TN General Sales Tax Act: Maize Starch Would Be Covered By Taxation Entry And Not By Exemption Entry- SC

The Supreme Court in a case relating to the classification of maize starch under the Tamil Nadu General Sales Tax Act, 1959 has held that the maize starch would be covered by the taxation entry and not by the exemption entry.

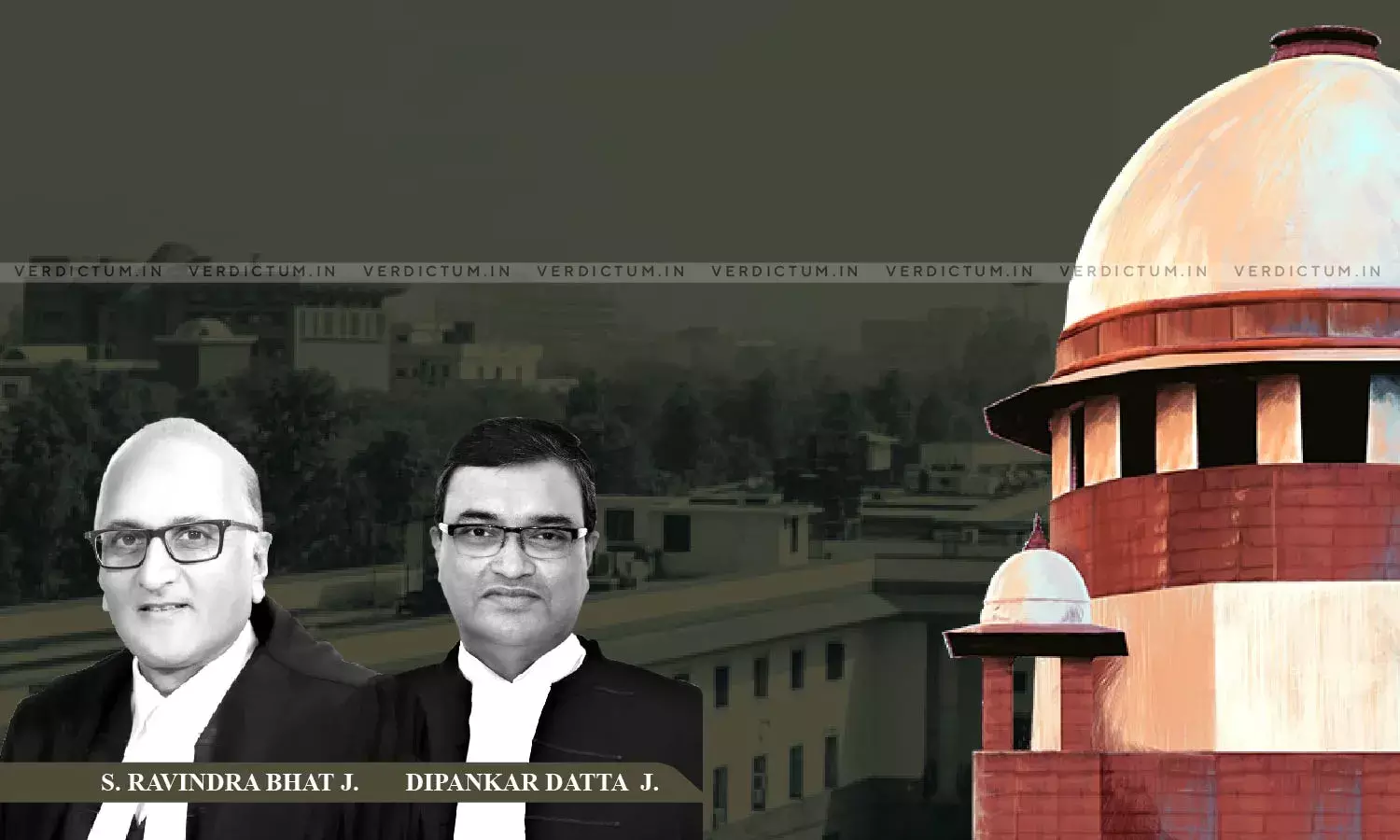

The Bench of Justice S. Ravindra Bhat and Justice Dipankar Datta observed, “Law is well settled that if in any statutory rule or statutory notification two expressions are used - one in general words and the other in special terms - under the rules of interpretation, it has to be understood that the special terms were not meant to be included in the general expression; alternatively, it can be said that where a statute contains both a general provision as well as a specific provision, the latter must prevail. ... Looking at the specific (Taxation Entry No.61) in contradistinction with the general (Exemption Entry No.8), there can be no manner of doubt that maize starch would be covered by the taxation entry and not by the exemption entry.”

The Bench said that the entries under Schedule I are taxed under Section 3(2) of the Act while the entries under Schedule III are exempted under Section 8 thereof.

Advocate K.K. Mani appeared on behalf of the appellant while Advocate C. Kranthi Kumar appeared on behalf of the respondents.

Factual Background -

The appeals were filed against the orders passed by the Madras High Court and the appellant i.e., Santhosh Maize & Industries Limited was registered under the Tamil Nadu General Sales Tax Act which was dealing in maize starch since 1975. The classification of maize starch under the said Act was the subject of dispute in the appeals. The Tamil Nadu Government had exempted the products of millets including maize from tax payable under the Act vide a notification.

The Legislative Assembly did some amendments to the aforesaid Act and some of them sparked controversy. The Commissioner clarified that maize starch was taxable from April 1, 1994, since Item 8 of Part B of Schedule III did not include maize starch subject to a 4% tax. Questioning the same, the appellant made a representation which got rejected and was served with notices for recovery of general sales tax to the tune of Rs. 7,69,729/-.

