Cellular Mobile Service Providers Need Not Deduct TDS On Income/Profit Component In Payments Received By Distributors/Franchisees From Customers: SC

The Supreme Court held that the cellular mobile telephone service providers are not legally obliged to deduct Tax at source (TDS) on the income or profit component in the payments received by the distributors or franchises from the third parties or customers or while selling or transferring the pre-paid coupons or starter-kits to the distributors under Section 194-H of the Income Tax Act, 1961 (ITA).

The Court held thus in an appeal filed by Bharti Cellular Limited (Now Bharti Airtel Limited) against the Assistant Commissioner of Income Tax.

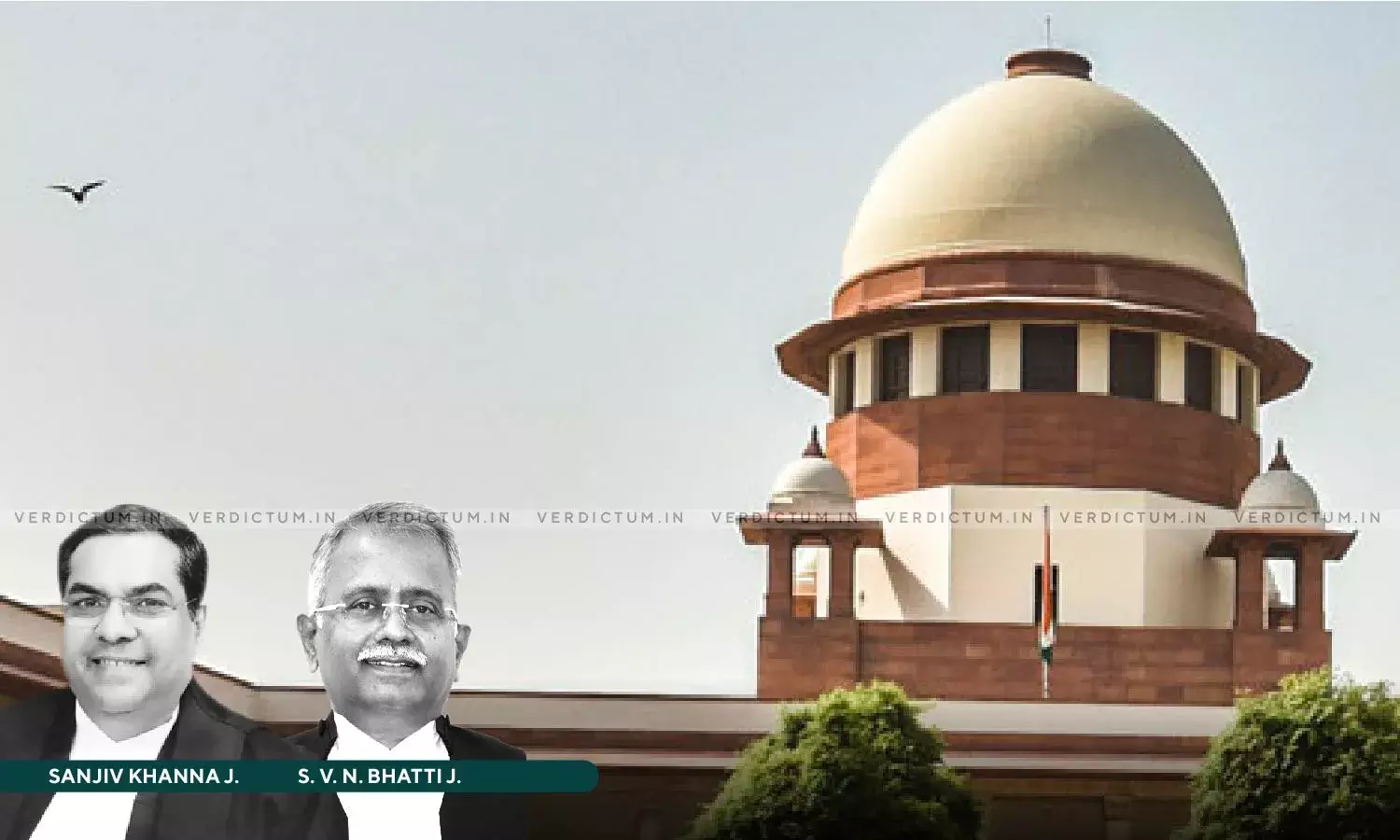

The two-Judge Bench comprising Justice Sanjiv Khanna and Justice S.V.N. Bhatti observed, “… we hold that the assessees would not be under a legal obligation to deduct tax at source on the income/profit component in the payments received by the distributors/franchisees from the third parties/customers, or while selling/transferring the pre-paid coupons or starter-kits to the distributors. Section 194-H of the Act is not applicable to the facts and circumstances of this case.”

The Bench said that when the obligation, and the time and manner in which the tax is mandated by law to be deducted at source, is fixed by the statute, the same cannot be shifted/altered/modified or postponed on a concession in the court by the Revenue.

Senior Advocates Arijit Prasad, Rupesh Kumar, and Advocate Praveen Kumar represented the appellant while Senior Advocates Kavin Gulati, Arvind P. Datar, Ajay Vohra, and Advocate Raj Bahadur Yadav represented the respondents.

