Mere Delay In Intimating Insurance Company About Occurrence Of Theft Cannot Be A Ground To Deny Claim When FIR Was Lodged Immediately After Theft - SC

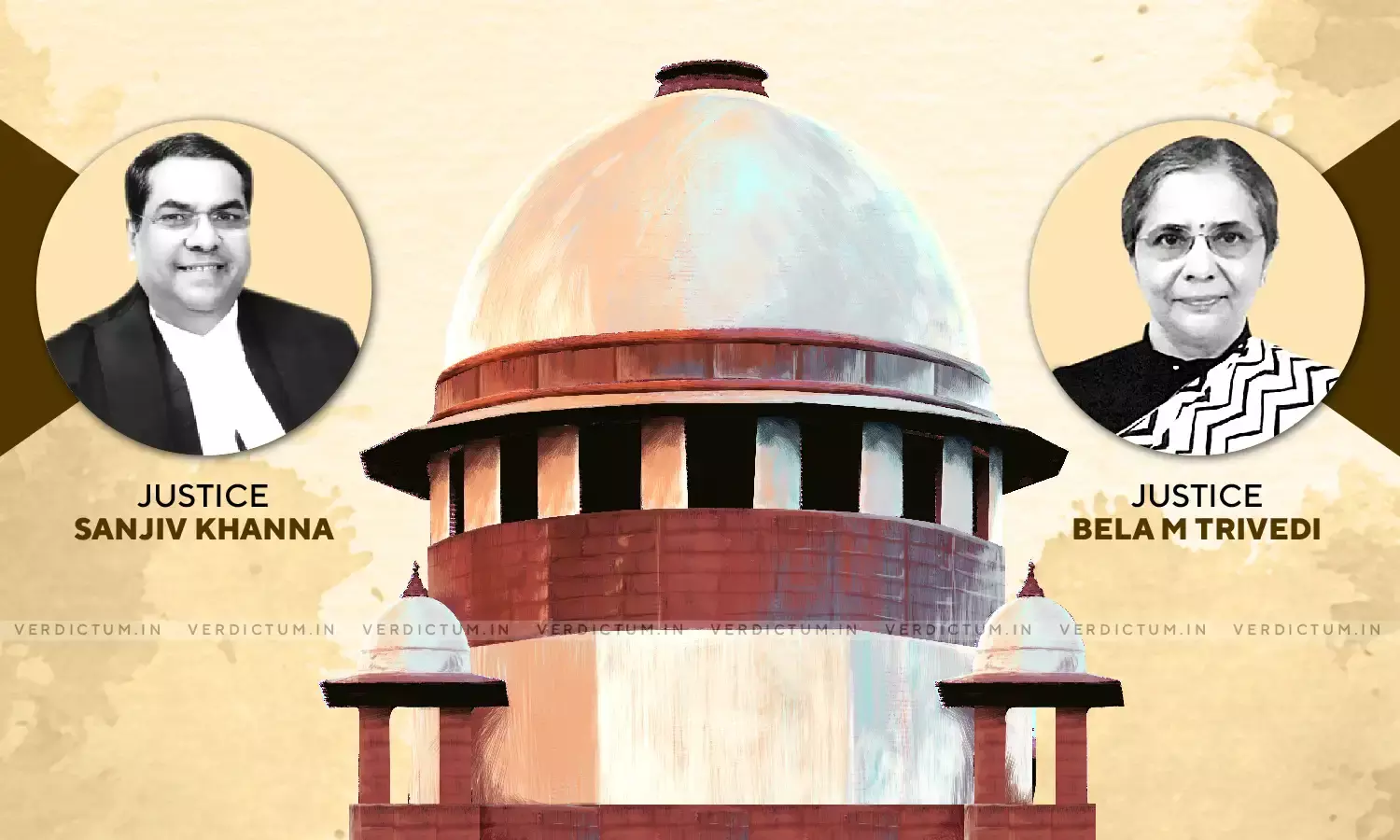

A two-judge bench of the Supreme Court comprising of Justice Sanjiv Khanna and Justice Bela M Trivedi has observed that when an insured had lodged the FIR immediately after the theft of a vehicle occurred and when the police after the investigation had lodged a final report after the vehicle was not traced and when the surveyors/investigators appointed by the insurance company had found the claim of the theft to be a genuine, then mere delay in intimating the insurance company about the occurrence of the theft cannot be a ground to deny the claim of the insured.

In this case, a Tata Aiwa Truck was purchased by the Appellant. The said vehicle was duly insured with Respondent No. 1 i.e. the Insurance Company. The vehicle was robbed by some miscreants and an FIR was registered by the Appellant-complainant under Section 395 IPC at Police Station Nagina, District Mewat (Haryana). The police arrested the accused, however, the vehicle in question could not be traced and, therefore, the police filed an untraceable report. The Insurance Company, however, failed to settle the claim within a reasonable time, and therefore, the Appellant-complainant filed a complaint before the District Consumer Disputes Redressal Forum, Gurgaon which was allowed.

The aggrieved Insurance Company preferred an appeal before the State Consumer Disputes Redressal Commission (Haryana), Panchkula which dismissed the appeal filed by the Insurance Company and partly allowed the appeal filed by the complainant by increasing the rate of interest awarded by the District Forum from 6% to 9%. The aggrieved Insurance Company preferred a Revision Petition before the National Consumer Disputes Redressal Commission, New Delhi which came to be allowed. This impugned judgment was challenged before the Supreme Court.

Counsel, Mr. Avinash Lakhanpal, appeared on behalf of the Appellant before the Apex Court.

The primary issue in this case was -

- Whether the Insurance Company could repudiate the claim in toto, made by the owner of the vehicle, which was duly insured with the insurance company, in case of loss of the vehicle due to theft, merely on the ground that there was a delay in informing the company regarding the theft of the vehicle.

The Court noted that there was a conflict of decisions of the Bench of two Judges of this Court in case of Om Prakash vs. Reliance General Insurance & Another and in case of Oriental Insurance Company Limited vs. Parvesh Chander Chadha, on the question as to whether the delay occurred in informing the Insurance Company about the occurrence of the theft of the vehicle, though the FIR was registered immediately, would disentitle the claimant of the insurance claim. Hence, the matter was referred to a three-Judge Bench in the case of Gurshinder Singh vs. Shriram General Insurance Company Ltd. which observed that when an insured had lodged the FIR immediately after the theft of a vehicle occurred and when the police after the investigation had lodged a final report after the vehicle was not traced and when the surveyors/investigators appointed by the insurance company had found the claim of the theft to be a genuine, then mere delay in intimating the insurance company about the occurrence of the theft cannot be a ground to deny the claim of the insured.

The Court opined that in this case, when the complainant had lodged the FIR immediately after the theft of the vehicle, and when the police after the investigation had arrested the accused and also filed challan before the concerned Court, and when the claim of the insured was not found to be not genuine, the Insurance Company could not have repudiated the claim merely on the ground that there was a delay in intimating the Insurance Company about the occurrence of the theft.

Hence, the impugned order was erroneous and against the settled position of law and was set aside, accordingly. Thus, the appeal was allowed which affirmed the order of the State Commission.

Click here to read/download the Judgment