Income Tax Act

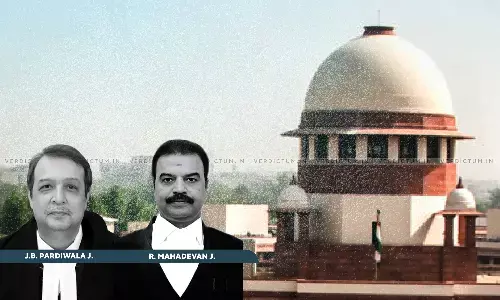

Courts Must Remain Alive To Distinction Between Commercial Gain & Hypothetical Accretion: Supreme...

The Supreme Court said that business, by its very nature, admits of profits arising in diverse forms, whether in money or in kind, yet the common...

Supreme Court: Receipt Of Shares Of Amalgamated Company In Substitution Of Stock-In-Trade Can Give...

The Supreme Court said that once the shares held as stock-in-trade in the amalgamating company ceases to exist and are replaced by shares of the...