Supreme Court Explains 'Uberrimae Fidei' And 'Contra Proferentem Rule' While Directing Medical Insurer To Indemnify The Insured

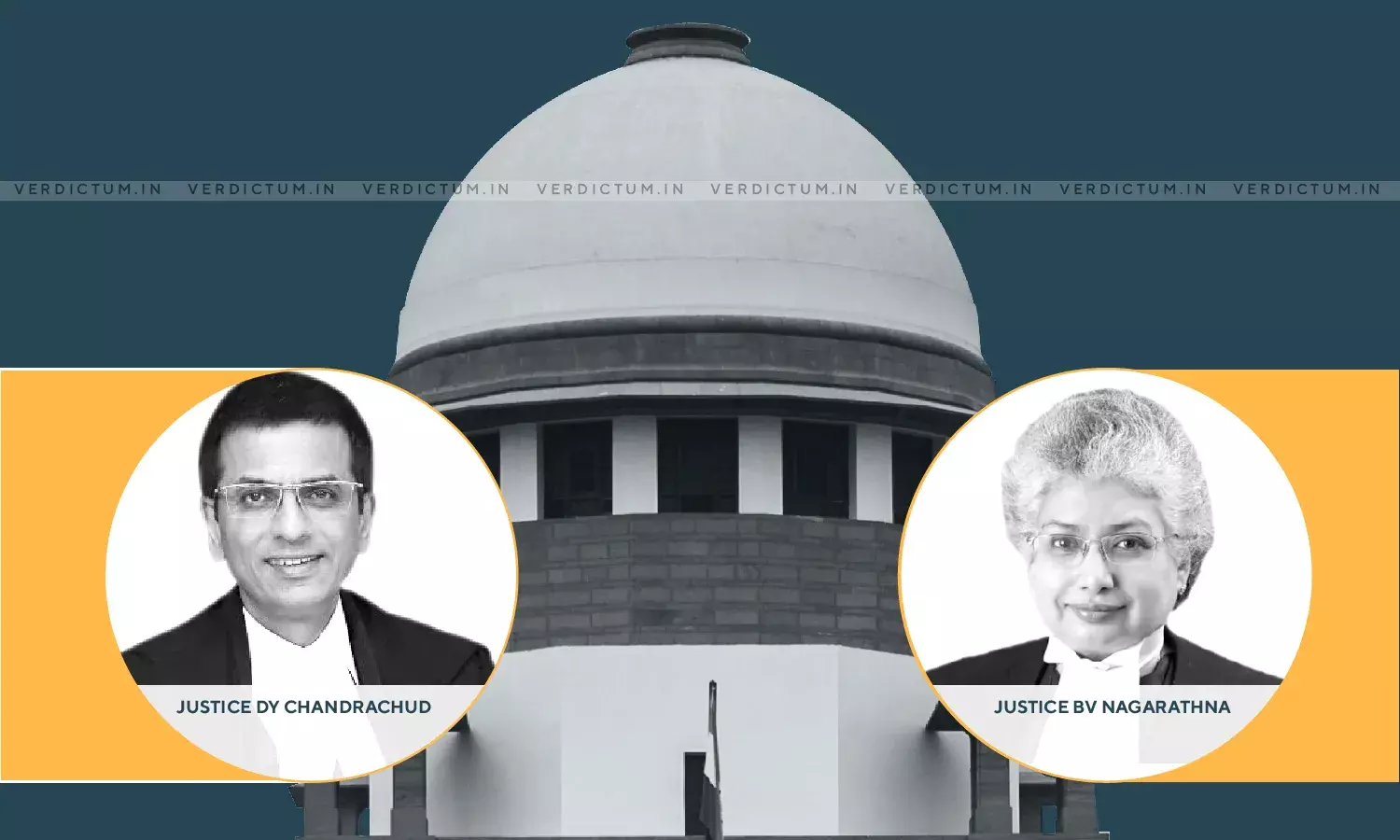

A Division Bench of the Supreme Court comprising of Justice Dhananjaya Y Chandrachud and Justice B.V. Nagarathna, in an appeal filed against the order of the National Consumer Disputes Redressal Commission [in short "Commission"] read the clauses in the insurance policy against the insurer by applying the contra proferentem rule to give meaning to the contract of insurance in question and held that the insurer was not right in repudiating the subject claim.

The appellant was represented by Mr. Gopal Sankarnarayanan, Senior Advocate along with Ms. Zehra Khan, Advocate while submissions on behalf of the insurer were advanced by Ms. Sunaina Phul, Advocate. The judgement was authored by Justice B.V. Nagarathna.

