise of voluntary contribution.

ITAT in its impugned order had revered the order of the AO and had held that assess is is entitle for exemption.

The Revenue thus submitted that the assessee has collected a sum of Rs.27,23,55,000/- as donation in violation of the Karnataka Educational Institutions (Prohibition of Capitation Fee) Act, 1984

While placing reliance on New Noble Educational Society v. Chief Commissioner of Income-Tax [2022] 143 taxmann.com 276 (SC) para 70, the revenue assailed the ITAT’s order arguing that since there was violation of provisions of the KEI (Prohibition of Capitation Fee) Act, assessee is not entitled for exemption as the same shall also amount to violation of Sections 11 and 12 of Act.

However, the respondent in turn placed reliance on Kammavari Sangham Vs. Deputy Director of Income-tax (Exemptions) [2023] 146 taxmann.com 367 (Karnataka) para 16 while contending that the premise of the revenue is unfounded. It was submitted that the court has taken a view already that so long as exemption certificate is in force, the Income Tax Authorities are bound by the same and that assessee had filed an affidavit before the ITAT stating that no action under the KEI (Prohibition of Capitation Fee) Act was initiated against the assessee.

Accordingly, the bench while holding the questions of law in favour of the assessee, dismissed the appeal.

Cause Title: PR Commissioner Of Income-1 Tax (Exemptions) v. S Rashtreeya Sikshana Samithi Trust

Click here to read/download the Judgment