Mandamus Cannot Be Issued To Direct Bank To Grant Benefit Of OTS To Borrower: Supreme Court

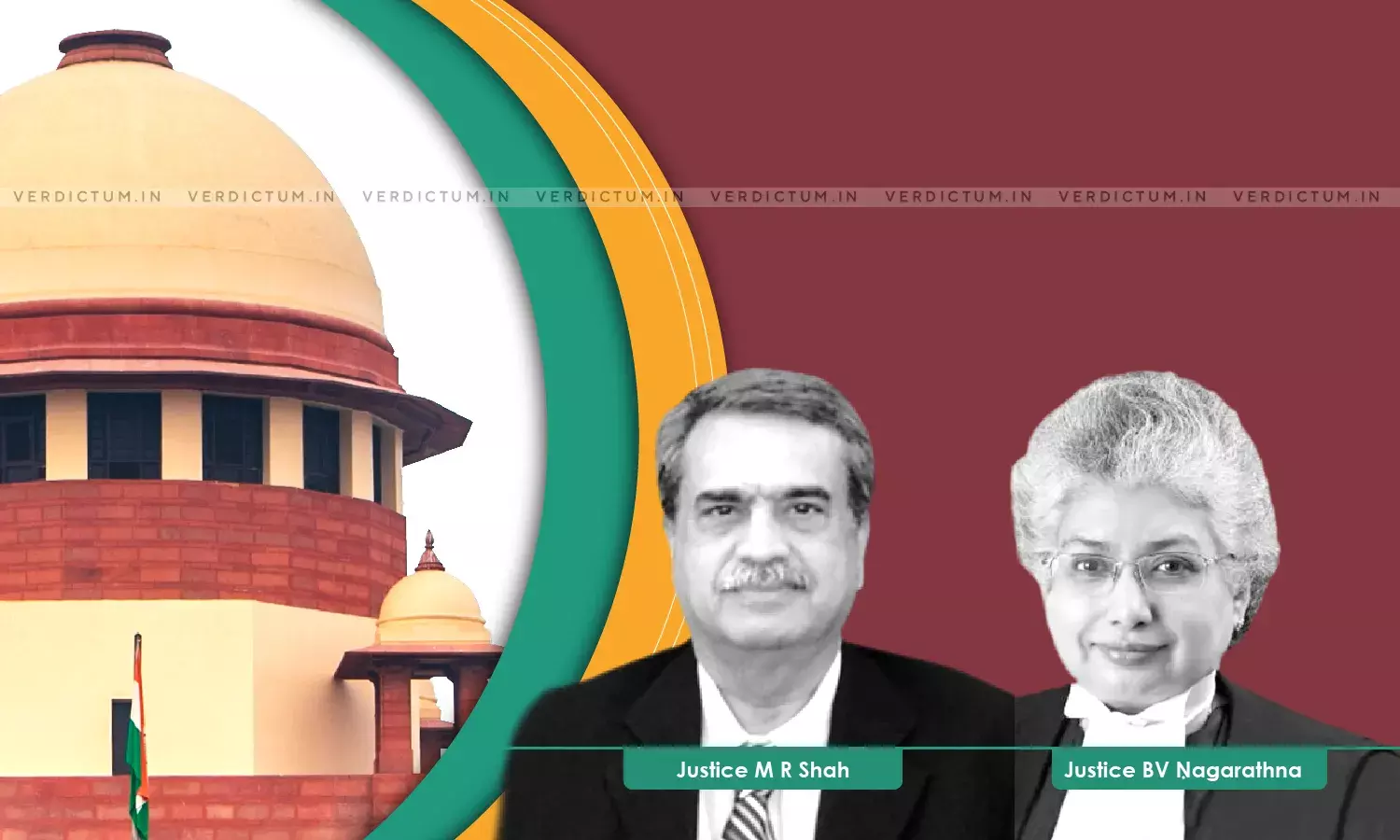

A Bench of the Supreme Court consisting of Justice MR Shah and Justice BV Nagarathna has ruled that no writ of mandamus can be issued by the High Court in exercise of powers under Article 226 of the Constitution of India, directing a financial institution/bank to positively grant the benefit of One Time Settlement Scheme (OTS) to a borrower.

The Bench also held that no borrower can pray for benefit of under OTS as a matter of right and the same is subject to fulfilling the eligibility criteria mentioned in the scheme.

