Income-Tax Act | Specific Provision Section 40A(7)(b) Will Take Precedence Over Comparatively General Provision Section 43B: Madras High Court

The Madras High Court was considering an Appeal filed under Section 260A of the Income-Tax Act against the order of the Income Tax Appellate Tribunal.

The Madras High Court has reaffirmed that a specific provision such as Section 40A(7)(b) of the Income-Tax Act, 1961, will take precedence over a comparatively general provision like Section 43B.

The High Court was considering an Appeal filed under Section 260A of the Income-Tax Act against the order of the Chennai Bench of the Income Tax Appellate Tribunal.

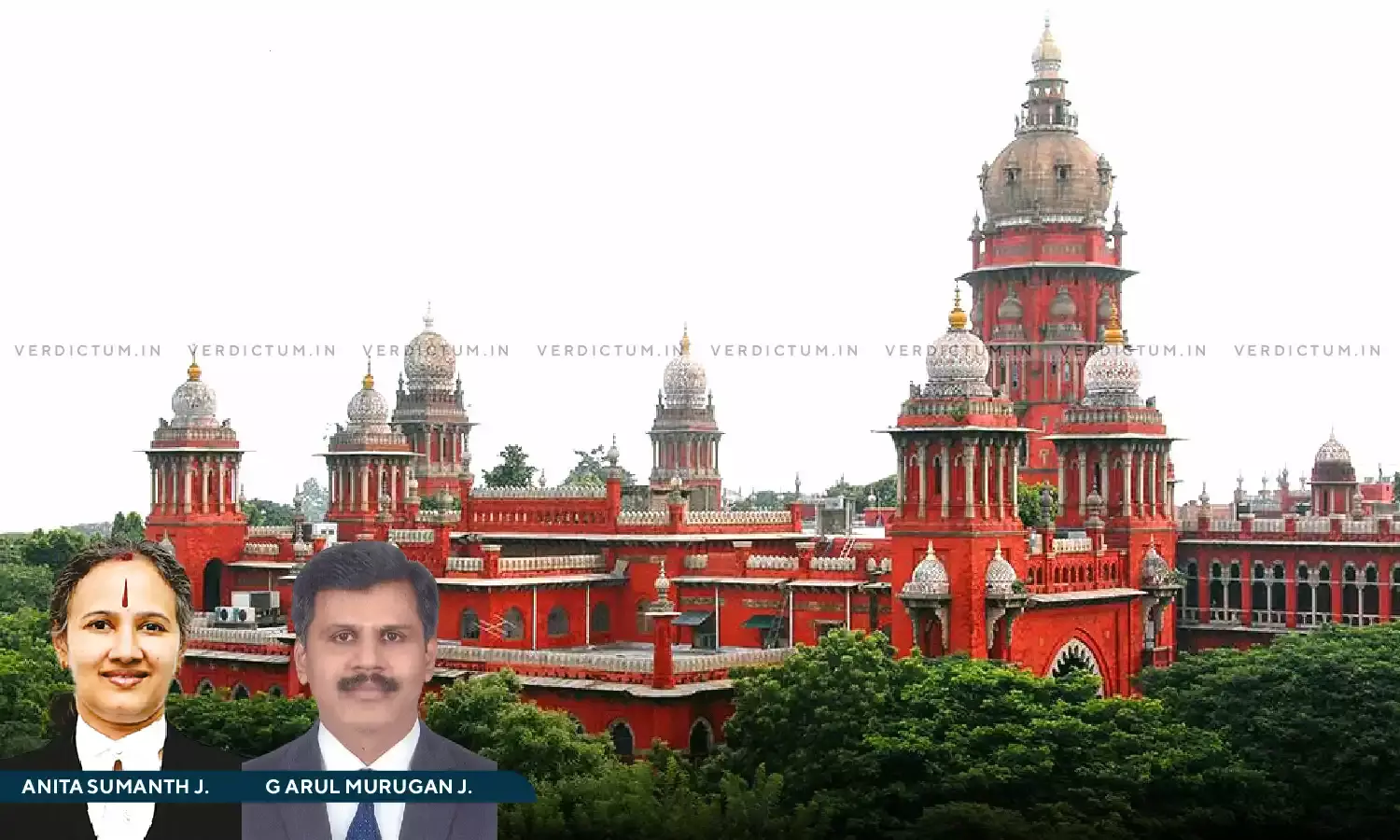

Referring to the judgment of the Delhi High Court in CIT v Bechtel India (P) Ltd, the Division Bench of Justice Anita Sumanth and Justice G . Arul Murugan said, “We find support for our conclusion at paragraph 20 supra, in the observations of the Delhi Court above to the effect that a specific provision such as Section 40A(7)(b) will take precedence over ‘a comparatively general provision like Section 43B’.”

