SC Permits Magistrates To Appoint And Authorize Advocate Commissioners To Take Possession Of Secured Assets U/s. 14 Of SARFAESI Act

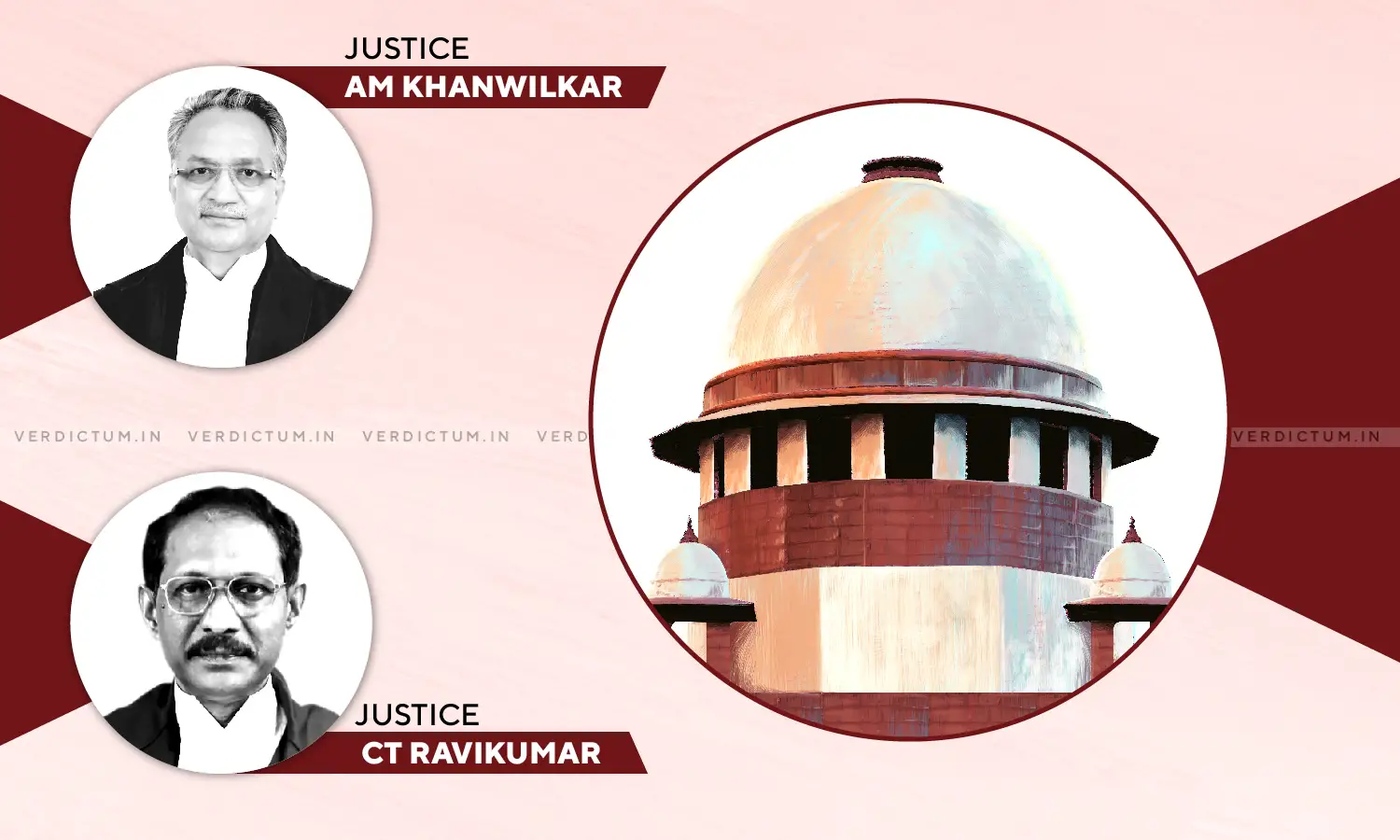

The Supreme Court bench comprising of Justice A. M. Khanwilkar and Justice C. T. Ravikumar adjudicated on the issue that whether it is open to the District Magistrate or the Chief Metropolitan Magistrate to appoint an advocate and authorize him/her to take possession of the secured assets and documents relating thereto and to forward the same to the secured creditor within the meaning of Section 14(1A) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI).

This issue had been previously raised before the Bombay High Court where it was decided that the advocate cannot be appointed to take possession of the secured assets and documents relating thereto and to forward the same to the secured creditor as he is not a subordinate officer of the District Magistrate or the Chief Metropolitan Magistrate. Contrary to the opinion of the High Court, the Madras High Court through a judgment in the case filed by secured creditor (Canara Bank) decided that the advocate is regarded as an officer of the court and, thus, subordinate to the Chief Metropolitan Magistrate or the District Magistrate.

The High Courts of Kerala (in Muhammed Ashraf and Anr. vs. Union of India and Ors., The Federal Bank Lyd vs A. V. Punnus and V. S. Sunitha vs Federal Bank Ltd.), Madras (in S. Chandramohan and Anr. vs The Chief Metropolitan Magistrate, Egmore, Chennai and Ors.) and Delhi (in Rahul Chaudhary vs Andhra Bank and Ors.) have taken a similar view as was taken in the case of Canara Bank.

The Apex Court ascertained that the issue regarding the appointment of an advocate in the exercise of powers under section 14(1A) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act by the District Magistrate or the Chief arose because of the expression used in the said provision, "may authorize any officer subordinate to him."

While deciding on the matter the Bench observed that "The construct of the provision, however, must depend on the context of the legislative intent and the purpose for which such dispensation has been envisaged. The setting in which the expression has been used in the concerned section of the Act would assume significance." The court also observed that, "the underlying purpose of the 2002 Act is to empower the financial institutions in India to have similar powers as enjoyed by their counterparts, namely, international banks in other countries. One such feature is to empower the financial institutions to take possession of securities and sell them. The same has been translated into provisions falling under Chapter III of the 2002 Act."

Analyzing the provisions of the Act the Court stated, "The statutory obligation enjoined upon the CMM/DM is to immediately move into action after receipt of a written application under Section 14(1) of the 2002 Act from the secured creditor for that purpose. As soon as such application is received, the CMM/DM is expected to pass an order after verification of compliance of all formalities by the secured creditor referred to in the proviso in Section 14(1) of the 2002 Act and after being satisfied in that regard, to take possession of the secured assets and documents relating thereto and to forward the same to the secured creditor at the earliest opportunity. The latter is a ministerial act. It cannot brook delay. Time is of the essence. This is the spirit of the special enactment. However, it is common knowledge that the CMM/DM are provided with limited resources. That inevitably makes it difficult, if not impossible, for the CMM/DM to fulfil his/her obligations with utmost dispatch to uphold the spirit of the special legislation."

Allowing the appeals filed by the secured creditors the Supreme Court stated, "It is well established that an advocate is a guardian of constitutional morality and justice equally with the Judge. He has an important duty as that of a Judge. He bears responsibility towards the society and is expected to act with utmost sincerity and commitment to the cause of justice. He has a duty to the court first."

It was also observed that "No such rule has been framed by the Central Government in reference to sub-Section (1A) of Section 14 of the 2002 Act much less to expressly or by necessary implication prohibiting the CMM/DM to engage an Advocate Commissioner for taking possession of the secured assets. In absence thereof, exclusion of engagement of an advocate as commissioner cannot be countenanced."

It was also pointed out by the Court that the apprehensions of the borrowers about improper execution of orders by the Advocate Commissioner are plainly misplaced.

Accordingly, the Court allowed the appeals and set aside the impugned judgment of the Bombay High Court.