Bank Cannot Resist Claim Of Customer With The Defence Of Negligence On Customer's Part While Making Payment Of Forged Cheque: SC

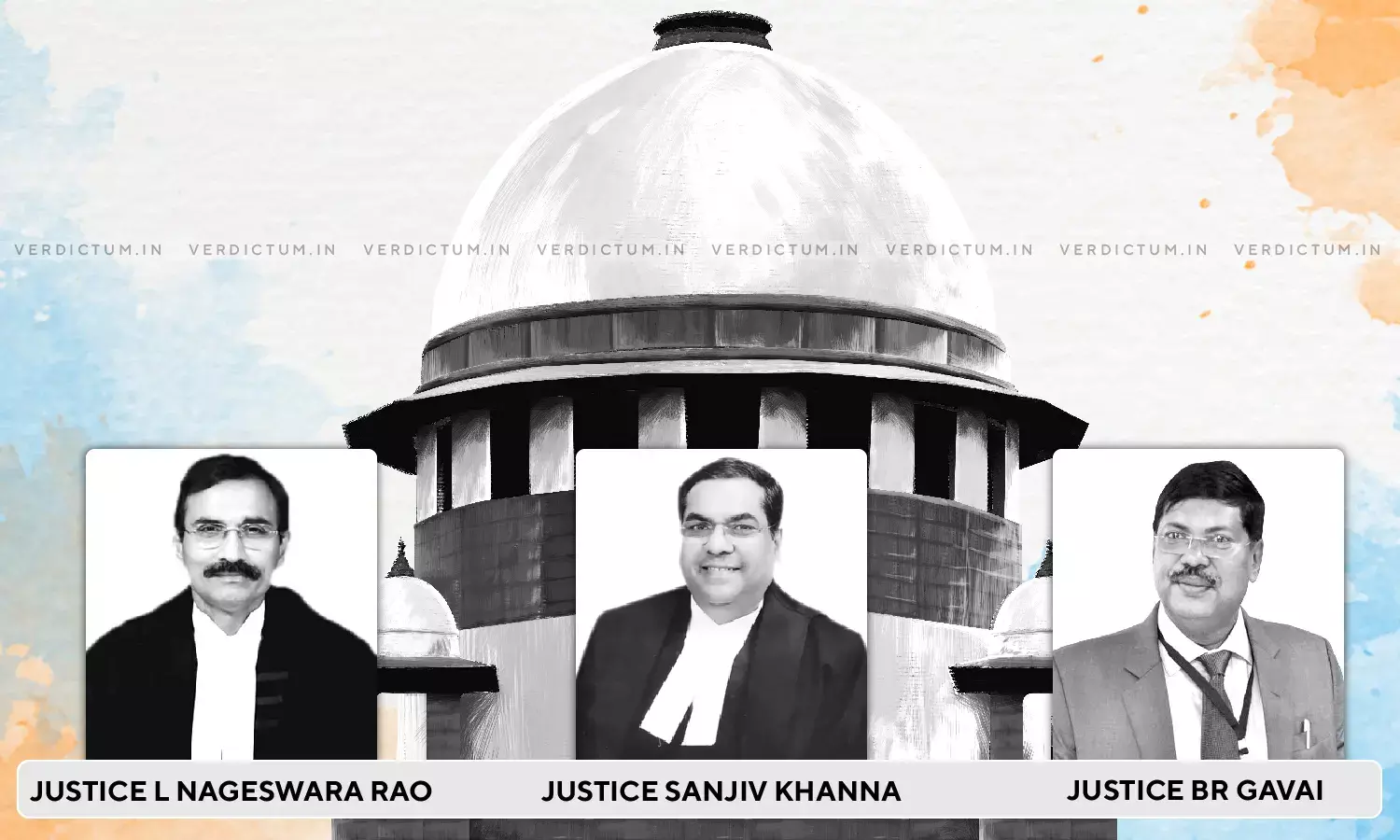

A three-Judge Bench of the Supreme Court comprising Justice Nageswara Rao, Justice Sanjiv Khanna, and Justice BR Gavai while relying upon the observations made in Tai Hing Cotton Mill Ltd. v. Liu Chong Hing Bank Ltd. and Others, (1985) 2 All ER 947, has held that the bank can succeed on the plea of the negligence of the customer when it establishes adoption, estoppel or rectification on the customer's part.

The Court noted that "when it [bank] makes payment of a forged cheque, it cannot resist the claim of the customer with the defence of negligence on the customer's part."