Factual Matrix:

The appellant had applied for an overseas Mediclaim policy as he wanted to travel to the United States in order to attend the wedding of his sister-in-law's daughter. The insurer in the instant case [i.e., United Insurance Co. Ltd.] had the appellant medically examined. The report categorically stated that appellant had diabetes-type II [i.e., diabetes mellitus]. No other adverse medical condition was reported.

There were various queries (concerning any abnormalities in the ECG Test) put in the medical report to which the doctor who examined the appellant had answered "normal" or "no". The insurer proceeded to accept the proposal form and issued the subject policy from 19.05.2009 to 01.06.2009.

The appellant boarded a flight to San Francisco. While he was exiting the airport, he felt weak and started sweating upon which he was admitted to a medical centre wherein certain procedures were performed on him, and stents were inserted. The representative of the insurer was duly contacted by the appellant's family and documentation, as sought, was provided.

However, after a few months, the appellant started receiving bills from the medical centre. When he approached the insurer, he was informed that "his claim had been repudiated as the appellant had a history of hyperlipidaemia and diabetes and the policy did not cover perexisting [sic pre-existing] conditions and complications arising therefrom." The appellant approached the Commission, which dismissed the complaint filed by the appellant on the ground of non-disclosure of the material facts. Resultantly, the instant appeal was filed before the Apex Court.

Reasoning and decision:

The Court, succinctly, culled out the following issues for consideration:-

"(i) Whether the appellant herein had suppressed or not disclosed material facts in the proposal form which could have led the insurer to repudiate the policy in question?

(ii) Whether the Commission was justified in dismissing the complaint?

(iii) What Order?"

The Court, broadly, based its discussion on the legal maxim uberrimae fi dei and the contra proferentem rule.

The Court observed that the insurance contracts are special contracts in which the law demands a higher standard of good faith. It was observed that the phrase "material facts" is not definable as the same would depends on the nature and extent of coverage of risk under a policy in question. The Court held that the principle of utmost good faith imposes meaningful reciprocal duties owed by the insured to the insurer and vice versa. It was noted that the test is to be a prudent insurer while issuing a policy of insurer.

The Court noted that while the standard of duty of disclosure that is imposed on an insured could make him vulnerable, equally, the application of contra proferentem rule could be triggered and the clauses could be interpreted as against the insurer.

Considering the facts of the case, the Court noticed that the insurer was appraised about the medical condition of the appellant, and it did not consider the same as a risk factor for a possible cardiac ailment during the term of the policy in order to decline the issuance of the policy. It was observed that while diabetes mellitus-II is a risk factor for a cardiac ailment, it is not a hard and fast rule that a person suffering from diabetes mellitus-II would necessarily suffer from a cardic ailment. The Court came to the conclusion that the appellant only had the knowledge of existence of diabetes mellitus-II; for which he had filed various medical reports which showed normal results. The observations of the Court being apposite are extracted hereafter.

"Viewed in the aforesaid perspective, it is held that the respondent insurance company could not have repudiated the policy on the ground that acute myocardial infraction suffered by the appellant on landing at San Francisco, USA was a "preexisting and related complication" which was excluded under the policy. The insurer was informed about the preexisting condition of the appellant, namely, diabetes mallitus II and it was for insurer to gauge a related complication under the policy as a prudent insurer and then issue the policy when satisfied. In the absence of the same, the treatment availed by the appellant for acute myocardial infraction in USA could not have been termed as a direct offshoot of hyperlipidaemia and diabetes mellitus so as to be labelled as a preexisting disease or illness which the appellant suffered from and had not disclosed the same. At any rate, the appellant had in the proposal form disclosed that he was suffering from diabetes mellitus II and for which the medical test reports were submitted along with the proposal form which were considered by the insurance company before the policy was issued to the appellant. … Therefore, the insurance company was well aware of the fact that the insured was a diabetic and was taking all necessary medication for preventing further complications and controlling the disease. Hence in our view, there was no suppression of any material fact by the appellant to the insurer."

The Court noted that the objective sought to be achieved by seeking a Mediclaim is to claim indemnification in the eventuality of a sudden illness that is not expected and may otherwise occur overseas. The Court noted that a duty is cast on the insurer to indemnify the appellant for the expense incurred if the sudden sickness or ailment is not expressly excluded under the policy.

The Court came to the conclusion that the repudiation of the policy by the insurer was not in accordance with the law, and hence, proceeded to allow the appeal. The insurer was directed to indemnify the appellant in respect of the expenses incurred within the subject period. The Court also ordered payment of Rs. 1 lakh towards litigation cost in favour of the appellant.

Click here to read/download the Judgment