"The grant of benefit under the OTS is always subject to the eligibility criteria mentioned under the OTS Scheme and the guidelines issued from time to time. If the bank/financial institution is of the opinion that the loanee has the capacity to make the payment and/or that the bank/financial institution is able to recover the entire loan amount even by auctioning the mortgaged property/secured property, either from the loanee and/or guarantor, the bank would be justified in refusing to grant the benefit under the OTS Scheme," the Bench observed.

In this case of The Bijnor Urban Cooperative Bank Limited, Bijnor & others Vs. Meenal Agarwal & Others the High Court had issued a writ of mandamus and directed the Bank to positively consider an application by the borrower for grant of benefit under the OTS Scheme. Hence, the Bank filed an Appeal before the Supreme Court.

Senior Advocate Meenakshi Arora represented the Bank while Senior Advocate VK Shukla appeared for the Respondent.

After hearing the parties the Bench framed the following issues:-

"i) Whether benefit under the OTS Scheme can be prayed as a matter of right?;

ii) Whether the High Court in exercise of powers under Article 226 of the Constitution of India can issue a writ of mandamus directing the Bank to positively cnonsider the grant of benefit under the OTS Scheme and that too de hors the eligibility criteria mentioned under the OTS Scheme?"

The Bench referred to the relevant clauses of OTS and explained that, "a wilful defaulter in repayment of loan and a person who has not paid even a single installment after taking the loan and will not be able to pay the loan will be considered in the category of "defaulter" and shall not be eligible for grant of benefit under the OTS Scheme. Similarly, a person whose account is declared as "NPA" shall also not be eligible."

Dealing with the observations by the High Court that the proceedings initiated by the Bank under the SARFAESI Act have remained pending for seven years and the Bank has been unable to recover its dues and therefore the hope of recovery is illusory, the Bench observed that this conclusion is not supported by the an material on record.

"Merely because the proceedings under the SARFAESI Act have remained pending for seven years, the Bank cannot be held responsible for the same. No fault of the bank can be found. What is required to be considered is a conscious decision by the Bank that the Bank will be able to recover the entire loan amount by auctioning the mortgaged property and a due application of mind by the Bank that there are all possibilities to recover the entire loan amount, instead of granting the benefit under the OTS Scheme and to recover a lesser amount," the Bench stated.

The Bench further observed that no borrower can, as a matter of right, pray for grant of benefit of One Time Settlement Scheme and it would amount to giving premium to the debtor.

"In a given case, it may happen that a person would borrow a huge amount, for example Rs. 100 crores. After availing the loan, he may deliberately not pay any amount towards installments, though able to make the payment. He would wait for the OTS Scheme and then pray for grant of benefit under the OTS Scheme under which, always a lesser amount than the amount due and payable under the loan account will have to be paid. This, despite there being all possibility for recovery of the entire loan amount which can be realised by selling the mortgaged/secured properties. If it is held that the borrower can still, as a matter of right, pray for benefit under the OTS Scheme, in that case, it would be giving a premium to a dishonest borrower, who, despite the fact that he is able to make the payment and the fact that the bank is able to recover the entire loan amount even by selling the mortgaged/secured properties, either from the borrower and/or guarantor.", the Bench held.

The Bench further observed that, "This is because under the OTS Scheme a debtor has to pay a lesser amount than the actual amount due and payable under the loan account. Such cannot be the intention of the bank while offering OTS Scheme and that cannot be the purpose of the Scheme which may encourage such dishonesty."

The Bench also noted that, "Ultimately, such a decision should be left to the commercial wisdom of the bank whose amount is involved and it is always to be presumed that the financial institution/bank shall take a prudent decision whether to grant the benefit or not under the OTS Scheme, having regard to the public interest involved and having regard to the factors which are narrated hereinabove."

The Bench opined that, "If a prayer is entertained on the part of the defaulting unit/person to compel or direct the financial corporation/bank to enter into a one-time settlement on the terms proposed by it/him, then every defaulting unit/person which/who is capable of paying its/his dues as per the terms of the agreement entered into by it/him would like to get one time settlement in its/his favour. Who would not like to get his liability reduced and pay lesser amount than the amount he/she is liable to pay under the loan account?"

The Court further concluded that, "The sum and substance of the aforesaid discussion would be that no writ of mandamus can be issued by the High Court in exercise of powers under Article 226 of the Constitution of India, directing a financial institution/bank to positively grant the benefit of OTS to a borrower."

Click Here to Read/Download the Judgment