The civil appeals before the Supreme Court were preferred by Pradeep Kumar and Raj Rani while assailing the judgment of the NCDRC, via which, the complaint registered against the Post Master General and other Respondents was dismissed though allowed and decreed against Rukhsana.

The Appellants had purchased Kisan Vikas Patras in 1995 and 1996 in joint names from various post offices in different denominations with a combined face value on the maturity of Rs. 32.60 lakhs however they were encashable at post offices before the maturity at a lower value after the lock-in period.

The Appellants wanted to transfer their KVPs to another post office and the postmaster recommended that they take services of Rukhsana; an agent appointed by the State of UP and associated with the post office. The monthly income scheme passbook was taken by Rukhsana and a receipt was executed on this behalf. Rukhsana told, when contacted, that the process was taking time.

Appellants learnt that Rukhsana had cheated several investors and had been arrested. It was later revealed that the KVPs had been encashed and Rukhsana had pocketed the entire amount.

A complaint was filed before the NCDRC. NCDRC dismissed the complaint against the Respondents holding they had acted in accordance with Rules 14 and 15 of the KVP Rules. Rukhsana being a service provider was liable to pay Rs. 25,54,000 with interest @9%. She was also liable to pay Rs. 1,00,000 as compensation and Rs. 10,000 as litigation expenses. Liberty was given to sue the state government for its omission and commission in appointing Rukhsana as an agent in the eventuality of nonrecovery.

The Court noted that under the Negotiable Instruments Act, 1881 a banker includes any person acting as a banker and any post office savings bank. The Court also noted that the KVPs are a promissory instrument as defined by Section 4 of the said Act.

The Court then discussed the distinction between holder and holder in due course defined in Section 9. The Court noted that "when payment is made in accordance with the apparent tenor of the instrument in good faith and without negligence to a person in possession thereof, it is payment in due course. The requirement in Section 10 that the payment should be in both good faith and without negligence is cumulative. Thus, mere good faith is not sufficient."

The Court noted that once an account is opened, the contractual relationship is created and mutual rights and obligations between the banker and customer are created under the law.

The Court noted that the presumption under Section 118(g) would not apply as Rukhsana was not an endorsee and the instruments were in the name of the Appellants. The Court noted that Rukhsana was not a holder in due course as she had obtained the instrument by means of fraud. However, the Court noted, that Section 78 used the expression holder and not a holder in due course.

On the question as to whether the KVPs were simple bearer instruments or a bear instrument with conditions, the Court considered the 1998 rules framed on this behalf.

The Court made the following crucial observations:

"Clause 23(1) prescribes a detailed procedure for verification by the post master when a KVP, not accompanied by identity slip, is presented for encashment at the post office other than the registered post office. It mandates that the presenter shall make an application which shall be date stamped. After one week, the post master would return the original certificate to the holder for presentation. The verification exercise includes ascertaining the authenticity of the signature on the application with the signature of the person in whose name the certificate was issued. In case of a mismatch, a detailed procedure for authentication of signature is prescribed."

The Court while concluding, made the following observations:

"In the light of the aforesaid discussion, it can be concluded that the payment was made in violation of the statutory mandate of Section 10 of the NI Act and, therefore, there is no valid discharge under clause (c) to Section 82 of the NI Act. Further, as held above, Rukhsana not being a 'holder', payment to her is not a valid discharge under Section 78 read with Section 8 of the NI Act. The respondents would have avoided the liability and claimed valid discharge if they had accepted the KVPs with the identity slip19 or if they had made payment by cross cheque, in which case, they would have satisfied the condition that they had made payment in good faith and there was no negligence, a requirement of clause (c) to Section 82 read with Section 10 of the NI Act."

On the issue as to whether the Respondents would be liable for the wrongs and act of Respondent no. 4 in connivance or at the behest of Rukhsana the Court noted that he was an officer and employee of the Post Office. The Court noted that such acts when done during the course of employment are binding on the Post Office at the instance of the person who is damnified by the fraud and wrongful acts of the officers of the bank/post officer.

The Court noted that the Post Office is entitled to proceed against the officer but this would not absolve them of liability if the employee was acting in course of his employment.

The Court noted that "In the context of the factual background of the present case, we have no doubt in our mind that the fraud was committed by M.K. Singh, respondent No. 4, in and during the course of his employment."

The appeals were allowed and Respondents no. 1 to 4 were held jointly and severally liable to pay the maturity value of the KVPs as on the date the KVPs were presented to the post office for encashment, along with 7% simple interest per annum from the said date till the date of payment.

In addition, thereto, compensation of Rs. 1,00,000 and costs of Rs. 10,000 were awarded to Appellants.

Click here to read/download the Judgment