The Supreme Court after hearing the contentions of the counsel noted, “Once it becomes clear from Exemption Entry No.8, as introduced by Act No.32 of 1994, that (i) it does not include the noun “like” as the first word within brackets and (ii) that maize is only included along with rice, flour, etc. (and not maize starch), it is only those items within the brackets which, for the purposes of exemption, qualify as products of millets. It is, therefore, those products of millets specifically indicated, which are entitled to exemption under Section 8 of the Act read with Schedule III as per Exemption Entry No.8.”

The Court said that maize starch cannot be considered a millet product as in Exemption Entry No. 8 and that maize is the raw product, whereas maize starch is a processed product.

“While we are bound to hold that maize is entitled to exemption in terms of Exemption Entry No.8 as it stood prior to the relevant assessment year, maize starch being a product of maize derived through mechanical process, it cannot be read as “like maize”, the “like” having been excluded by Act No. 32 of 1994. Maize starch being a kind of starch, it is covered by Taxation Entry No. 61 as introduced by Act No.37 of 1996 which is to the effect “… starch of any kind”, further noted the Court.

The Court said that sago is a starch extracted from the pith or spongy core tissue of various tropical palm stems and therefore, what is taxable under Taxation Entry No. 61 is ‘sago’, which itself is a starch, as well as starch of any kind which would obviously include maize starch.

“We hold that ‘any kind’ in the context the same has been used in the taxation entry clearly indicates that it has been used in a wide sense extending from one to all and admits of no exception. … Trite to say, the Legislature may not have intended two entries for the self same commodity, one under the exempted category and the other under the taxable entry. Therefore, maize starch has to be either covered by Taxation Entry No.61 or Exemption Entry No.8. For the purpose of ascertaining which of the two is the applicable entry, we need not labour much having regard to the language in which the two entries are expressed”, observed the Court.

The Court concluded that the circular issued by the Commissioner in question does not run counter to the provisions of the Act.

Accordingly, the Court dismissed the appeals and upheld the judgment of the High Court.

Cause Title- Santhosh Maize & Industries Limited v. The State of Tamil Nadu & Anr.