While Deducting Tax That Has Already Been Paid, Effect Would Have To Be Given To Any Refund As Well...

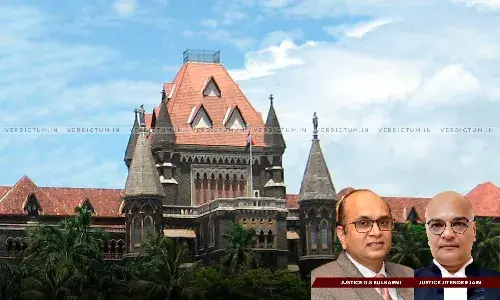

While dismissing the petition filed by Bombay Dyeing & Manufacturing Co. Ltd. (petitioner), the Bombay High Court upheld the tax authority's...

Auction Sale Conducted Over Non-Payment Of Loan By Borrower Gets Nullified Once Loan Was Repaid In...

In a refund claim, the Calcutta High Court has directed the State Bank of India (SBI) to refund the entire bid amount of Rs.55,19,250 along with...

![[Section 56 CGST Act, 2017] Taxpayers Are Eligible To Claim Interest On Delayed Refunds: Gujarat High Court [Section 56 CGST Act, 2017] Taxpayers Are Eligible To Claim Interest On Delayed Refunds: Gujarat High Court](https://www.verdictum.in/h-upload/2023/07/21/500x300_1523270-vipul-m-pancholidevan-m-desai-gujarat-hc.webp)