Section 12AA of Income Tax Act

Section 12AA(2) Income Tax Act Doesn’t Recognize Deeming Fiction That Registration Application Be...

The Bombay High Court reiterated that Section 12AA(2) of the Income Tax Act, 1961 (IT Act) does not recognize any deeming fiction that the...

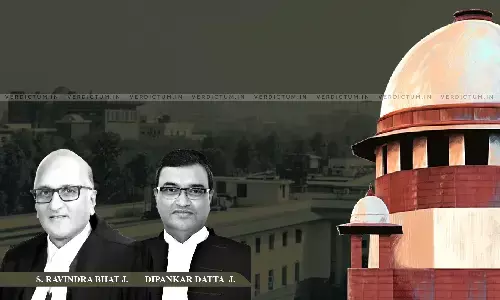

SC Directs AO To Examine Documents To Ascertain Whether Respondent Is Charitable Trust Entitled To...

The Supreme Court while dealing with an appeal filed by the Principal Commissioner of Income Tax against the judgment of the Delhi High Court has...