Advocate Vijayaraghavan represented the Appellant while Senior Standing Counsel J.Narayanaswamy represented the Respondent.

Factual Background

The Tax Case (Appeal) relates to the Assessment Year (AY) 2008-09. The appellant/assessee is engaged in the business of manufacturing and sale of specialty Chemicals and Biotechnology products. Returns were filed under the Income-Tax Act, 1961 (Act) in respect of AY 2008 – 09, and an intimation under Section 143(1) was issued.

One of the issues picked up for assessment related to a provision made towards gratuity fund with the Life Insurance Corporation of India (LIC). The assessing officer noted that the claim had been made as per the provisions of Section 40(A)(7)(b) of the Act. It was observed that though the narration in the schedules to the balance-sheet and profit and loss account stipulated that the amount was towards gratuity, it was only a provision. Hence, the claim was hit by the provisions of Section 43B, which requires certain claims to be allowed only based on actual payment. The provision was thus disallowed, and the amount of Rs.31,24,172/-was added back to the total income.

The Commissioner of Income-Tax Appeals (CIT(A)) allowed the appeal. The Revenue’s appeal before the Income Tax Appellate Tribunal (ITAT) was allowed. Aggrieved thereby, the appellant-assessee approached the High Court.

Reasoning

The Bench explained that Section 40(A)(7)(b) refers specifically to an approved gratuity fund and Section 43B, in generic terms, to a gratuity fund, and thus there is no conflict in applying the provision of Section 40(A)(7)(b) in preference to Section 43B in the case of an approved gratuity fund.

“The Rule that a general provision should yield to specific provision springs from the common understanding that when two directions are given one encompassing a large number of matters in general and another to only some, the latter directions should prevail as being more specific in nature. Section 40A has been inserted by the Finance Act, 1968 with effect from 01.04.1968 whereas Section 43B has been inserted later vide Finance Act, 1983 with effect from 01.04.1984”, it said. It was observed that a specific provision,such as Section 40A(7)(b), will take precedence over a general provision like Section 43B.

It was further noted by the Bench that the provisions of Section 43B mandate that certain deductions would be allowed only on actual payments. Section 40A(9) states that no deduction shall be allowed in respect of any sum paid by the assessee as an employer towards setting up, or its contribution to any fund/trust/company/AoP/ DOI/Society/Institution, except were the sum is paid in accordance with the relevant provisions of Section 36 or as required by, or under any other law for the time being in force.

Referring to the judgment of the Apex Court in Shasun Chemicals and Drugs Limited v CIT, the Bench said, “So too in the present case, we agree that the provisions of Section 40A(7) would override Section 43B if the assessee in question satisfies the stipulations under clauses (a) and (b) thereof.”

The Bench found that the contributions of the assessee company stood covered under the ambit of the approved gratuity fund. The aforesaid variation had been carried forward throughout the deed of trust issued in 1978, thus bringing the subsidiaries/associates of Chemicals and Plastics Limited also within the cover of the approved gratuity fund. A letter from LIC was also produced setting out the actuarial valuation under Group Gratuity Scheme/ Master Policy, which was computed at a sum of Rs.18,24,96,153/.

It was further noticed that there was no dispute with respect to the fact that the Assessee had been granted the benefit of the claim under examination for the previous and subsequent years. The documentation produced was identical to the documentation on the basis of which the claim had been accepted by the Department for the other years. Thus, answering the question in favour of the assessee and against the revenue, the Bench allowed the Tax Case (Appeal).

Cause Title: M/s. Sanmar Speciality Chemicals Limited v. The Assistant Commissioner of Income-Tax Company Circle, VI (1), Chennai (Neutral Citation: 2025:MHC:769)

Appearance:

Appellant: Advocate Vijayaraghavan For M/s. Subbarayaaiyar Padmanabhan

Respondent: Senior Standing Counsel J. Narayanaswamy