Pension Scheme- Amendment Taking Away Existing Benefit Of Employee Retrospectively Is Violative Of Articles 14 And 16: Supreme Court

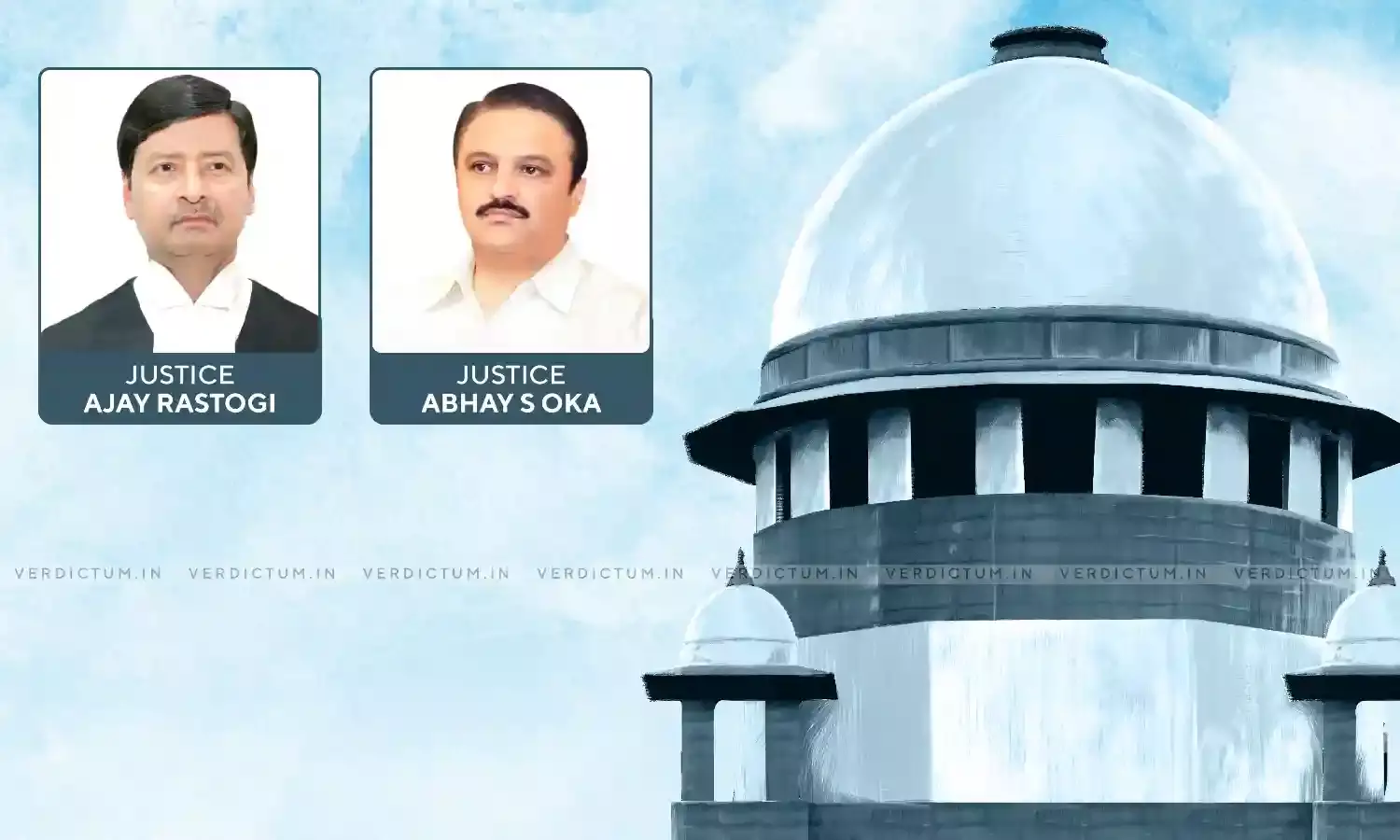

A two-judge Bench of Justice Ajay Rastogi and Justice Abhay S. Oka, after considering various authorities on the subject, observed as follows:

"The exposition of the legal principles culled out is that an amendment having retrospective operation which has the effect of taking away the benefit already available to the employee under the existing rule indeed would divest the employee from his vested or accrued rights and that being so, it would be held to be violative of the rights guaranteed under Articles 14 and 16 of the Constitution."

Senior Counsel Mr. P.S. Patwalia appeared for the Respondents, Senior Counsel Mr. Gurminder Singh appeared for the serving employees of the Bank and Counsel Mr. Siddharth appeared for the Regional Provident Fund Commissioner before the Court.

Impugned before the Apex Court was the judgment of the Division Bench of the Punjab and Haryana High Court.

The Appellant before the Apex Court was Punjab State Cooperative Agricultural Development Bank Ltd. The connected appeals were preferred by serving employees of the bank.

The Respondents are the original writ petitioners who are retired employees. The service conditions are governed by Punjab State Cooperative Agricultural Land Mortgage Banks Service Common Cadre Rules, 1978.

Prior to 1989, employees of the Bank were governed under EPF and Miscellaneous Provisions Act. Thereafter, Bank Pension Scheme was introduced w.e.f. 01.04.1989. A trust was created for management and effective implementation of the Scheme.

The Board of Directors of the Bank reconsidered the matter about giving pension of the bank employees wherein it was inter alia resolved that Scheme will not be applicable in case of employees employed on or after 01.01.2004.

The Bank sent a letter to Registrar Cooperative Societies seeking approval of the resolution. The Registrar asked the Bank to review its proposal. The Bank submitted revised proposal. The same was turned down by the Registrar, however, the Bank decided to discontinue the Scheme and revert to Contributory Provident Fund with a proposal of OTS.

The Court culled out the question for its consideration -

What is the concept of vested or accrued rights of an employee and at the given time whether such vested or accrued rights can be divested with retrospective effect by the rule-making authority?

The Court held that the amendment which has been made with retrospective operation to take away the right accrued to the retired employee under existing rule is certainly violative of not only Article 14 but also Article 21 of the Constitution.

On the submission concerning the financial distress of the Bank, the Court noted as follows:

"So far as the submission made by learned counsel for the appellant about the financial distress of the appellant Bank to justify the impugned amendment to say that it may not be possible to continue the grant of pension any more is concerned, suffice to say, that the rule making authority was presumed to know repercussions of the particular piece of subordinate legislation and once the Bank took a conscious decision after taking permission from the Government of Punjab and Registrar, Cooperative, introduced the pension scheme with effect from 1st April 1989, it can be presumed that the competent authority was aware of the resources from where the funds are to be created for making payments to its retirees and merely because at a later point of time, it was unable to hold financial resources at its command to its retirees, would not be justified to withdraw the scheme retrospectively detrimental to the interests of the employees who not only became member of the scheme but received their pension regularly at least upto the year 2010 until the dispute arose between the parties and entered into litigation."

The Court noted that non-availability of financial resources would not be a defence available with the Bank in taking away the vested rights when it is for their socio-economic security.

Accordingly, the appeals were dismissed and the Bank was directed to pay arrears towards pension upto 31.12.2021 in 12 monthly installments in the next one year by the end of December 2022 after adjusting the payment under OTS if any. The Court also noted that each of the employees who is member of the Bank Pension scheme must get pension to which he/she is entitled from the month of January 2022 as admissible under the law.

Click here to read/download the Judgment