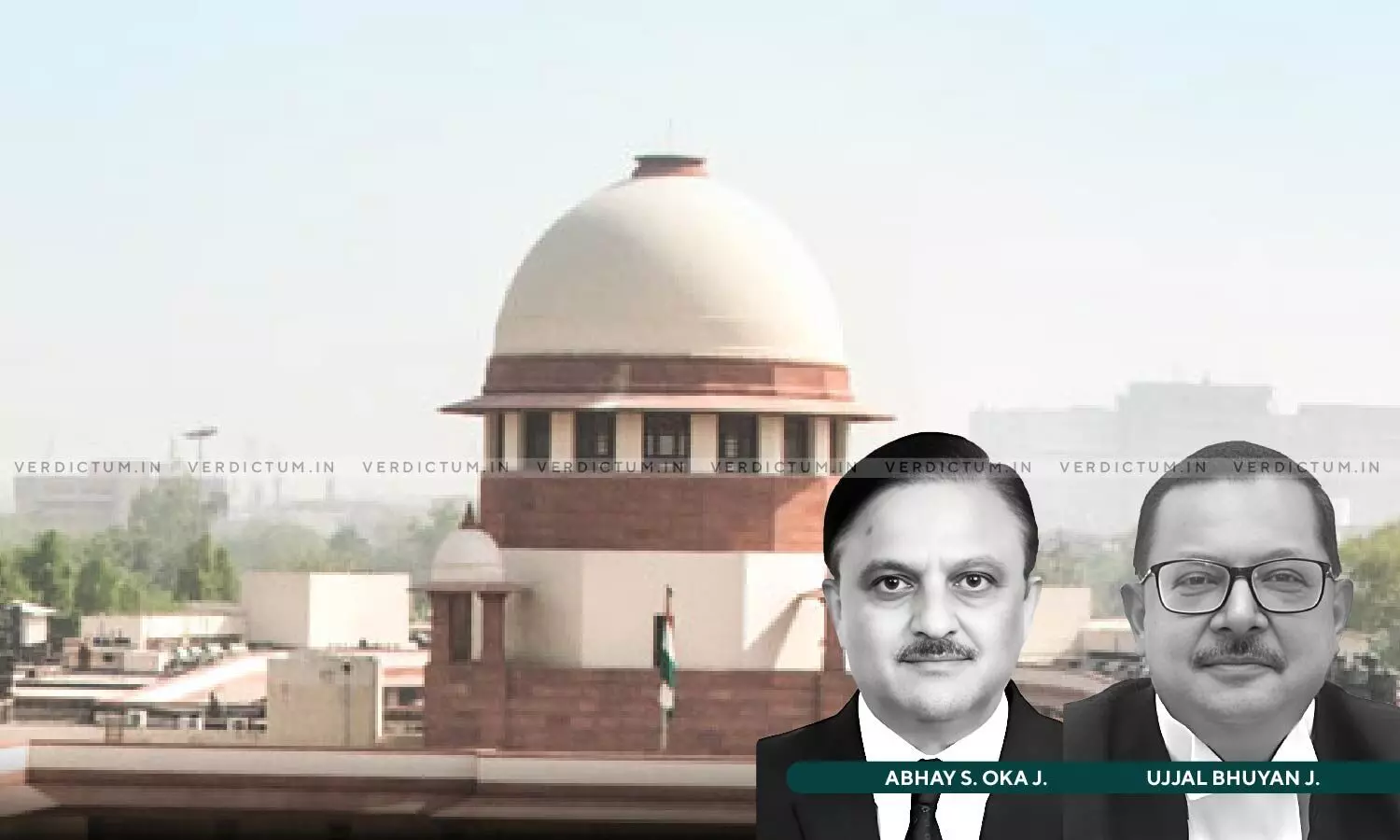

Justice Abhay S. Oka, Justice Ujjal Bhuyan, Supreme Court

Crude Degummed Soyabean Oil Not An Agricultural Product; Distinct From Soyabean: Supreme Court

|

|The Supreme Court explained that the expression ‘agricultural purposes’ refer to tilling and cultivation for the purposes of raising crops and in their widest sense, the words may include grazing as well.

The Supreme Court held that a crude degummed soyabean oil cannot be treated as an agricultural product.

The Court held thus in a Civil Appeal filed by a trading company namely Noble Resources and Trading India Private Limited, against the Judgment of the Gujarat High Court

The two-Judge Bench of Justice Abhay S. Oka and Justice Ujjal Bhuyan observed, “… it is the contention of the appellant that crude degummed soyabean oil is a commodity clearly distinct from soyabean. Through a series of process, the original agricultural product soyabean completely loses its identity. The natural identity of soyabean is completely lost and a new product is manufactured which is distinct from soyabean. Therefore, crude degummed soyabean oil cannot by any stretch of imagination be treated as an agricultural product.”

The Bench explained that the expression ‘agricultural purposes’ refer to tilling and cultivation for the purposes of raising crops and in their widest sense, the words may include grazing as well.

Senior Advocate Vikram S. Nankani represented the Appellant while Additional Solicitor General (ASG) Archana Pathak Dave represented the Respondents.

