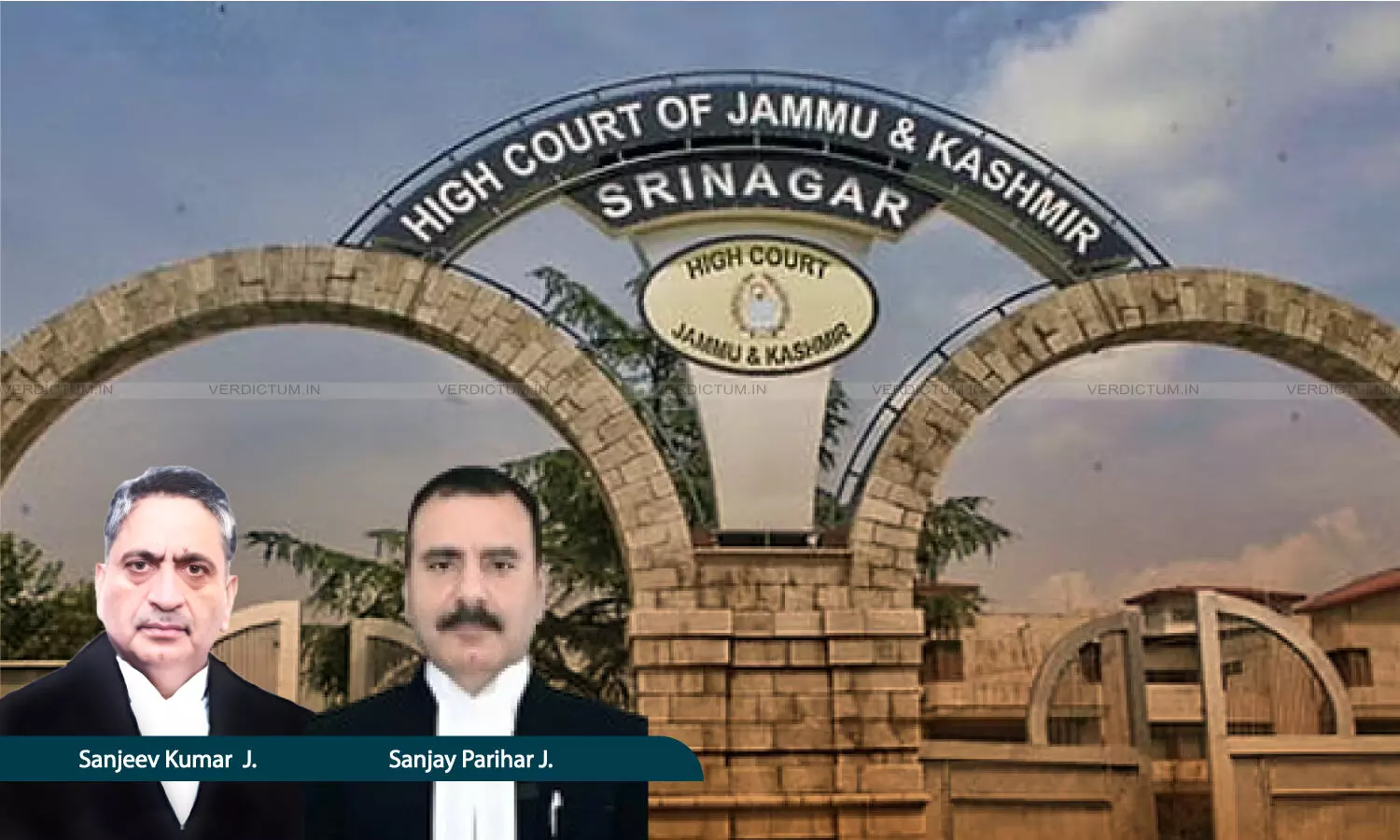

Justice Sanjeev Kumar, Justice Sanjay Parihar, Jammu & Kashmir and Ladakh High Court

Consumer Commission Cannot Summarily Adjudicate Complaints Without Allowing Parties to Lead Evidence or Prove Documents: Jammu and Kashmir & Ladakh High Court

|

|The Jammu and Kashmir & Ladakh High Court dealt with an appeal arising out of the decision of Consumer Commission, which held the insurance company guilty of deficiency in service.

The Jammu and Kashmir & Ladakh High Court observed that merely because the Commission is created for summary disposal of consumer disputes does not empower the Commission to dispose of the complaint by summary adjudication, without affording reasonable opportunity to lead evidence or prove documents.

The insurance company filed an appeal against the order of J&K State Consumer Disputes Redressal Commission which directed the insurance company to indemnify the insurer by paying a sum of Rs. 35,56,980/-.

The Bench of Justice Sanjeev Kumar and Justice Sanjay Parihar observed, “Though the Commission is a quasi-judicial authority which has all the powers of a civil court to enforce the attendance of witnesses, it was required to provide inexpensive and speedy resolution of disputes arising between the consumers and service providers. However, merely because the Commission is created for summary disposal of such disputes does not clothe it with the power to dispose of the complaint by summary adjudication, without affording reasonable opportunity to lead evidence or prove documents.”

Advocate Mudasir-bin-Hassan represented the Appellants, while Advocate Ateeb Kanth represented the Respondent.

Case Brief

The insurance company contended that the insurer had resorted to misrepresentation and fraud and had deliberately concealed factum of pre-existing disease, whereas, in the proposal form no such disclosure was made which leads to the only conclusion that the policies were not procured in good faith.

Further, it was submitted that once the insurance company had demonstrated that the insured had obtained policy by concealment or non-disclosure of true facts, there was no reason for the Commission to have approved the claim.

Court’s Analysis

The Court opined that the overall purpose of the Consumer Protection Act is to provide an alternative, efficacious, and speedy remedy to consumers.

“In the present case, upon going through the record of the Commission, we are surprised to note that the findings returned by the Commission on the issues involved in the complaint are bereft of any reasons. It appears that the Commission has proceeded to allow the consumer complaint in a summary manner”, the Court said.

The Court noted that there were two-fold objections raised: a case of mistaken identity or misrepresentation and non-disclosure of a pre-existing disease by the insured at the time of entering into the insurance contract. However, the Commission resorted to disposal of the complaint of the insured in haste, thereby depriving the insurance company of a reasonable opportunity of being heard and to lead evidence in rebuttal to the claim of the insured.

Accordingly, the matter was remanded back to the Commission for fresh adjudication.

Cause Title: Met Life India Insurance Company Ltd V. Abdul Aziz Khan

Click here to read/download Judgment