Lacks In-Depth Examination Of Facts - SC On Gujarat HC's Order Classifying "KADIPROL" As Poultry Feed

On the Gujarat High Court's decision classifying Kadiprol as Poultry feed, the Supreme Court observed that the aforesaid decision lacked detailed and an indepth examination of the facts.

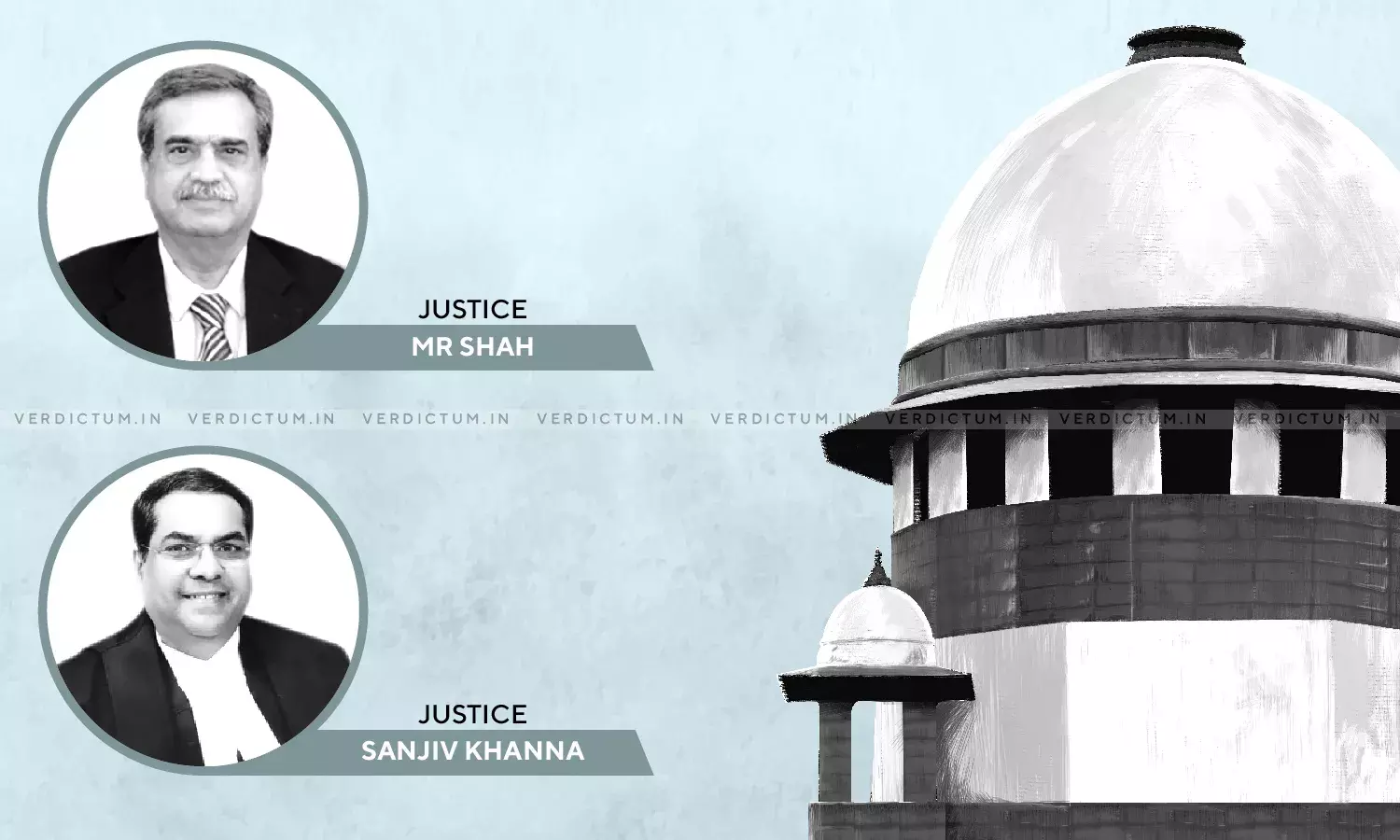

"It merely quotes and relies upon the two decisions in the case of Glaxo Laboratories (India) Ltd. (supra) and M/s. Pfizer (India) Ltd. (Supra) without a detailed and an indepth examination of the facts as found.", the Bench of Justice MR Shah and Justice Sanjiv Khanna observed.

Facts & History of the Case

On the Assessee-Respondent's application to determine tax rate, the Deputy Commissioner of Sales Tax under Section 62 of the GST Act passed a Determination Order that "Kadiprol" would be considered as "Drug and Medicine" under Entry 26(1) of Schedule II Part A of the GST Act.

The Respondent's application before the Assistant Commissioner, Food and Drugs Control Administration seeking license under the Drugs and Cosmetics Act, 1940 for manufacturing Kadiprol was also turned down.

The Respondent then preferred a Reference Application under Section 69 of the GST Act before the Tribunal for referring the matter to the High Court. The reference was made to the High Court where it was held that the product kadiprol would fall under the category of "Poultry Feed" under Entry 25 of Schedule I of the GST Act.

Feeling dissatisfied by the Order of the High Court of Gujarat, the State approached the Supreme Court.

Issue – Whether "Kadiprol" can be classified under the category of Poultry Feed in Entry 25 of Schedule I or Drug and Medicine in Entry 26(1) of Schedule II under the Gujarat Sales Tax Act?

Aastha Mehta, counsel appearing on behalf of the Appellant-State contended that the High Court did not state any reasons for overturning the findings of the Deputy Sales Tax Commissioner. It was further argued that the predominant purpose of the drug in question was to eliminate or prevent the subclinical coccidian infection in poultry. Reliance was placed on the decision of the High Court in State of Gujarat vs. M/s. Pfizer (India) Ltd. in Sales Tax Reference No.38 of 1980 where it was held that if the main purpose of a product is medicinal and not nutrition, then the product would not be Poultry Feed.

Kavita Jha, counsel representing the Respondent-Assessee argued that the product Kadiprol was added to poultry feed to prevent Vitamin K deficiency in birds, and such being an essential poultry feed supplement, it ought to be classified under "Poultry Feed" of Entry 25 of Schedule I of the GST Act.

On considering the submission made by the Counsels, keeping in view the order passed by the High Court, the Bench noted that – " it is noticed that the product in question was sold in a sachet/packet of 100 gm. It was not meant to be given as a food to the poultry. It was required to be mixed with the feed given to the poultry/birds. It cannot be directly fed and/or given to the birds. Therefore, there is some merit in the contention of the Revenue that the impugned judgment and order does not deal with reasoning…"

In view of the above, the Apex Court disposed of the appeal by holding that – "… the issue in question is in the academic interest and as there is no revenue implication as there are no tax dues and therefore there is zero tax effect, we close the present proceedings keeping the larger question on the Common Parlance Test open."

Click here to read/download the Judgment