Factual Background

The Appellant was a government recognized two-star export house and a trading company engaged in the export of rice, sesame seeds, soyabean meal extracts, etc. Earlier its name was M/s Andagro Services Private Limited but has since been renamed as Noble Resources and Trading India Private Limited. Under the Export-Import (EXIM) policy of 2002 2007, which provided for exempting goods when imported into India under a duty-free credit entitlement (DFCE) certificate, Appellant was granted such a certificate for import of goods having a nexus with the products exported by it under the category ‘67/food products’. Under this certificate, the Appellant imported crude degummed soyabean oil vide two Bills of Entry, claiming duty exemption. The exemption claimed was in terms of para 3.7.2.1(vi) of the EXIM policy. Thereafter, a show-cause notice (SCN) was issued to the Appellant by the Office of the Commissioner of Customs, Kachchh Commissionerate stating that under the DFCE scheme, the Appellant was not eligible for benefits on the import of crude degummed soyabean oil as it was an agricultural product.

Since goods in the nature of agricultural and dairy products were excluded under the said notification, Appellant was liable to discharge the duties as applicable. Revenue was of the further view that the import made by the Appellant should have a nexus with the product group exported. One of the goods exported by the Appellant was soyabean meal extract while the product imported was crude degummed soyabean oil; there was no nexus between the two. The notice therefore called upon the Appellant to pay all the duties chargeable with interest. Appellant contended that the product imported by it i.e., crude degummed soyabean oil, was not an agricultural and dairy product so as to be excluded from the notification No.53/2003. It was denied the benefit of duty free credit entitlement by the Assistant Commissioner, Customs House, which was assailed before the High Court. However, its Writ Petition was dismissed and hence, the case went to the Apex Court.

Reasoning

The Supreme Court after hearing the arguments of the parties, noted, “Following the clear principle of law enunciated by this Court, it is evident that the Board could not have expanded the scope of the expression ‘other than agricultural and dairy products’ as stipulated in the statutory notification dated 01.04.2003 to mean and include all types of products derived from agriculture/dairy origin including crude edible oil by way of the administrative circular dated 30.01.2004. If this is accepted, it would amount to rewriting the conditions of exclusion from exempted goods statutorily provided in the notification dated 01.04.2003. This is impermissible. To that extent, circular No.10/2004-Cus. dated 30.01.2004 would be of no legal consequence.”

The Court added that the Board could not have curtailed the benefits granted to the Appellant under the statutory notification by expanding the scope of the exclusionary clause “other than agricultural and dairy products”.

“Unlike eucalyptus oil, soyabean on extraction of oil does not lose its identity. High Court relied on the test report placed on record to hold that unless the crude degummed soyabean oil is refined, it cannot be used for human consumption. High Court, therefore, rejected the contention of the appellant that after going through the process as explained, soyabean acquires a distinct marketable identity is without any merit and upheld the finding of the assessing authority that crude degummed soyabean oil is an agricultural product”, it said.

Manufacturing Test

The Court further took note of the following essential features to constitute manufacture –

i. There must be a process or series of process.

ii. The original commodity or raw material undergoes a transformation through the process or series of process.

iii. At the end of the process or series of process, a new commodity emerges.

iv. The new commodity should have a distinct name, character or use and can no longer be regarded as the original commodity.

v. It should be regarded as distinct from the original commodity and recognized as so in the trade.

The Court observed that the test is not whether the end product is a consumable product or not; therefore, the High Court clearly missed the point by holding that because crude degummed soyabean oil was not further refined and therefore was not a consumable item; it did not have a distinct identity.

“This is not the test of manufacture. While there is no dispute that soyabean is an agricultural product, the High Court while endorsing the view of the Assistant Commissioner held that crude degummed soyabean oil is also an agricultural product. Certainly, crude degummed soyabean oil is distinct from soyabean; it is not the same thing as soyabean”, it also enunciated.

Conclusion

The Court, therefore, came to the following points of conclusion –

i. The circular bearing No.10/2004 dated 30.01.2004 insofar it expands the exclusionary clause in the statutory notification No.53/2003 dated 01.04.2003 would have no legal consequence.

ii. Crude degummed soyabean oil is a product different and distinct in character and identity from soyabean.

iii. The process carried out by the Appellant using soyabean as raw material and ending in the product crude degummed soyabean oil is manufacturing.

iv. Crude degummed soyabean oil is not an agricultural product.

v. Therefore, Appellant would be entitled to the benefits under notification No.53/2003 dated 01.04.2003.

Accordingly, the Apex Court allowed the Appeal and set aside the High Court’s Judgment.

Cause Title- Noble Resources and Trading India Private Limited v. Union of India & Ors. (Neutral Citation: 2025 INSC 684)

Appearance:

Appellant: Senior Advocate Vikram S. Nankani, AOR Mahfooz Ahsan Nazki, Advocates Kumar Visalaksh, Hardik Modh, and Udit Jain.

Respondents: ASG Archana Pathak Dave, AORs Raj Bahadur Yadav, Gurmeet Singh Makker, Advocates Shashank Bajpai, Ashok Panigrahi, Raghav Sharma.