Writ Directly Filed Without Availing Statutory Remedy Under VAT Act To Overcome Hurdle Of Limitation Is Not Maintainable: HP HC

The Himachal Pradesh High Court has dismissed the petition filed by Highway Filling Station (Petitioner-taxpayer) terming it to be not bona fide since the petitioner had failed to avail the statutory remedy available to it within the stipulated period.

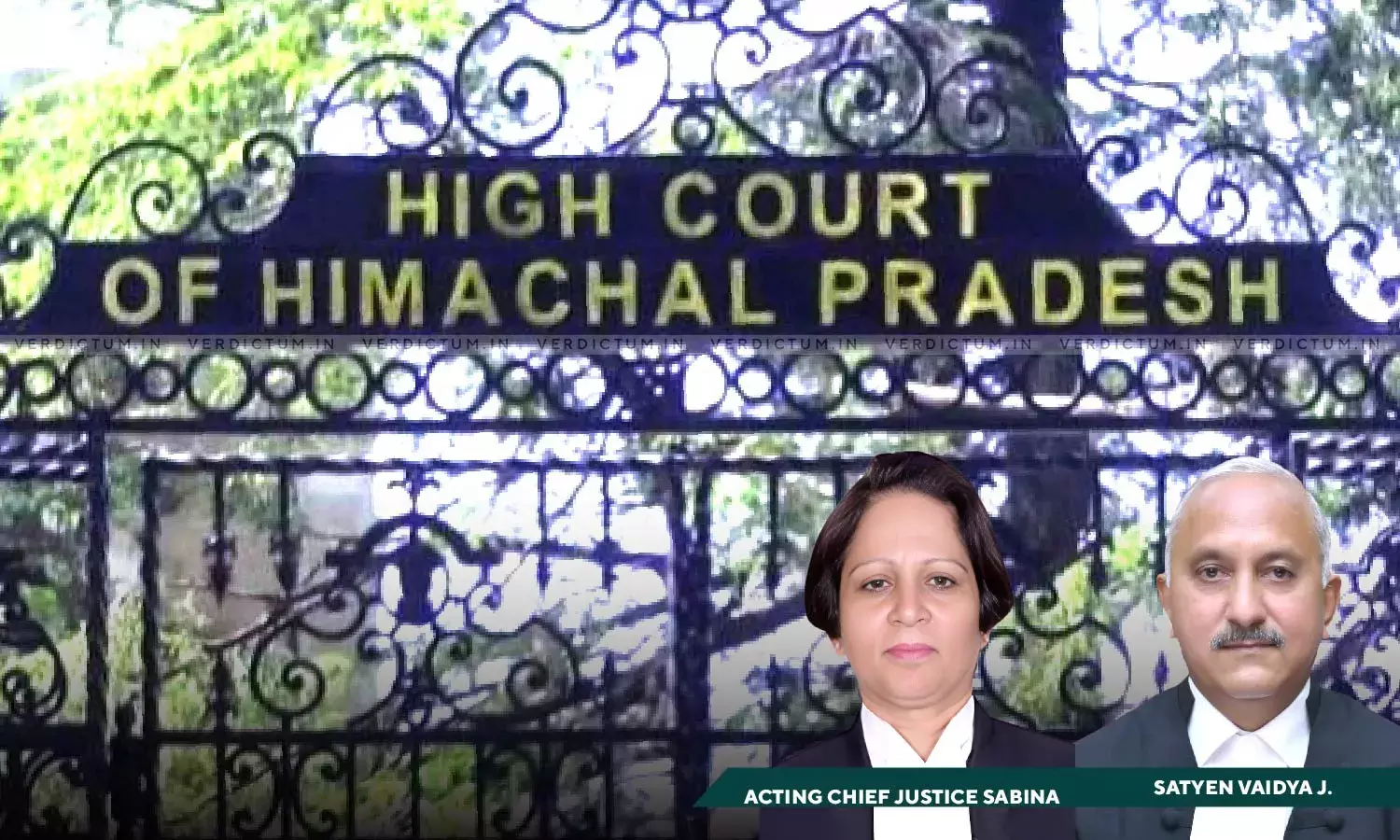

Since the alternate remedy of appeal before the Appellate Revenue Authority was not availed within the limitation period prescribed by the Himachal Pradesh Value Added Tax Act, 2005 (H.P VAT Act), the Division Bench of Acting Chief Justice Sabina and Justice Satyen Vaidya refused to entertain the matter.

Advocate A. K. Sachdeva appeared for the Petitioner and Advocate Pranay Pratap Singh appeared for the Respondent.

In a nutshell, the petitioner had approached this court seeking quashing of the order determining the purported demand of tax and penalties in a most capricious and arbitrary manner.

Since the order passed by second respondent i.e., Himachal State Tax Department was totally arbitrary and against the principles of natural justice, the petitioner had foregone the statutory remedy of appeal and approach this Court contending that Tax Department had failed to follow the mandatory provisions of Section 21 of the H.P VAT Act and had passed the assessment before financial year was over. It was also alleged that said order was passed even before the petitioner had filed the return.

The Division Bench found from the perusal of Section 45 of the H.P VAT Act, that remedy of appeal is available against the order assailed by way of instant petition, subject however to the limitation provided therein. As per the said provision, no appeal shall be entertained unless it is filed within sixty days from the date of communication of the order appealed against, or such longer period as the Appellate Authority may allow, for reasons to be recorded in writing.

Finding that the Assessing Authority had supplied the copy of the assessment order on the same date when it was passed, the High Court observed that the petitioner had failed to file the appeal within the prescribed period of limitation.

Accordingly, since the petitioner had approached the Court by invoking the extraordinary writ jurisdiction to overcome the hurdle of limitation for filing the statutory appeal, the same was not maintainable, concluded the Division Bench.

Cause Title: Highway Filling Station v. State of H.P. & Anr.