Brief Facts -

A batch of appeals was filed by the assessees who were cellular mobile telephone service providers and the issue was related to the liability to deduct tax at source under Section 194-H of ITA on the amount which as per the Revenue was a commission payable to an agent by the assessees under the franchise or distributorship agreement between the assessees and the franchisees or distributors. As per the assessees, neither they were paying a commission or brokerage to the franchisees/distributors, nor the franchisees/distributors were their agents. The High Courts of Delhi and Calcutta had held that the assessees were liable to deduct tax at source under Section 194-H of the Act, whereas the High Courts of Rajasthan, Karnataka and Bombay held that Section 194-H of the Act is not attracted to the circumstances under consideration.

Section 194-H of ITA imposes the obligation to deduct tax at source and states that any person responsible for paying at the time of credit or at the time of payment, whichever is earlier, to a resident any income by way of commission or brokerage, shall deduct income tax at the prescribed rate The expression “any person (...) responsible for paying” is a term of art, defined vide Section 2042 of the Act. As per the clause (iii) of Section 204, in the case of credit or in the case of payment in cases not covered by clauses (i), (ii), (ii)(a), (ii)(b), “the person responsible for paying” is the payer himself, or if the payer is a company, the company itself and the principal officer thereof.

The Supreme Court in view of the facts and circumstances of the case noted, “When there is apparent divergence of opinion, to avoid litigation and pitfalls associated, it may be advisable for the Central Board of Direct Taxes to clarify doubts by issuing appropriate instruction/circular after ascertaining view of the assesses and stakeholders. In addition to enhancing revenue and ensuring tax compliance, an equally important aim/objective of the Revenue is to reduce litigation. The instructions/circular, if and when issued, should be clear, and when justified – require the obligation to be made prospective.”

The Court said that the argument of the Revenue that assessees should periodically ask for the information/data and thereupon deduct tax at source should be rejected as far-fetched, imposing unfair obligation and inconveniencing the assesses, beyond the statutory mandate and further, it will be willy-nilly impossible to deduct, as well as make payment of the tax deducted, within the timelines prescribed by law, as these begin when the amount is credited in the account of the payee by the payer or when payment is received by the payee, whichever is earlier.

“The payee receives payment when the third party makes the payment. This payment is not the payment received or payable by the assessee as the principal. The distributor/franchisee is not the trustee who is to account for this payment to the assessee as the principal. The payment received is the gross income or profit earned by the distributor/franchisee. It is the income earned by distributor/ franchisee as a result of its efforts and work, and not a remuneration paid by the assessee as a cellular mobile telephone service provider”, it added.

The Court, therefore, rejected the argument of the Revenue relying upon the case of Singapore Airlines Limited and Another v. Commissioner of Income Tax (2023) 1 SCC 497, that assessees would be liable to deduct tax at source even if the assessees are not making payment or crediting the income to the account of the franchisee/distributor.

“The concession may be granted, when permissible, by way of a circular issued in accordance with Section 119 of the Act. We do not think that the decision in Singapore Airlines Limited (supra) can be read in the manner as suggested by the Revenue. … Coming back to the legal position of a distributor, it is to be generally regarded as different form that of an agent. The distributor buys goods on his account and sells them in his territory. The profit made is the margin of difference between the purchase price and the sale price. The reason is, that the distributor in such cases is an independent contractor. Unlike an agent, he does not act as a communicator or creator of a relationship between the principal and a third party. The distributor has rights of distribution and is akin to a franchisee”, it emphasised.

The Court further remarked that an independent contractor is free from control on the part of his employer, and is only subject to the terms of his contract, but an agent is not completely free from control, and the relationship to the extent of tasks entrusted by the principal to the agent are fiduciary.

“As contract with an independent agent depends upon the terms of the contract, sometimes an independent contractor looks like an agent from the point of view of the control exercisable over him, but on an overview of the entire relationship the tests specified in clauses (a) to (d) in paragraph 8 may not be satisfied. The distinction is that independent contractors work for themselves, even when they are employed for the purpose of creating contractual relations with the third persons. An independent contractor is not required to render accounts of the business, as it belongs to him and not his employer”, it observed.

The Court concluded that the term ‘agent’ should be restricted to one who has the power of affecting the legal position of his principal by the making of contracts, or the disposition of the principal’s property; viz. an independent contractor who may, incidentally, also affect the legal position of his principal in other ways.

Accordingly, the Apex Court dismissed the appeals.

Cause Title- Bharti Cellular Limited (Now Bharti Airtel Limited) v. Assistant Commissioner of Income Tax, Circle 57, Kolkata and Another (Neutral Citation: 2024 INSC 148)

Appearance:

Appellant: Senior Advocates Arijit Prasad, Rupesh Kumar, AOR Praveen Kumar, ASG Venkatraman, AOR Raj Bahadur Yadav, Advocates Alka Agarwal, Digvijay Dam, V C Bharathi, Santosh Kumar, and Prahlad Singh.

Respondents: Senior Advocates Kavin Gulati, Arvind P. Datar, Ajay Vohra, AOR Raj Bahadur Yadav, Advocates Mahesh Agarwal, Rishi Agrawala, Sayree Basu Mullick, M.S. Ananth, Syree Basu Mullick, Madhvi Agarwal, Madhavi Agarwal, Sayaree Basu Mallik, Madhavi Agrawal, Abhinabh Garg, AOR E. C. Agrawala, AOR Harish Pandey, Advocates Sachit Jolly, Anuradha Dutt, Disha Jham, Soumya Singh, AOR B. Vijayalakshmi Menon, Advocates Kumar Visalaksh, Udit Jain, Archit Gupta, Arihant Tater, Ajitesh Dayal Singh, Ajitesh Dayal Singh, Praveen Kumar, Harish Pandey, and AOR Abhishek Vikas.