Expression 'Sufficient Cause' Cannot Be Interpreted Liberally If Negligence Is Attributable To Party: Madras HC Refuses To Condone Delay In Filing Appeals

Remarking that the Assessee suddenly woke up from slumber like Rip Wan Winkle and prayed to condone the delay in filing the appeals without any sufficient cause, the Madras High Court rejected Assessee’s plea for condonation of delay of 1072 days in filing the appeal against ITAT order due to Assessee's callous and lackadaisical attitude.

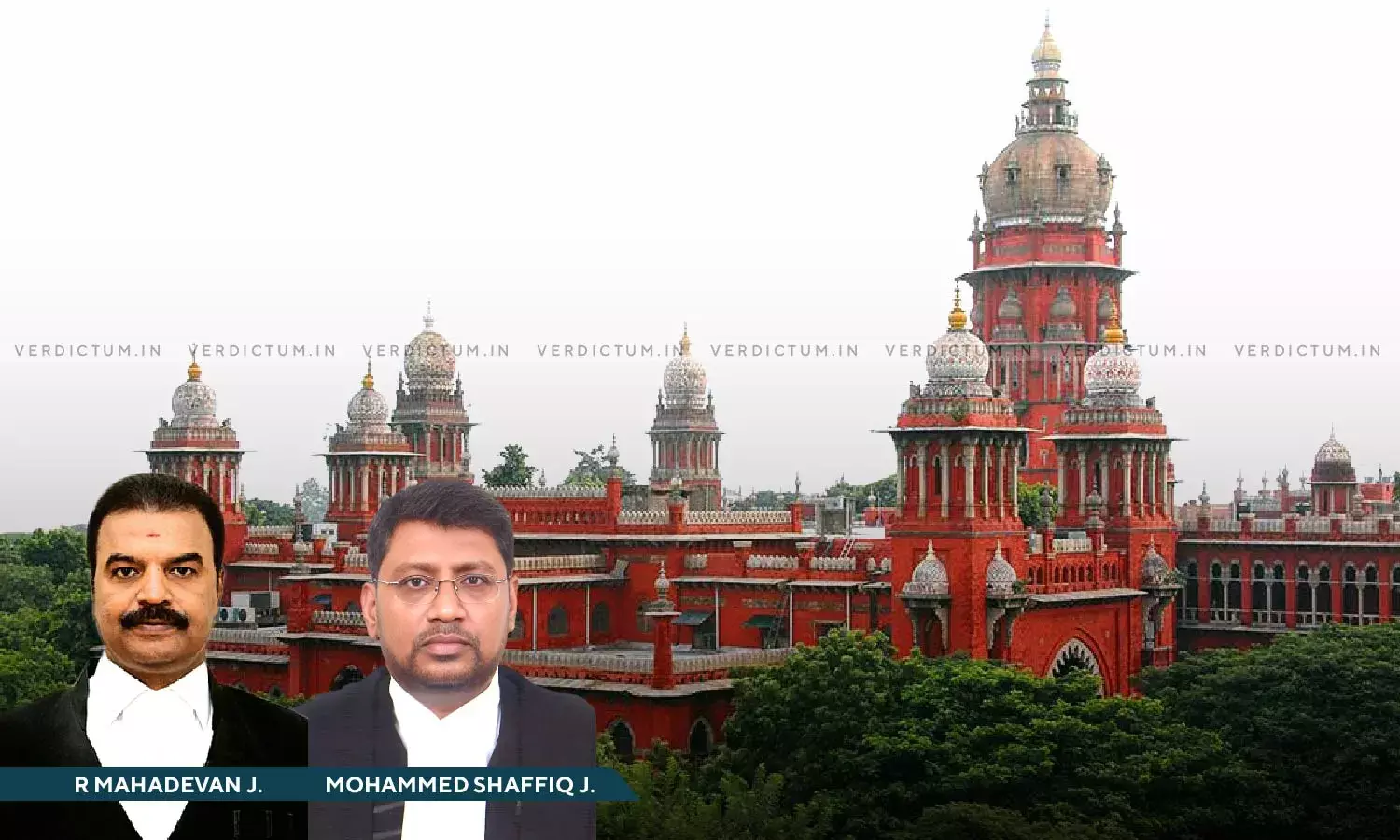

The Division Bench comprising of Justice R. Mahadevan and Justice Mohammed Shaffiq observed that “the discretion to condone the delay has to be exercised judiciously based on facts and circumstances of each case and that, the expression 'sufficient cause' cannot be liberally interpreted, if negligence, inaction or lack of bona fides is attributed to the party. In the present case, the petitioner/appellant has not given 'sufficient cause' for condoning the huge delay of 1072 days in filing the appeals”.

Advocate Sairam on behalf of S. Sridhar appeared for the Assessee while Revenue was represented by Advocate V. Pushpa.

Claiming for its cause, the Assessee submitted that it was pursuing alternate remedy under the Income Tax Act and subsequently, the new counsel pointed out that the distinction between the remedy of waiver of interest available under the Act and the right to appeal to challenge the very levy of such interest, which led to a delay of 1072 days in filing appeals which was neither wilful nor wanton.

Opposing the same, the Revenue Department contended that Assessee never averred any good and valid reason for condoning huge delay of 1072 days and hence, the delay petition was liable to be dismissed. The Department also contended that the Assessee deliberately left the case unattended since 2012 i.e., nearly 11 years without taking any effective steps for having the appeal numbered which evidences lack of interest in pursuing the appeals.

After considering the submission, the Bench observed that where a case has been presented in the Court beyond limitation, the Assessee must explain the Court as to what was the sufficient cause which means an adequate and enough reason which prevented him to approach the Court within limitation.

The Bench went on to explain that the discretion to condone the delay must be exercised judiciously based on facts and circumstances of each case and the expression sufficient cause cannot be interpreted if negligence, inaction or lack of bona fides is attributed to the party.

The Bench found that appeals were filed along with condonation of delay petition in the year 2012 itself and in pursuance to which notice was issued to the Revenue in the petitions seeking condonation of delay.

However, the Bench noted that subsequently on two occasions in March 2015 the matter stood adjourned for filing counter by the Revenue, but nothing moved and Assessee did not take any step to follow up the same until June 2023.

Therefore, the High Court dismissed the assessee’s prayer and concluded that such callous and lackadaisical attitude on the part of the Assessee cannot be countenanced.

Cause Title: Royal Stitches P Ltd v. Deputy CIT

Click here to read/ download the Order