Grandparents Not “Family”; Settlements By Grandchildren Attract Higher Duty: Madras High Court

The High Court held that the statutory definition of “family” under Explanation to Article 58(a)(i) of the Indian Stamp Act, as amended by Tamil Nadu, is exhaustive and cannot be expanded to include grandparents, and therefore, concessional stamp duty is unavailable for such settlements.

The Madras High Court has held that the expression “family” under Explanation 58(a)(i) of the Indian Stamp Act, 1899, as amended by the State of Tamil Nadu, does not include grandparents, and therefore settlements executed by grandchildren in favour of grandparents are not entitled to concessional stamp duty.

The Court was hearing writ petitions raising a reference on account of conflicting judicial views regarding whether grandparents fall within the definition of “family” for purposes of stamp duty concession under Article 58(a)(i).

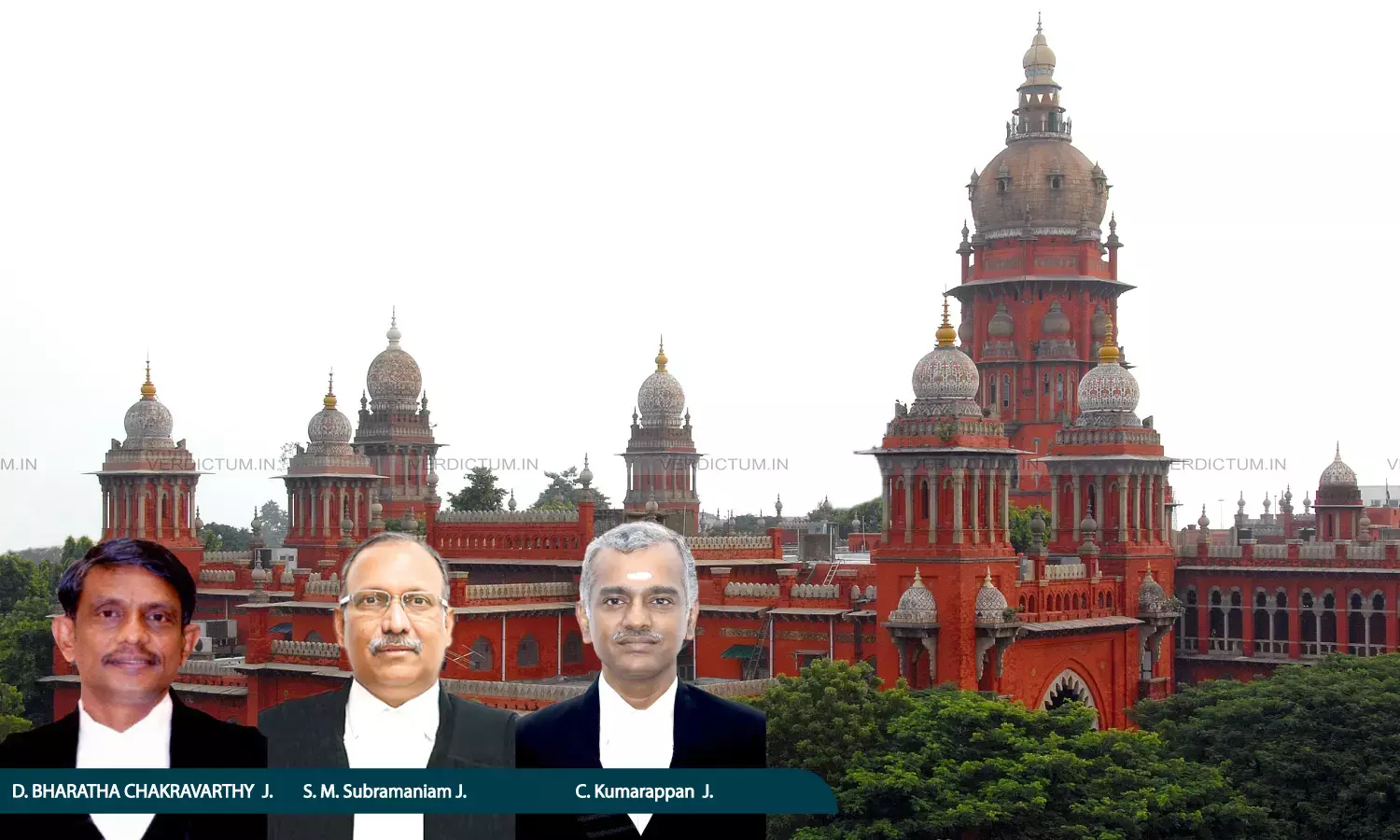

A Bench comprising Justice S.M. Subramaniam, Justice D. Bharatha Chakravarthy and Justice C. Kumarappan answered the reference, holding that “the term ‘Family’, as contained in Explanation 58(a)(i) of the Indian Stamp Act, 1899, as amended by the State of Tamil Nadu, cannot be read to include grandfather and grandmother”.

Consequently, the Bench further clarified that “settlements by grandchildren in favour of grandparents cannot be treated as settlements between the members of the family and would be chargeable as per the appropriate provisions and not under Article 58(a)(i).”

Background

Article 58 of the Indian Stamp Act prescribes stamp duty for settlement instruments, with concessional duty applicable when settlement is in favour of a “member of a family” as defined in the Explanation. The definition expressly lists the following relations: father, mother, spouse, son, daughter, grandchild, brother, and sister.

Disputes arose when settlement deeds executed by grandchildren in favour of grandparents were denied concessional duty by registration authorities, who treated them as falling under the higher-duty category applicable to non-family settlements.

Conflicting decisions of Division Benches and Single Judges had taken divergent views — some holding grandparents implicitly included as a corollary of “grandchild,” and others holding that only expressly listed relations could be included. In view of this conflict, the issue was referred for determination by a Larger Bench.

Court’s Observation

The Full Bench examined the nature of statutory definitions and held that legal definitions vary across enactments depending on legislative purpose, and cannot be imported from sociological or general meanings.

It observed that the definition of “family” in Article 58(a)(i) is a legal fiction created for a fiscal statute and must therefore be interpreted strictly. Where a definition clause uses the word “means,” it is exhaustive and cannot be expanded by interpretation.

The Court reiterated settled principles that fiscal statutes must be construed literally when the language is unambiguous, and that concessional provisions must be strictly applied.

It further noted that the legislative intent behind concessional duty was to facilitate settlements made out of love and affection among specified close relations. The legislature could legitimately limit such a concession to particular categories, and exclusion of grandparents from the definition could not be treated as irrational or illegal.

The Bench also referred to Supreme Court precedents on stamp duty principles, emphasising that stamp duty is determined by reference to the instrument itself and must be assessed strictly in accordance with statutory classification.

Conclusion

The High Court held that grandparents cannot be included within the definition of “family” under Explanation 58(a)(i) of the Indian Stamp Act as amended in Tamil Nadu. Settlements executed by grandchildren in favour of grandparents are therefore not entitled to concessional stamp duty and must be charged under the appropriate higher-duty provisions.

The reference was accordingly answered, and the matters were directed to be placed before the appropriate Bench for disposal.

Cause Title: V. Shiva v. Inspector General of Registration & Ors. (and connected matter)

Appearances

Petitioners: Advocates N. Kumar Rajan, Ralph V. Manohar

Respondents: Haja Nazirudeen, AAG; Special GP U. Baranidharan, Government Advocates P. Harish, P. Haribabu